How To Fill Out A Health Insurance Claim Form - Page 2

What is How to fill out a health insurance claim form?

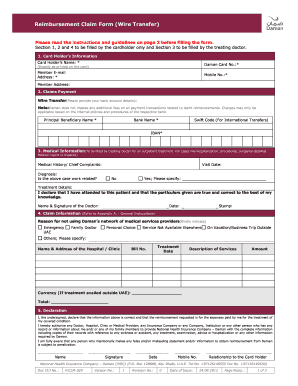

Filling out a health insurance claim form is a crucial step in getting the healthcare coverage you deserve. It is a document where you provide details about the medical services you received and submit it to your insurance company for reimbursement. By correctly filling out this form, you ensure that you receive the financial support you are entitled to for your healthcare expenses.

What are the types of How to fill out a health insurance claim form?

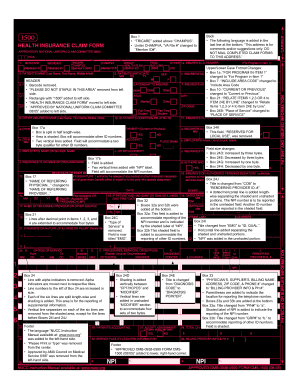

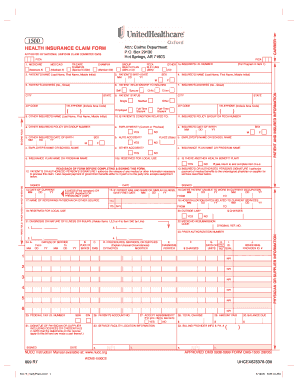

There are various types of health insurance claim forms, each catering to different insurance providers and policies. Some common types include HCFA-1500, UB-04, and CMS-1500 forms. These forms may have slightly different layouts and requirements, so it's essential to use the correct form according to your insurance provider.

How to complete How to fill out a health insurance claim form

To successfully complete a health insurance claim form, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.