Car Insurance Claim Denial Letter Sample - Page 2

What is Car insurance claim denial letter sample?

A Car insurance claim denial letter sample is a formal document sent by an insurance company to inform the insured that their claim has been denied. This letter usually includes the reasons for the denial and any steps the insured can take to appeal the decision.

What are the types of Car insurance claim denial letter sample?

There are several types of Car insurance claim denial letter samples based on the reasons for denial. Some common types include:

Denial due to lack of coverage

Denial due to policy terms and conditions

Denial due to incomplete or inaccurate information

Denial due to suspected fraud

How to complete Car insurance claim denial letter sample

When completing a Car insurance claim denial letter sample, it is important to follow these steps:

01

Review the denial letter carefully to understand the reasons for denial

02

Gather any additional information or documentation that may support your claim

03

Draft a formal letter to appeal the decision, including any relevant evidence or arguments

04

Submit the appeal letter to your insurance company and follow up to ensure it is received and processed

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Car insurance claim denial letter sample

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

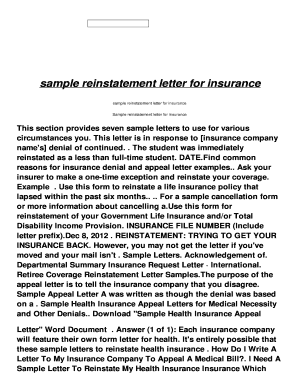

How to write a letter to insurance company that rejected a claim?

To Whom It May Concern: I am writing to request a review of your denial of the claim for treatment or services provided by name of provider on date provided. The reason for denial was listed as (reason listed for denial), but I have reviewed my policy and believe treatment or service should be covered.

How do I write an appeal letter for insurance claim denial?

Things to Include in Your Appeal Letter Patient name, policy number, and policy holder name. Accurate contact information for patient and policy holder. Date of denial letter, specifics on what was denied, and cited reason for denial. Doctor or medical provider's name and contact information.

How do I decline an insurance claim?

Specifically, your response should always include the following three things: A clear statement that you reject the settlement offer that you received. A list of specific reasons why that explain why the offer is too low. and. A demand for a better offer.

How to counter offer insurance?

Once you have your number and feel like you are ready, then you will want to send a counter-offer letter to the insurance company. The letter should include: A summary of the initial offer that was sent to you and explain why that was too low or not fully representing your injuries and costs..

How do I reject an insurance claim?

Specifically, your response should always include the following three things: A clear statement that you reject the settlement offer that you received. A list of specific reasons why that explain why the offer is too low. and. A demand for a better offer.

When can insurance claim be rejected?

A term insurance plan is provided based on your age, medical history, lifestyle habits, income and occupation. If any of the information is declared false, incomplete or undisclosed, the insurance company may reject the claim and suspend policy benefits.