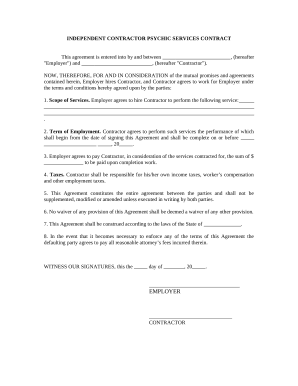

Independent Contractor Application Form - Page 2

What is Independent contractor application form?

An Independent contractor application form is a document used by companies to gather information from individuals who wish to work as independent contractors. This form helps companies assess the qualifications, experience, and suitability of potential contractors for various projects or tasks.

What are the types of Independent contractor application form?

There are several types of Independent contractor application forms depending on the industry and company requirements. Some common types include:

General Independent Contractor Application Form

Construction Independent Contractor Application Form

Freelance Independent Contractor Application Form

Consulting Independent Contractor Application Form

How to complete Independent contractor application form

To efficiently complete an Independent contractor application form, follow these steps:

01

Read the instructions carefully before filling out the form.

02

Provide accurate and detailed information about your skills, experience, and qualifications.

03

Double-check the form for any errors or missing information before submitting it.

04

Sign the form where required to attest to the accuracy of the information provided.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Independent contractor application form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I set up myself as a 1099 contractor?

Becoming an Independent Contractor Working as an Independent Contractor. Decide on Your Business Structure. Apply for a Tax ID Number and Other Tax Registrations. Register Your Business Name. Open Your Business Checking Account. Set up Your Business Record Keeping System. Frequently Asked Questions.

What is the difference between self-employed and independent contractor?

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

What IRS forms are needed for independent contractors?

Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more.

What 1099 form do I use for independent contractors?

Complete Form 1099-NEC, Nonemployee Compensation Businesses that pay more than $600 per year to an independent contractor must complete Form 1099-NEC and provide copies to both the IRS and the freelancer by the specified annual deadline.

What is a w9 form for an independent contractor?

W-9 forms are for self-employed workers like freelancers, independent contractors and consultants. You need to use it if you have earned over $600 in that year without being hired as an employee. If your employer sends you a W-9 instead of a W-4, the company has likely classified you as an independent contractor.

How do I set myself up as an independent contractor?

5 Steps: How to become an independent contractor Pick your vocation and obtain the necessary licensing. Focus on branding. Smooth out the specifics with a business plan. Open a business account and stay on top of taxes. Establish a winning marketing strategy.