Health Insurance Claim Form Example - Page 2

What is Health insurance claim form example?

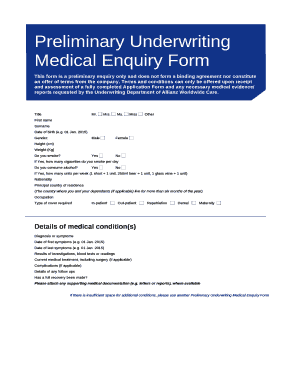

A Health insurance claim form example is a document that policyholders use to request reimbursement for medical expenses covered by their health insurance plan. It includes details such as the patient's information, treatment received, healthcare provider details, and the cost of services rendered.

What are the types of Health insurance claim form example?

There are several types of Health insurance claim form examples, including:

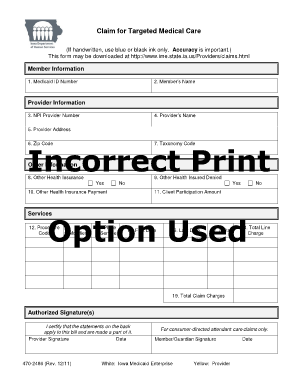

CMS-Used for medical claims by healthcare professionals

UB-Used for hospital and facility claims

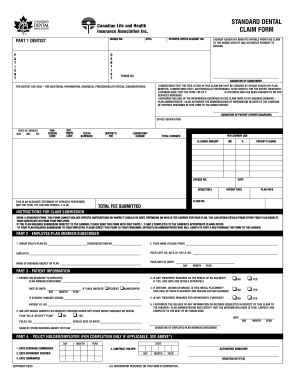

Dental Claim Form: Used for dental procedures and treatments

How to complete Health insurance claim form example

To complete a Health insurance claim form example, follow these steps:

01

Fill in the patient's information, including name, date of birth, and contact details

02

Provide details of the treatment received, including diagnosis codes and procedure codes

03

Include information about the healthcare provider, such as name, address, and NPI number

04

List the cost of services rendered and any out-of-pocket expenses

05

Review the form for accuracy and completeness before submission

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Health insurance claim form example

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I write an insurance claim form?

Key Components of a Car Insurance Claim Form Policyholder's name, address, and contact details. Policy number or identification number. Driver's license information.

How do I make a healthcare claim?

The easiest way to submit a claim is to have your health services provider do it for you, but they can't do so if they're not in the network. You may want to coordinate your benefits and submit two claims, one to your own insurance company and one to your spouse's insurer, if you're covered on two plans.

How to fill out a health insurance claim form 1500?

How to fill out a CMS-1500 form The type of insurance and the insured's ID number. The patient's full name. The patient's date of birth. The insured's full name, if applicable. The patient's address. The patient's relationship to the insured, if applicable. The insured's address, if applicable. Field reserved for NUCC use.

What is a CMS 1500 health insurance claim form?

The CMS-1500 form is the standard claim form used by a non-institutional provider or supplier to bill Medicare carriers and durable medical equipment regional carriers (DMERCs) when a provider qualifies for a waiver from the Administrative Simplification Compliance Act (ASCA) requirement for electronic submission of

What goes in box 19 on 1500 claim form?

Box 19 is used to identify additional information about the patient's condition or the claim. See the NUCC 1500 Health Insurance Claim Form Reference Instruction Manual for additional details.

What is the 1500 claim form?

The CMS-1500 claim form is used to submit non-institutional claims for health care services to many private payers, Medicare, Medicaid and other government health insurance programs. (Most institution-based claims are submitted using a UB-04 form.)