Homeowners Insurance Quote Template - Page 2

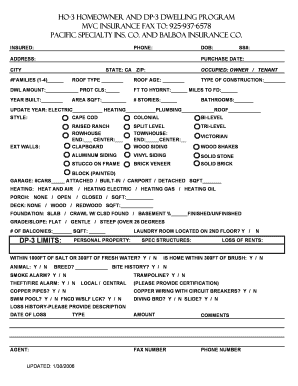

What is a Homeowners insurance quote template?

A Homeowners insurance quote template is a standardized form that allows homeowners to input information about their property and personal details to receive an estimate of insurance coverage costs. This template streamlines the process of obtaining quotes from different insurance providers by providing a consistent format for comparison.

What are the types of Homeowners insurance quote templates?

There are several types of homeowners insurance quote templates available, each catering to different needs and preferences. Some common types include:

How to complete a Homeowners insurance quote template

Completing a Homeowners insurance quote template is a simple process that can help you evaluate different insurance options effectively. Follow these steps to fill out the template:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.