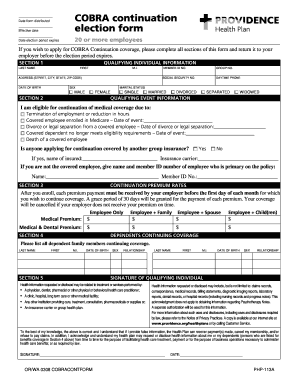

Cobra Application Form - Page 2

What is Cobra application form?

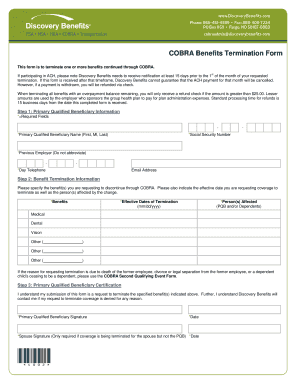

The Cobra application form is a document used to enroll in the Consolidated Omnibus Budget Reconciliation Act (Cobra) insurance coverage. This form allows individuals to continue their health insurance coverage after experiencing a qualifying event such as job loss or a reduction in hours.

What are the types of Cobra application form?

There are primarily two types of Cobra application forms: the initial enrollment form and the continuation coverage election form.

How to complete Cobra application form

Completing the Cobra application form is a simple process that involves providing personal information, selecting the coverage option, and submitting the form to the appropriate party.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.