What is Texas ag exemption renewal?

Texas ag exemption renewal is a process by which qualifying agricultural producers in Texas can renew their exemption status to benefit from certain tax advantages and incentives offered by the state.

What are the types of Texas ag exemption renewal?

There are two main types of Texas ag exemption renewal:

Agricultural Product Exemption Renewal

Timber Production Exemption Renewal

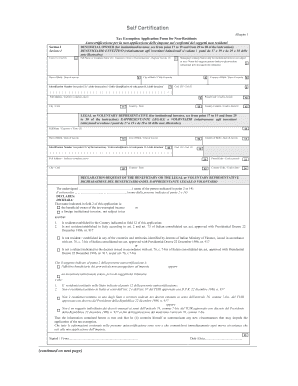

How to complete Texas ag exemption renewal

Completing Texas ag exemption renewal is a straightforward process that involves the following steps:

01

Gather all necessary documentation such as proof of agricultural production or timber production.

02

Fill out the renewal form accurately and completely.

03

Submit the renewal form to the appropriate state agency before the deadline.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Texas ag exemption renewal

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I keep land ag exemption in Texas?

Land must have been devoted to a qualifying agricultural use for at least 5 of the last 7 years. (On property inside city limits, ag production must have occurred for 5 of the last 5 years.) The landowner must file a timely and valid application with the appraisal district.

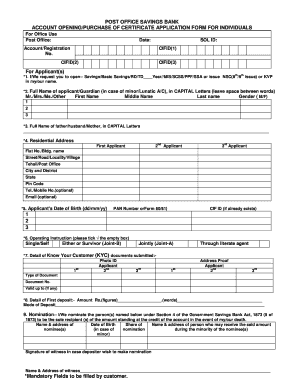

What are the requirements for agricultural tax exemption in Texas?

All purchasers, including non-Texas residents, must have a valid agricultural and timber registration number (Ag/Timber Number) issued by the Comptroller to claim exemption from Texas tax. If you do not have a valid Ag/Timber Number, you must pay tax to retailers on your purchases.

Can you get an ag exemption for 3 acres in Texas?

How many acres do you need to be ag exempt in Texas? Ag exemption requirements vary by county, but generally speaking, you need at least 10 acres of qualified agricultural land to be eligible for the special valuation.

Can you lose ag exemption in Texas?

All we know is that if an ag exemption or valuation is lost on a property, the current or new owners could be responsible for three to five years of rollback taxes including interest.

How many cows do I need for ag exemption in Texas?

Travis Central Appraisal District. How many animals do I need on my property to qualify for Agricultural Valuation? The minimum requirement for grazing stock is 4 animal units. A grazing livestock animal unit equals. 1 mature cow. 2 five-hundred pound calves. 6 sheep. 7 goats, or 1 mature horse.

Can you get an ag exemption on 5 acres in Texas?

Minimum acres required. AG Exemption requirements vary by county, but most commonly, you'll need at least 10 acres of qualified agriculture land to be eligible for this special valuation.