Free Insurance Verification Form Template - Page 2

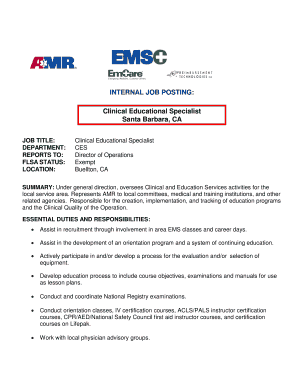

What is Free insurance verification form template?

The Free insurance verification form template is a document that allows healthcare providers to verify a patient's insurance coverage and benefits. It helps streamline the billing process by ensuring that the correct information is obtained and recorded.

What are the types of Free insurance verification form template?

There are several types of Free insurance verification form templates available, including:

Basic insurance verification form template

Detailed insurance verification form template

Authorization to release insurance information form template

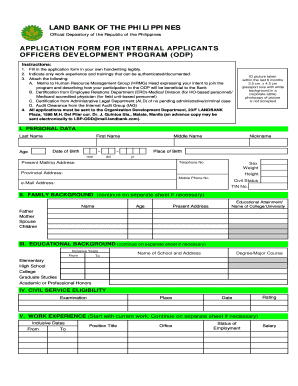

How to complete Free insurance verification form template

Completing the Free insurance verification form template is easy and straightforward. Here are the steps to follow:

01

Fill in the patient's personal information, including name, date of birth, and address.

02

Provide the insurance company's details, policy number, and contact information.

03

List any specific coverage details or limitations specified by the insurance company.

04

Obtain the patient's signature and date the form for validity.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Free insurance verification form template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the first step in verifying health insurance?

Step 1 – Collect the Patient's Insurance Information The billing team needs to ask appropriate questions during insurance eligibility verification to collect the relevant information, such as: Facilities must adhere to the hospital's insurance verification training manual.

What is insurance eligibility verification?

Patient eligibility and benefits verification is the process by which practices confirm information such as coverage, copayments, deductibles, and coinsurance with a patient's insurance company.

What are the questions needed to be asked for insurance verification?

71 Questions to ask when verifying insurance benefits: What is the patient's name? What is the patient's date of birth? What is the patient's insurance company? What is the patient's policy number? Does the patient have primary or secondary insurance coverage? Who is the primary insured on the policy?

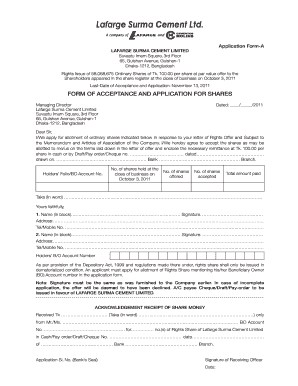

What information is needed in order to verify insurance coverage?

The name of the insurance company. The name of the primary insurance plan holder and their relationship to the patient. The patient's policy number and group ID number (if applicable). and. The insurance company's phone number and address.

What is verification of coverage?

Verification of Coverage is a statement provided by a life insurance company defining the current status of a life insurance policy, including relevant policy values, premium payments, and ownership status. This is similar to a title search conducted during a sale of a home or mortgage closing.

Which of the following is required for insurance verification?

Insurance Verification Checklist Insurance name, phone number, and claims address. Insurance ID and group number. Name of insured, as it isn't always the patient. Relationship of the insured to the patient.