Homeowners Insurance Quote Form

What is Homeowners insurance quote form?

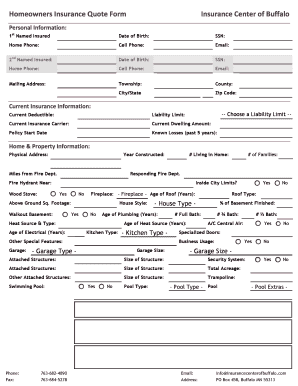

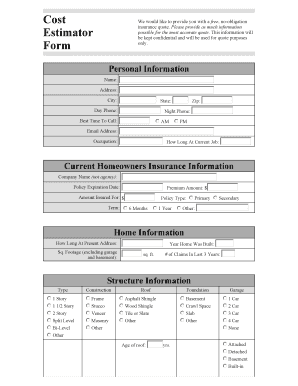

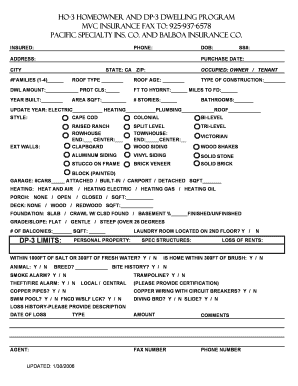

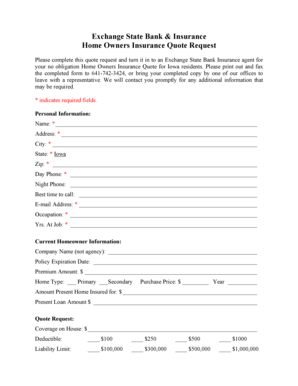

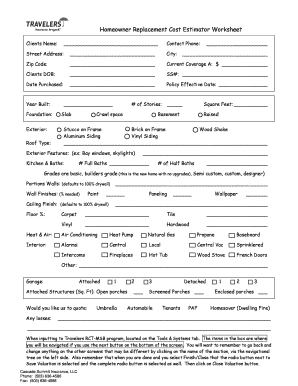

The Homeowners insurance quote form is a document used to gather information from individuals seeking insurance coverage for their homes. It allows insurance providers to assess the risk associated with insuring a specific property and calculate the appropriate insurance premium.

What are the types of Homeowners insurance quote form?

There are several types of Homeowners insurance quote forms, including:

Basic Homeowners insurance quote form

Comprehensive Homeowners insurance quote form

Specialty Homeowners insurance quote form

How to complete Homeowners insurance quote form

Completing a Homeowners insurance quote form is simple and straightforward. Here are some steps to follow:

01

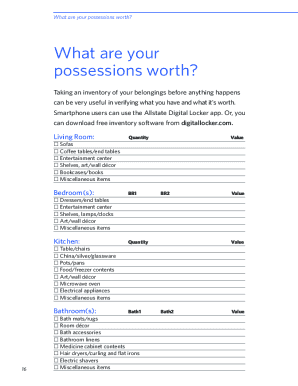

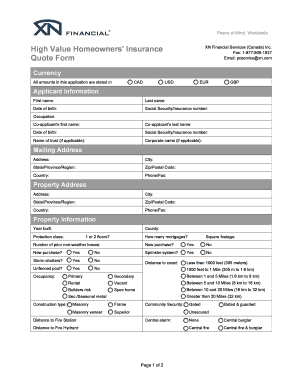

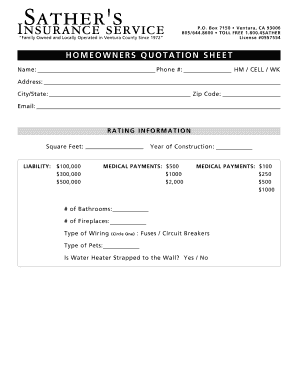

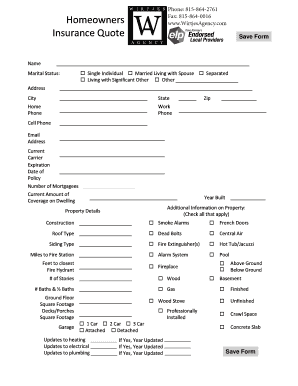

Fill in personal information such as name, address, and contact details

02

Provide details about the property to be insured, including its location and value

03

Answer questions about the type of coverage and limits desired

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Homeowners insurance quote form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Should I get multiple quotes for homeowners insurance?

The best way to lower your home insurance costs is to compare quotes among insurance companies. Not all insurers price their policies the same, so make sure you get quotes from multiple insurers so you can see a range of prices. You can also ask about home insurance discounts.

What is the basic form of homeowners insurance?

HO-1. An HO-1, or "basic form," is a policy that typically helps cover 10 perils (compared with the 16 perils covered by an HO-3). For example, falling objects or the weight of ice are perils not covered by an HO-1 form, the III says.

What is the most popular form of homeowners insurance?

What it is: HO-3 coverage is the most common type of homeowners insurance. It is also known as special form coverage. Under HO-3 insurance, your home will typically be covered at its replacement cost, while your personal property will be covered up to its actual cash value.

How many quotes should I get for homeowners insurance?

Key Takeaways The average homeowners insurance policy in the U.S. costs about $1,250 a year. You can get quotes online or by working directly with a home insurance agent. Plan on getting at least three quotes to make sure you find the best policy for your budget.

How many quotes should you get for insurance?

So many insurance quotes are available online, but how many quotes do you need to compare? We recommend comparing at least five insurance quotes before making a decision. However, before you pick the policy with the lowest premium rate, there are several other factors you need to consider.

How do you write an insurance quote?

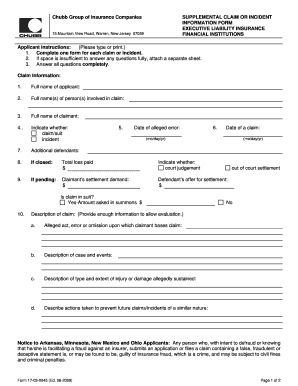

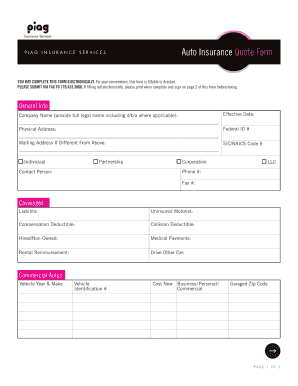

In the quotation form, you also need to specify the dwelling details. Plus, you need to explicitly state everything about policy coverage and give information on underwriting. Lastly, you should write details of the additional policy or coverage notes.