Template For Selling Your Business

What is Template for selling your business?

When preparing to sell your business, a template can serve as a structured guide or outline to ensure all necessary information and details are included in the sales process. It helps organize the data and present it in a clear and comprehensive manner, making it easier for potential buyers to evaluate the opportunity.

What are the types of Template for selling your business?

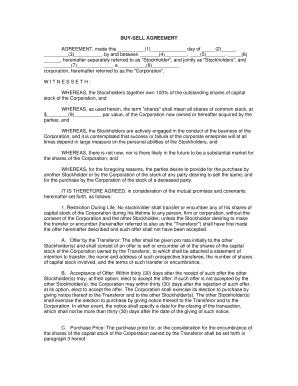

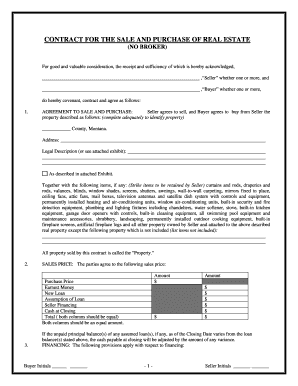

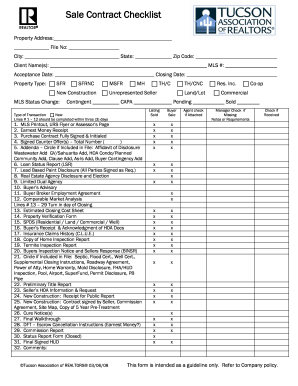

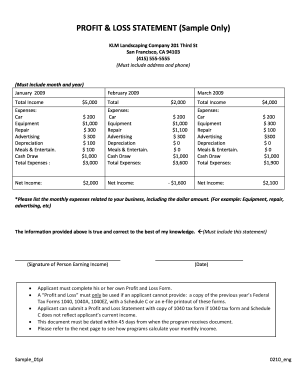

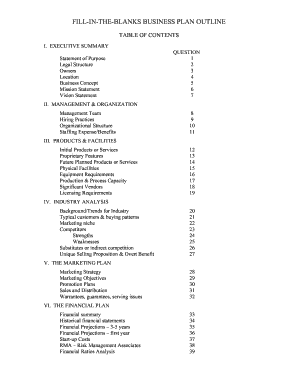

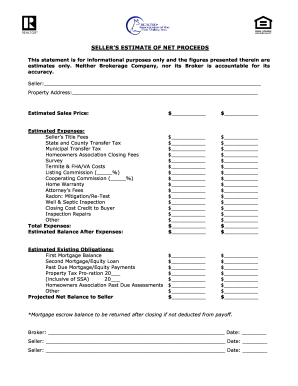

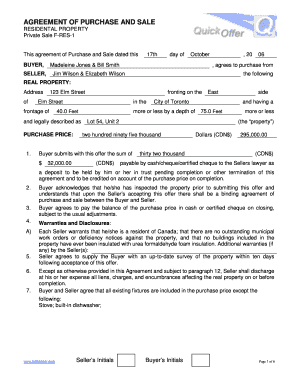

There are various types of templates available for selling your business, each designed to cater to different industries, sizes, and complexities of businesses. Some common types include:

How to complete Template for selling your business?

Completing a template for selling your business involves following a step-by-step approach to gather and structure all relevant information. Here are some key steps to complete the template:

pdfFiller empowers users to create, edit, and share documents online, offering unlimited fillable templates and powerful editing tools. It is the all-in-one PDF editor users need to efficiently manage their business documents.