When To Send A Demand Letter To Insurance Company

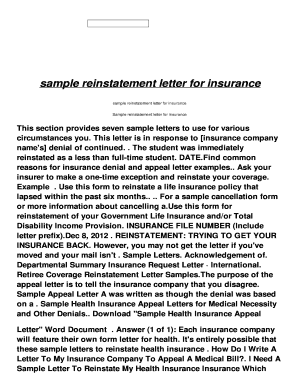

What is When to send a demand letter to insurance company?

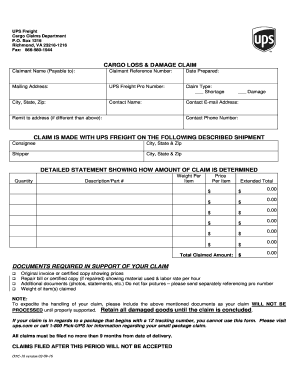

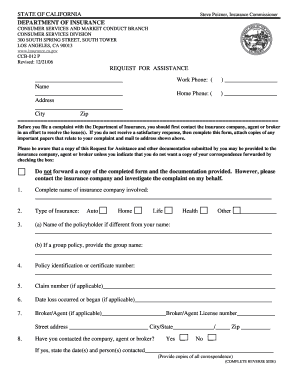

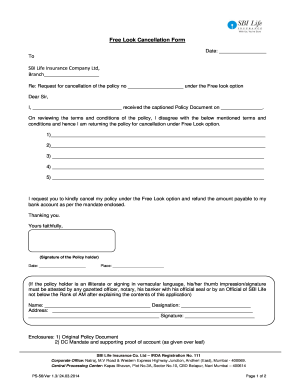

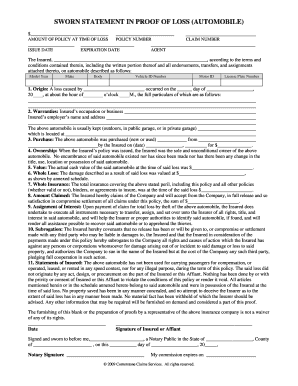

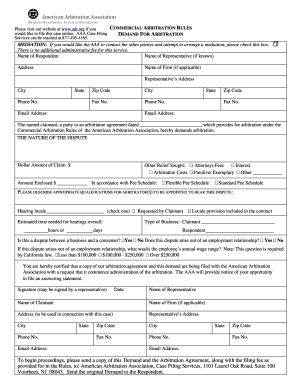

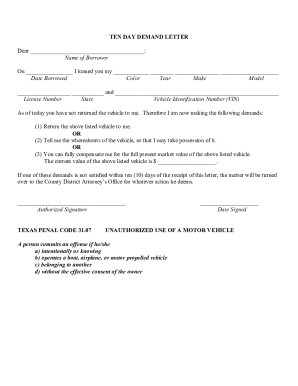

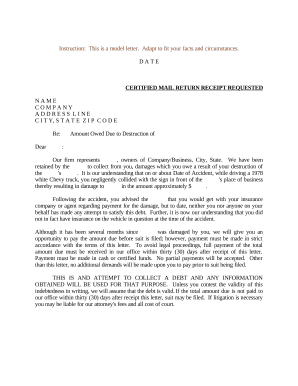

Sending a demand letter to an insurance company is a formal request for compensation for damages caused by the insured party. It acts as a precursor to legal action if the insurance company fails to respond or settle the claim satisfactorily.

What are the types of When to send a demand letter to insurance company?

There are two main types of demand letters that can be sent to an insurance company: the first-party demand letter, which is submitted by the policyholder to their insurance company, and the third-party demand letter, which is sent by an injured party to the at-fault party's insurance provider.

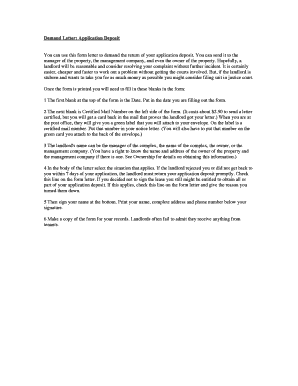

How to complete When to send a demand letter to insurance company

Here are the steps to successfully complete and send a demand letter to an insurance company:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.