Cancellation Of Insurance Policy

What is Cancellation of insurance policy?

Cancellation of an insurance policy refers to the process of terminating an existing insurance contract before its expiration date. This can be done by either the insurer or the policyholder.

What are the types of Cancellation of insurance policy?

There are two primary types of cancellation of insurance policy:

Voluntary cancellation: This occurs when the policyholder decides to terminate the insurance contract willingly.

Involuntary cancellation: This happens when the insurer decides to terminate the policy due to reasons such as non-payment of premiums or fraudulent activities.

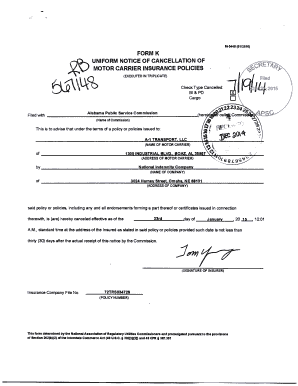

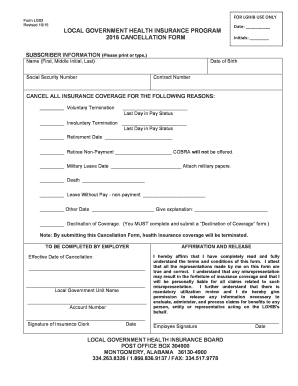

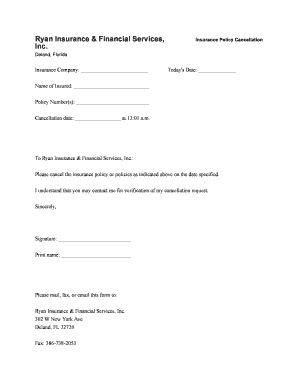

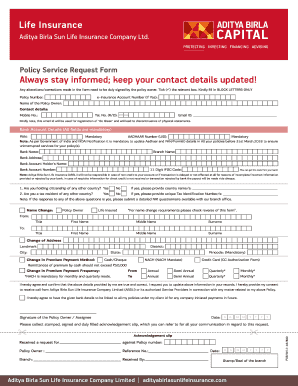

How to complete Cancellation of insurance policy

Completing the cancellation of an insurance policy involves the following steps:

01

Contact your insurance provider: Inform your insurer of your decision to cancel the policy.

02

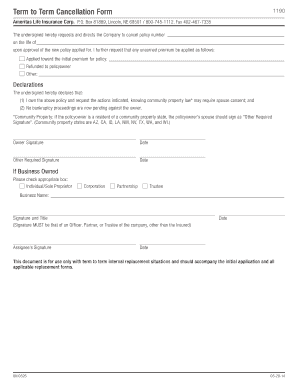

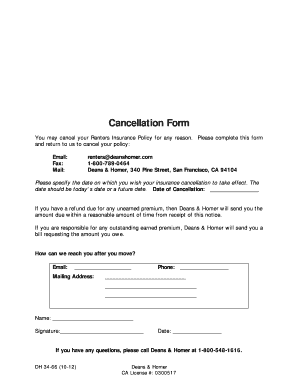

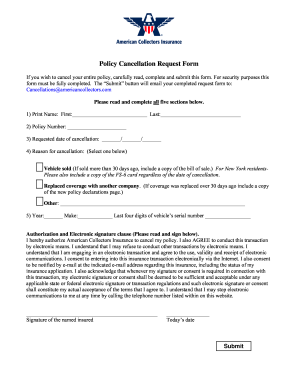

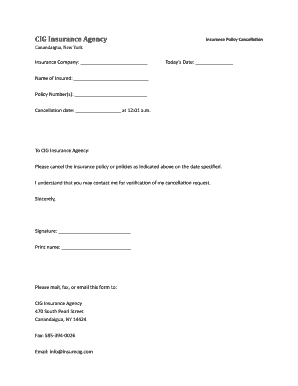

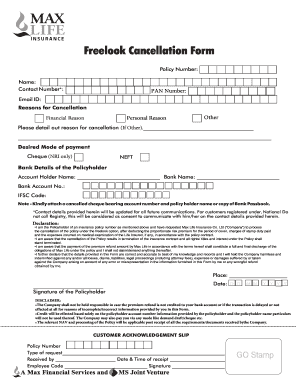

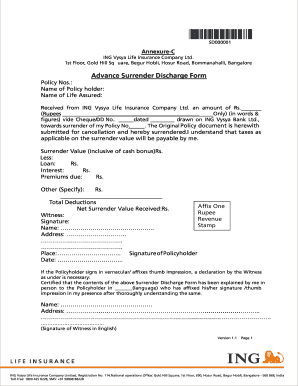

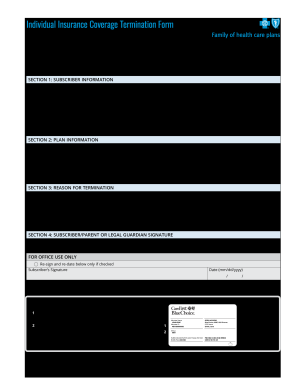

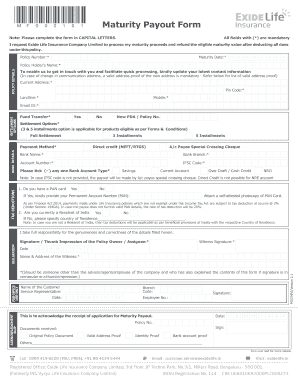

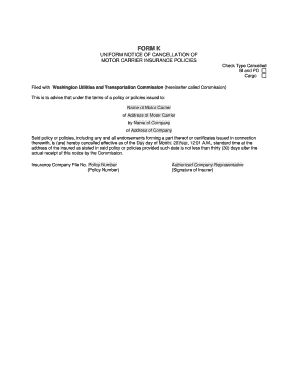

Submit a cancellation request: Fill out the necessary paperwork provided by the insurer to officially request the cancellation.

03

Receive confirmation: Once the cancellation request is processed, you will receive confirmation of the policy's termination.

04

Update records: Make sure to update your records to reflect the cancellation of the insurance policy.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Cancellation of insurance policy

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Can you just cancel an insurance policy?

You must contact your insurer to cancel the policy. Some policies are automatically renewed each year. It's important to check when your policy is due for renewal so you can make sure that it is not renewed when you don't want it to be.

What it called when you cancel an insurance policy?

Cancellation is the termination of an insurance policy or bond, before its expiration, by either the insured or the insurer.

Who has the right to cancel a policy?

Cancellation by the Policyholder Similar to the insurance company, a policyholder is not obligated beyond the term that is specified by the policy. Therefore, a policyholder may cancel the policy by simply not paying to renew it. It is also possible to cancel a policy midterm.

Who can cancel an insurance policy at any time for any reason?

Policyholders can cancel their auto insurance policy at any time, for any reason. And you never have to wait until the end of your policy period to cancel your policy. Even if your policy only started a few days ago, you may cancel it. Contact your insurer or agent to find the best way to cancel your policy.

Who has the right to cancel an insurance policy?

Cancellation by the Policyholder Similar to the insurance company, a policyholder is not obligated beyond the term that is specified by the policy. Therefore, a policyholder may cancel the policy by simply not paying to renew it. It is also possible to cancel a policy midterm.

What happens when you cancel an insurance policy?

If you paid your premium in advance and cancel your policy before the end of the term, the insurance company might refund the remaining balance. Most auto insurers will prorate your refund based on the number of days your current policy was in effect.