Insurance Form Builder

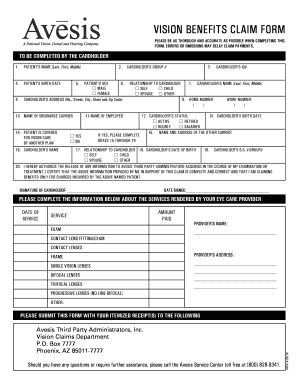

What is Insurance form builder?

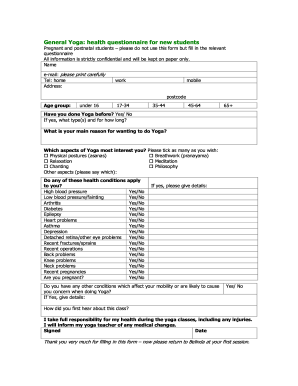

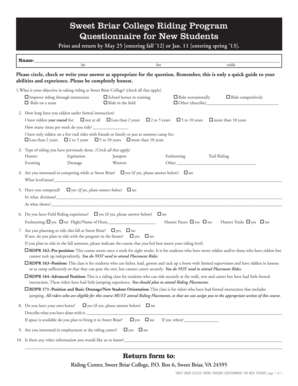

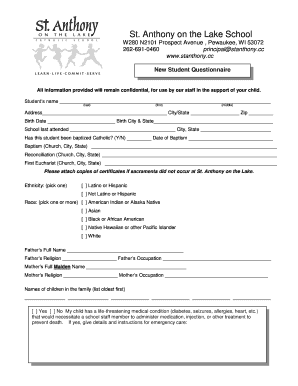

An Insurance form builder is a tool that allows users to create customized insurance forms tailored to their specific needs. With an insurance form builder, users can easily design and modify forms to collect relevant information from clients or policyholders.

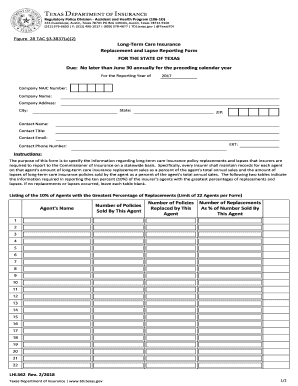

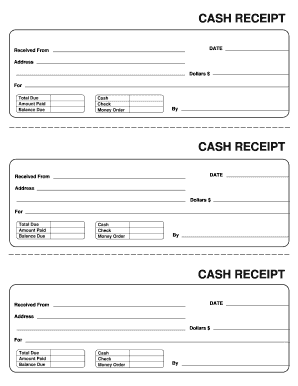

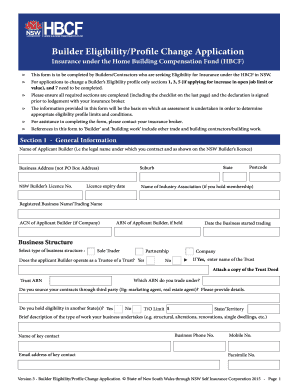

What are the types of Insurance form builder?

There are several types of Insurance form builders available in the market, each offering unique features to meet different requirements. Some common types include:

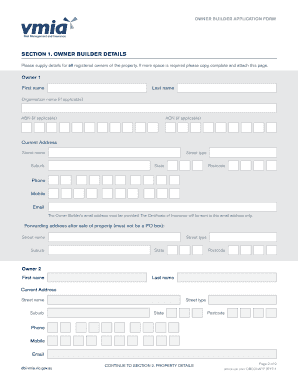

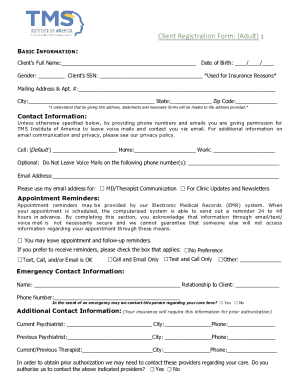

How to complete Insurance form builder

Completing an Insurance form builder is a simple and straightforward process. Here are some steps to guide you through:

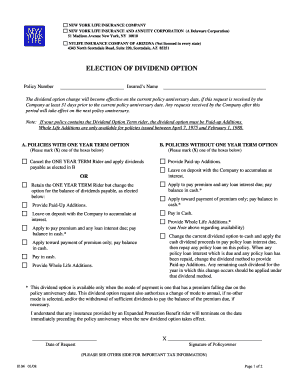

pdfFiller empowers users to create, edit, and share insurance forms online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to streamline your document management process.