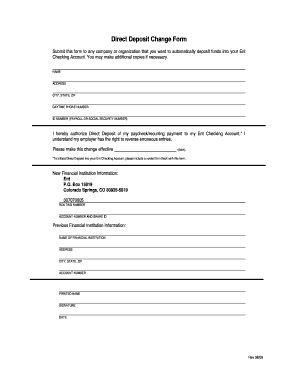

Direct Deposit Change Form - Page 2

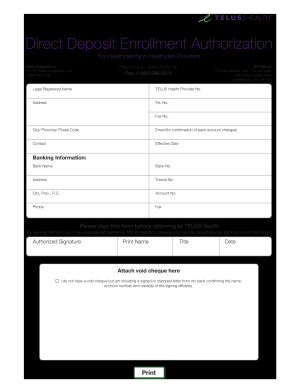

What is Direct deposit change form?

The Direct deposit change form is a document that allows individuals to update their banking information for direct deposit purposes. This form is commonly used by employees to change the account where their salary or wages are deposited.

What are the types of Direct deposit change form?

There are two main types of Direct deposit change forms:

Standard Direct deposit change form - This is the most common type of form used by employees to update their direct deposit information.

Government Direct deposit change form - This form is specifically used by government agencies for employees to update their direct deposit details.

How to complete Direct deposit change form

Completing a Direct deposit change form is easy and straightforward. Follow these steps:

01

Fill in your personal information such as name, address, and contact details.

02

Provide your current and new banking information including account number and routing number.

03

Sign and date the form to authorize the direct deposit change.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Direct deposit change form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How long does it take to change direct deposit accounts?

A change to your direct deposit account might not be immediate. It's possible that your direct deposit change will take effect before your next pay period, but that is not always the case. It is a good idea to ask your employer or the HR department when they will deposit your money into your new account.

Can you direct deposit into a different bank?

Typically, yes. In fact, many direct deposit programs allow you to split your pay between savings and checking accounts at different banks. You'll just need to add your banks' routing numbers, your account numbers and the account type for each. This can be a game changer when it comes to saving.

How do I switch my direct deposit to a different bank?

If you have direct deposit, fill out the papers directing your employer to reroute your paychecks to your new account. Do the same for any other direct deposit, such as Social Security payments. Find out the date your direct deposits will transfer.

What happens when you change direct deposit?

If you have direct deposit, fill out the papers directing your employer to reroute your paychecks to your new account. Do the same for any other direct deposit, such as Social Security payments. Find out the date your direct deposits will transfer.

How do I change my direct deposit for my employer?

You'll need your new account number and the routing number of the financial institution, along with their name, address, and main phone number. 2. Fill out a direct deposit authorization form with your employer. This will allow them to make the switch between your old checking account and your new one. Change Your Direct Deposit in 3 Easy Steps hfcu.org http://go.hfcu.org › blog › change-your-direct-deposit-in hfcu.org http://go.hfcu.org › blog › change-your-direct-deposit-in

What do you need to change direct deposit?

You'll need your new account number and the routing number of the financial institution, along with their name, address, and main phone number. 2. Fill out a direct deposit authorization form with your employer. This will allow them to make the switch between your old checking account and your new one.