Cancellation Of Insurance Policy Philippines

What is Cancellation of insurance policy Philippines?

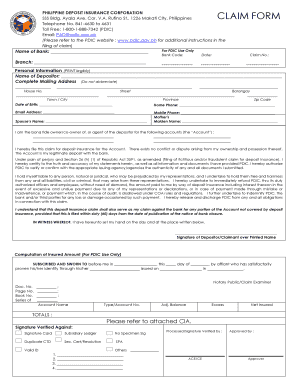

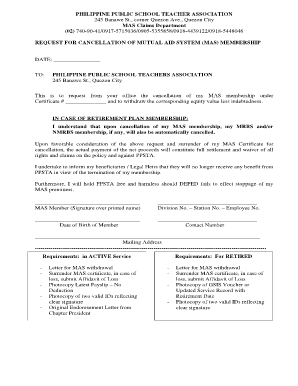

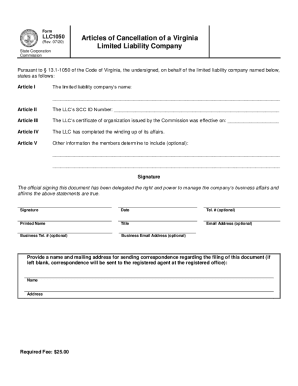

Cancellation of an insurance policy in the Philippines refers to the process of terminating or ending an existing insurance contract between the policyholder and the insurance company. This can be done for various reasons, such as finding a better insurance deal, no longer needing the coverage, or financial constraints.

What are the types of Cancellation of insurance policy Philippines?

There are several types of cancellations of insurance policies in the Philippines, including voluntary cancellation, non-payment cancellation, and policyholder request cancellation.

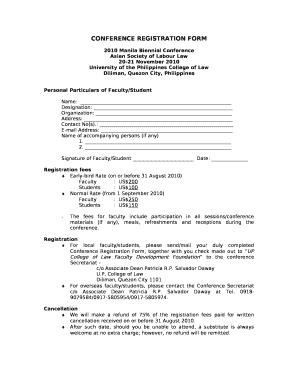

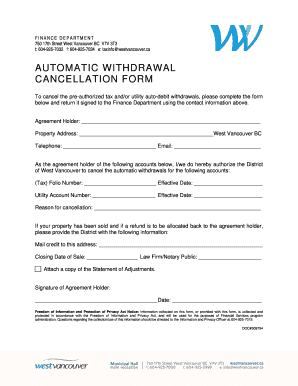

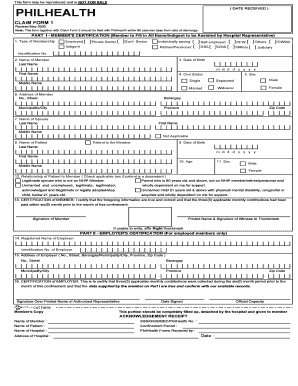

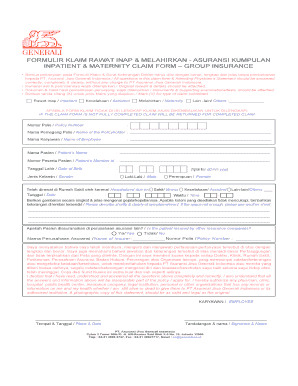

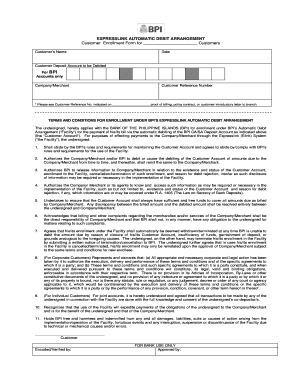

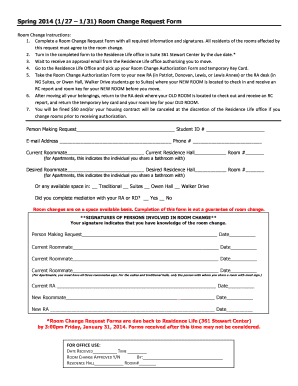

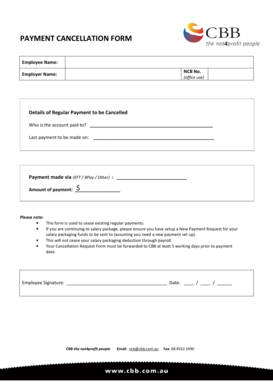

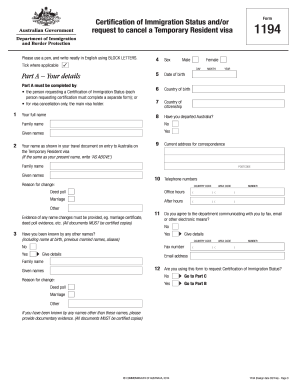

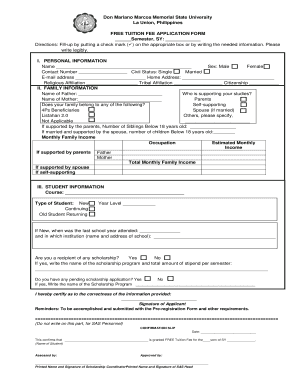

How to complete Cancellation of insurance policy Philippines

Completing the cancellation of an insurance policy in the Philippines requires the policyholder to follow certain steps to ensure a smooth process. Here are the steps to complete the cancellation:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.