Subsidiary Compliance

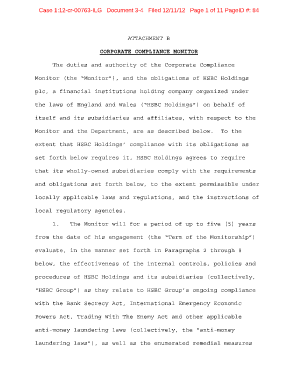

What is Subsidiary compliance?

Subsidiary compliance refers to the legal obligations and regulations that a subsidiary company must adhere to in order to operate within the laws of the jurisdiction it is located in. It involves ensuring that the subsidiary complies with all the necessary rules and regulations set forth by local authorities to conduct business legally and ethically.

What are the types of Subsidiary compliance?

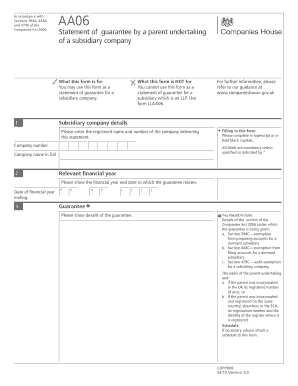

There are several types of subsidiary compliance that companies need to consider, such as:

How to complete Subsidiary compliance

Completing subsidiary compliance can seem daunting, but with the right tools and knowledge, it can be manageable. Here are some steps to help you navigate through the process:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.