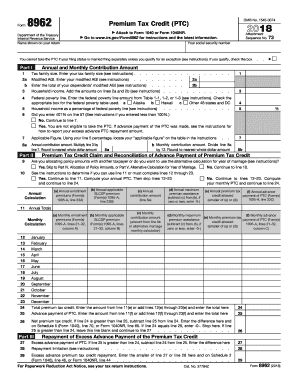

Form 8962 - Page 2

What is Form 8962?

Form 8962 is a tax form used by taxpayers who have purchased health insurance through the Health Insurance Marketplace and received premium tax credits. This form is used to reconcile the amount of premium tax credit received with the actual premium tax credit amount the taxpayer is eligible for based on their income and family status.

What are the types of Form 8962?

There are two main types of Form 8962:

Form 8962 for individuals and families who received advance premium tax credits to help pay for their health insurance premiums.

Form 8962 for individuals and families who are claiming the premium tax credit on their tax return for the first time.

How to complete Form 8962

Completing Form 8962 may seem daunting, but with the right guidance, it can be a breeze.

01

Gather all necessary documents such as Form 1095-A from the Health Insurance Marketplace.

02

Fill out Part I of Form 8962 with your personal information and the information from Form 1095-A.

03

Calculate your premium tax credit amount using the instructions provided and complete Part II of Form 8962.

04

Review your completed form for accuracy and submit it with your tax return.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Form 8962

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How does form 8962 affect tax return?

You will use Form 8962 to reconcile the difference between the APTC made on your behalf and the actual amount of the credit that you may claim on your return. This filing requirement applies whether or not you would otherwise be required to file a return.

Why is my tax return asking for form 8962?

Form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the Marketplace during that year.

What is the 8962 tax form for TurboTax?

Form 8962 for tax credits If you bought your health insurance from the Marketplace, you will file Form 8962 with your tax return. The ACA law includes a special Premium Tax Credit to help certain people pay the costs of health insurance, and Form 8962 relates to that credit.

What happens if I don't have form 8962?

In response to the rejection of an electronically filed return that's missing the Form 8962, individuals may refile a complete return by completing and attaching Form 8962 or a written explanation of the reasons for its absence.

What is form 8962 for?

Form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the Marketplace during that year.

Why is TurboTax asking for form 8962?

If someone else enrolled a member of your family in Marketplace health insurance coverage with APTC and you claim the family member on your tax return, you are required to complete Form 8962 and attach it to your return.