Salary Payroll Xls Excel Sheet

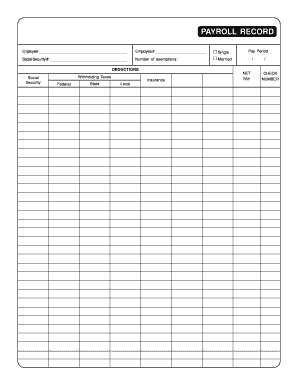

What is Salary payroll xls excel sheet?

A Salary payroll xls excel sheet is a spreadsheet created using Microsoft Excel that helps businesses manage and calculate salaries, wages, and taxes for their employees. It provides a structured format for recording employee information, hours worked, wages earned, deductions, and net pay.

What are the types of Salary payroll xls excel sheet?

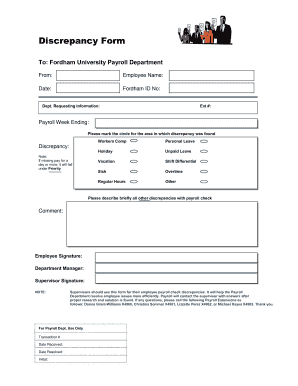

There are several types of Salary payroll xls excel sheets that businesses can use to streamline their payroll processes. Some common types include:

How to complete Salary payroll xls excel sheet

Completing a Salary payroll xls excel sheet is essential for accurate payroll management. To effectively complete the sheet, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.