How To File For Unemployment In California - Page 2

What is How to file for unemployment in California?

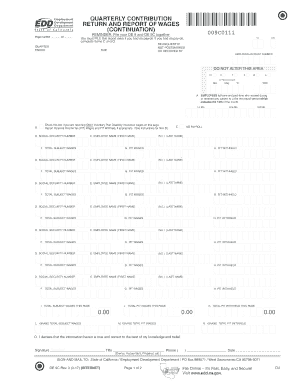

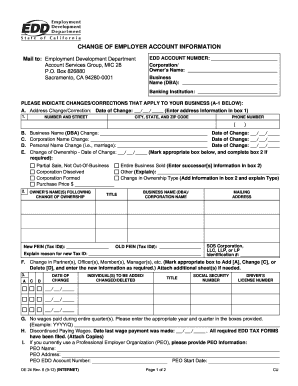

Filing for unemployment in California is a process where individuals who are currently unemployed can apply for financial assistance from the state government. This aid is designed to help individuals who have lost their jobs through no fault of their own and are actively seeking new employment opportunities.

What are the types of How to file for unemployment in California?

There are primarily two types of unemployment benefits available in California: Unemployment Insurance (UI) and Pandemic Unemployment Assistance (PUA). UI is for individuals who have lost their jobs due to reasons outside their control, while PUA provides benefits to those who are self-employed, independent contractors, or gig workers.

How to complete How to file for unemployment in California

To successfully complete the process of filing for unemployment in California, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.