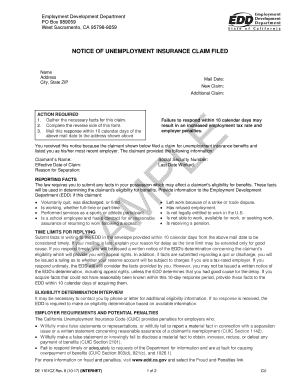

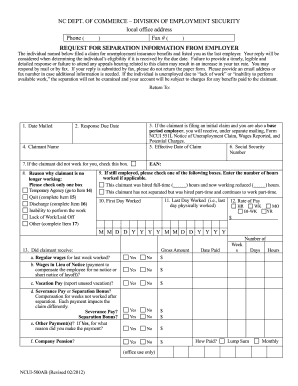

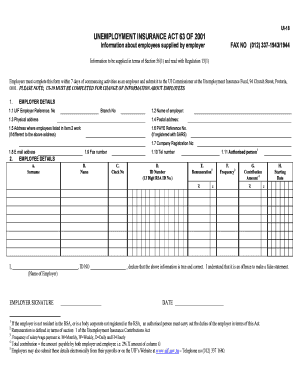

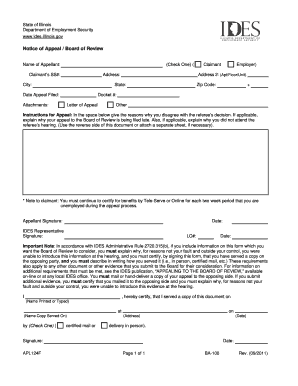

Unemployment Insurance Application Templates

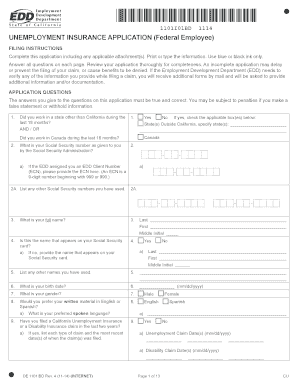

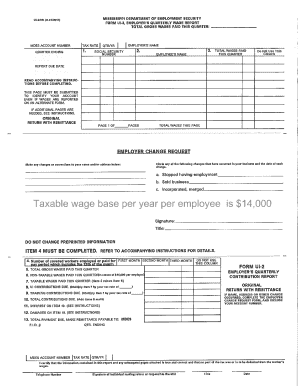

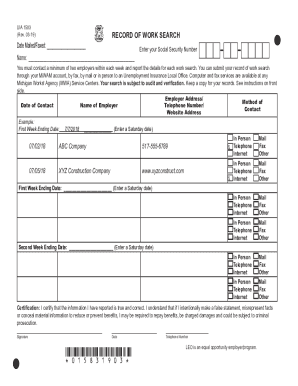

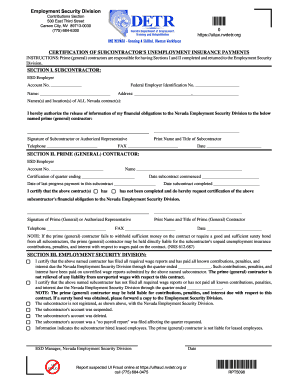

What are Unemployment Insurance Application Templates?

Unemployment Insurance Application Templates are pre-designed forms that individuals can use to apply for unemployment benefits. These templates streamline the application process by providing a structured format for collecting necessary information.

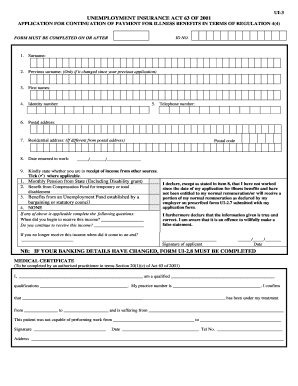

What are the types of Unemployment Insurance Application Templates?

There are several types of Unemployment Insurance Application Templates available, including: Regular Unemployment Insurance Application, Pandemic Unemployment Assistance Application, Extended Benefits Application, and Disaster Unemployment Assistance Application.

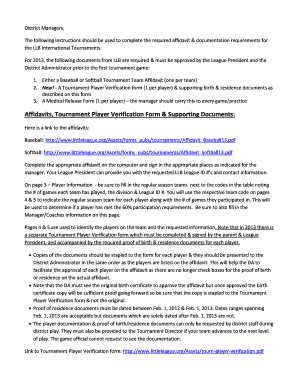

How to complete Unemployment Insurance Application Templates

Completing Unemployment Insurance Application Templates is simple with the following steps:

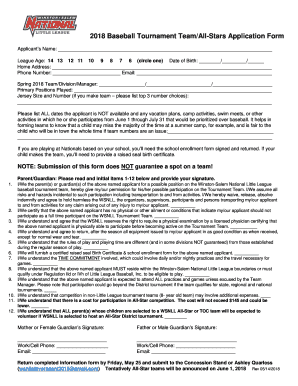

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.