Cancellation Of Life Insurance Policy - Page 2

What is Cancellation of life insurance policy?

Cancellation of a life insurance policy refers to the act of terminating or ending the coverage and benefits provided by the policy. This can be done for various reasons such as no longer needing the coverage, finding a better policy, or financial constraints.

What are the types of Cancellation of life insurance policy?

There are two main types of cancellation of a life insurance policy:

Voluntary cancellation: This occurs when the policyholder chooses to terminate the policy.

Involuntary cancellation: This happens when the insurance company cancels the policy due to non-payment of premiums or other policy violations.

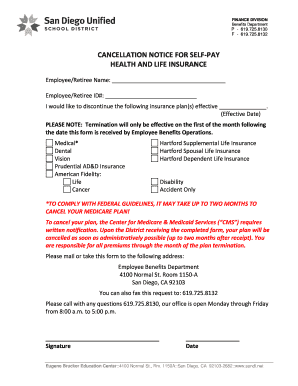

How to complete Cancellation of life insurance policy

To complete the cancellation of a life insurance policy, follow these steps:

01

Contact your insurance company: Inform them of your decision to cancel the policy.

02

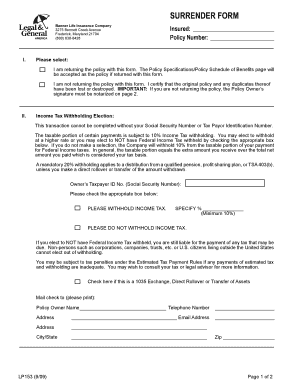

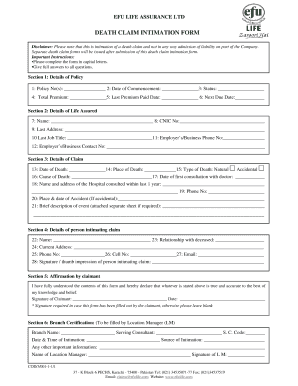

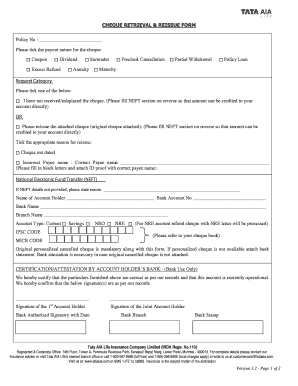

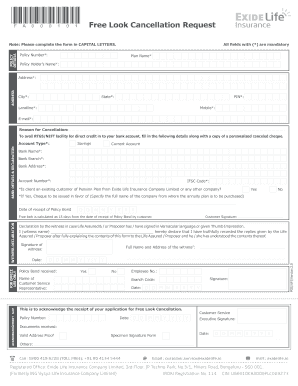

Fill out any required forms: The insurance company may require you to fill out a cancellation form.

03

Return the policy documents: You may need to return the original policy documents to the insurance company.

04

Receive confirmation: Once the cancellation is processed, make sure to receive written confirmation from the insurance company.

05

Consider alternatives: If needed, explore other insurance options to ensure you are adequately covered.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Cancellation of life insurance policy

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Can you cancel a life insurance policy at any time?

What Happens When You Surrender a Whole Life Policy? When you surrender a whole life policy, you give it up for the accumulated cash value. You stop paying premiums. the insurance company pays you the cash value minus any surrender charges. However, the surrendering option should be taken after careful consideration.

What happens if you cancel a whole life insurance policy?

If you happen to be unhappy with the policy - say if the terms and conditions stipulated in the plan do not meet your expectations, you can cancel it and receive a refund of your paid premium (subject to certain deductions). Your free-look period usually lasts for 15 days after receiving your insurance policy.

What happens when you cancel a life insurance policy?

Unless you've purchased a Return Of Premium Term Life Insurance Policy, you will not get your money back at the end of the term or at any time you cancel the policy.

Do you get all your money back from life insurance?

An insurance policy generally isn't something you can return for your money back. But there's one exception: return-of-premium life insurance. Also known as ROP life insurance, this type of coverage reimburses you for the money you paid in premiums if you don't die during the term.

What life insurance policy gives you money back?

A return of premium (ROP) life insurance rider is an optional add-on to a term life policy that, if you outlive the policy term, pays you all or some of the money you spent on policy payments.

Can you get any money back if you cancel a life insurance policy?

Non-payment of premiums This is the most common reason for policy cancellation. You must pay your premiums on time and in full to remain covered. Most insurers offer a grace period, which can be up to 30 days from the due date.