Printable Homeowners Insurance Quote Form

What is Printable homeowners insurance quote form?

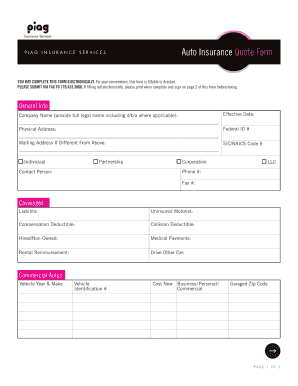

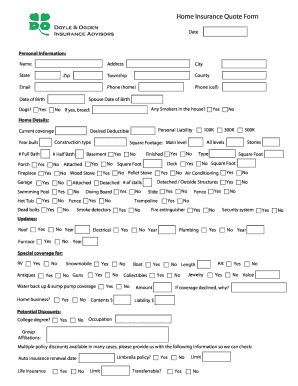

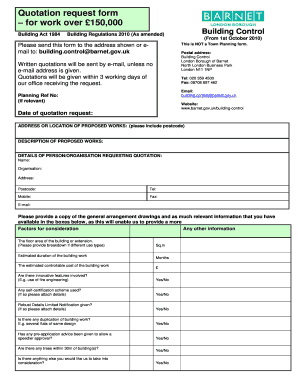

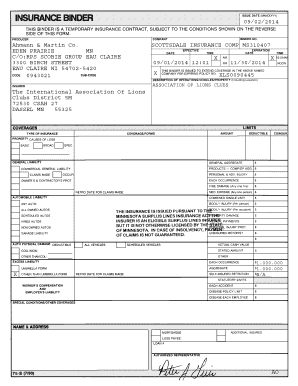

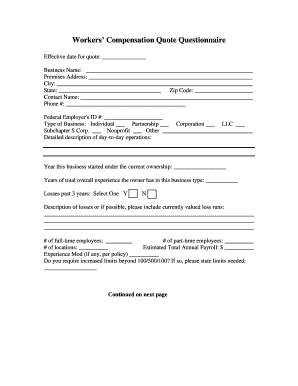

A Printable homeowners insurance quote form is a document that allows homeowners to request and receive quotes from insurance companies for their property insurance needs. This form typically includes details about the homeowner's property, coverage preferences, and contact information.

What are the types of Printable homeowners insurance quote form?

There are several types of Printable homeowners insurance quote forms available, including:

Standard homeowners insurance quote form

Specialized coverage homeowners insurance quote form

Bundle homeowners insurance quote form

How to complete Printable homeowners insurance quote form

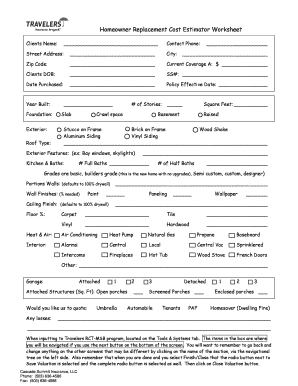

Completing a Printable homeowners insurance quote form is easy and straightforward. Follow these steps:

01

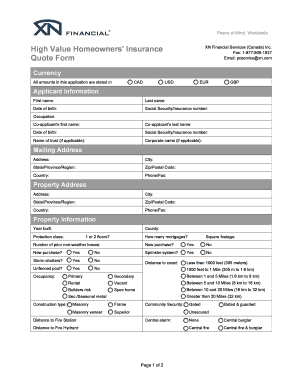

Fill in your personal information, such as name, address, and contact details.

02

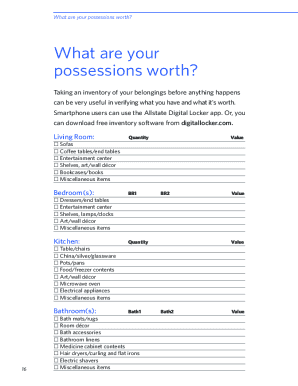

Provide details about your property, including its location, size, and construction.

03

Specify the coverage options you are interested in, such as liability, personal property, and additional endorsements.

04

Review the information provided and make any necessary changes before submitting the form.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Printable homeowners insurance quote form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What questions should I ask a home insurance company?

How much coverage did you quote on my house? How much coverage is provided for my personal property (my stuff)? Are my contents insured for replacement cost or actual cash value (ACV) Is my house insured for replacement cost or actual cash value (ACV) Do I have sewer and water coverage?

How many quotes should I get for homeowners insurance?

Key Takeaways The average homeowners insurance policy in the U.S. costs about $1,250 a year. You can get quotes online or by working directly with a home insurance agent. Plan on getting at least three quotes to make sure you find the best policy for your budget.

What four major factors determine the cost of home insurance?

Here's a rundown of 10 factors that could impact your home insurance costs. Your Location. The Size of Your Home. The Condition of Your Home. If You Own or Finance Your Home. Your Level of Coverage. Your Deductible. Previous Homeowners Insurance Claims. The Cost of Materials and Construction.

What is included in an insurance quote?

Your quote should come with plan details and what coverage is offered. It may also tell you if you qualify for a tax credit and how much if so.

How do you write an insurance quote?

In the quotation form, you also need to specify the dwelling details. Plus, you need to explicitly state everything about policy coverage and give information on underwriting. Lastly, you should write details of the additional policy or coverage notes.

What questions are asked for a home insurance quote?

To get a homeowners insurance quote, you'll typically be asked to provide identifying information such as your birth date and Social Security number, as well as the address of the home you want to insure. The coverages and limits you request will help determine how much you'll pay for a policy.