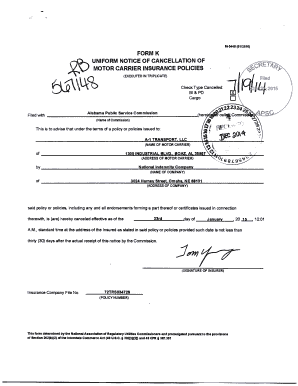

Cancellation Of Insurance Policy

What is Cancellation of insurance policy?

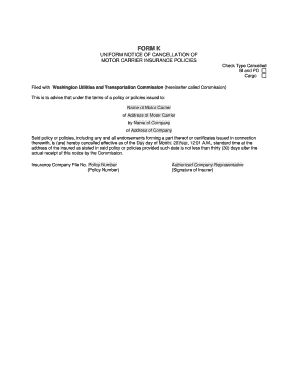

Cancellation of an insurance policy refers to the termination of an insurance contract by either the policyholder or the insurance company before the policy's expiration date. It can be initiated for various reasons and can have different implications depending on the specific terms of the insurance agreement.

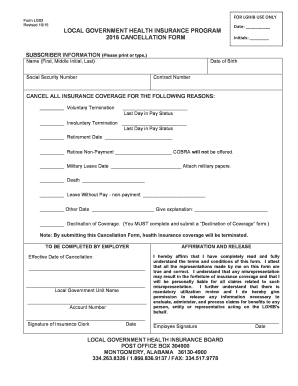

What are the types of Cancellation of insurance policy?

There are two main types of cancellation of insurance policies: voluntary cancellation and involuntary cancellation. Voluntary cancellation occurs when the policyholder decides to terminate the policy, while involuntary cancellation happens when the insurance company decides to terminate the policy due to non-payment, fraud, or other violations of the policy terms.

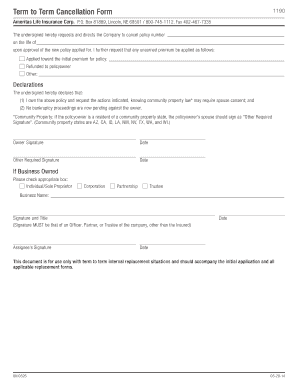

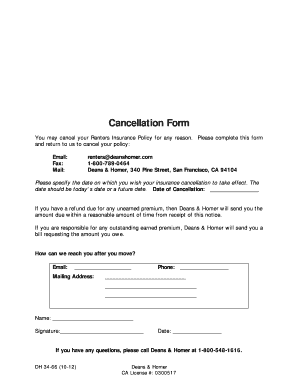

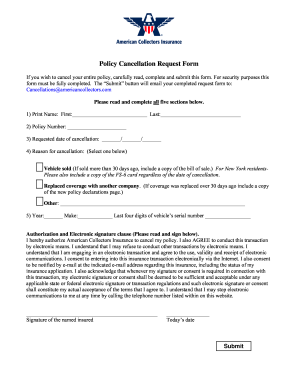

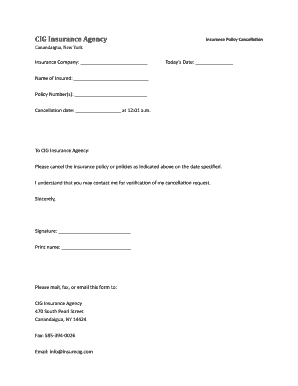

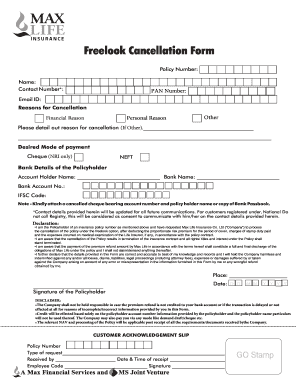

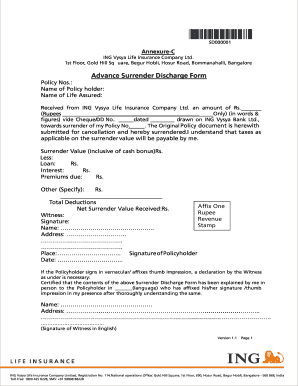

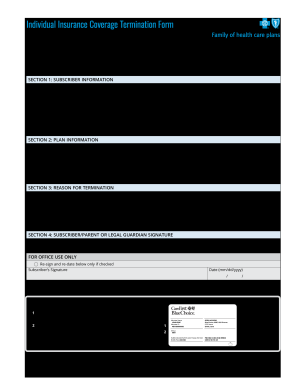

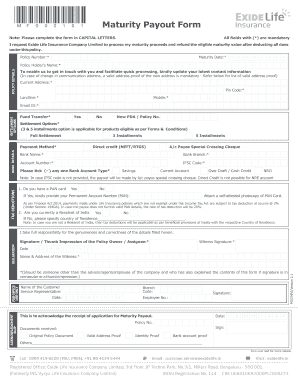

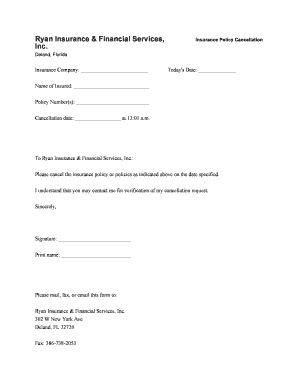

How to complete Cancellation of insurance policy

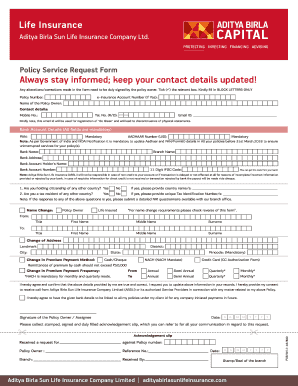

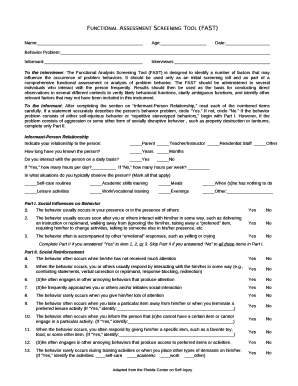

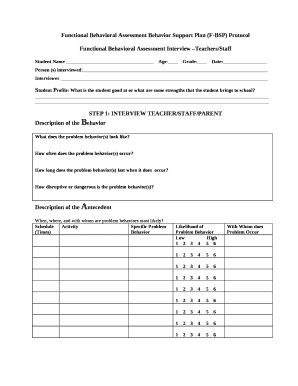

Completing the cancellation of an insurance policy involves following specific steps to ensure that the process is carried out correctly and efficiently. Here are the steps to complete the cancellation:

By utilizing pdfFiller, you can easily create, edit, and share insurance policy cancellation documents online. With unlimited fillable templates and powerful editing tools, pdfFiller simplifies the process, making it the only PDF editor you need to get your insurance policy cancellations done quickly and efficiently.