What is Nonprofit documents?

Nonprofit documents are essential paperwork that nonprofit organizations need to create, maintain, and submit to comply with legal regulations and maintain transparency.

What are the types of Nonprofit documents?

The types of Nonprofit documents include:

Articles of Incorporation

Bylaws

IRS Form 990

Financial Statements

Annual Reports

How to complete Nonprofit documents

Completing Nonprofit documents can be overwhelming, but with the right guidance, it can be a smooth process. Here are some steps to help you:

01

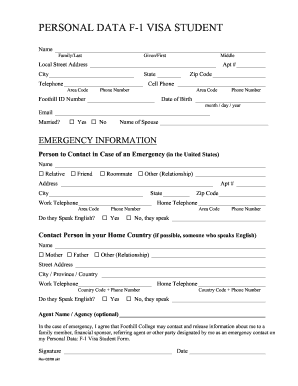

Gather all necessary information and data needed for the specific document.

02

Use a reliable online platform like pdfFiller to create, edit, and share your Nonprofit documents easily.

03

Review the document thoroughly for accuracy and compliance with regulations.

04

Seek legal advice if needed before finalizing the document.

05

Share the completed document with relevant parties as required.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Nonprofit documents

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the uniform guidance for nonprofits?

The Uniform Guidance expressly requires pass-through entities using any federal funds (typically states and local governments, as well as some larger nonprofits) and all federal departments/agencies to reimburse a nonprofit for the reasonable indirect costs it incurs in performing services on behalf of governments.

What is the difference between nonprofit and 501c?

Actually, no! These terms are often used interchangeably, but they all mean different things. Nonprofit means the entity, usually a corporation, is organized for a nonprofit purpose. 501(c)(3) means a nonprofit organization that has been recognized by the IRS as being tax-exempt by virtue of its charitable programs.

What are organizing documents for 501c3?

Organize Your Corporate Records the articles of incorporation. the bylaws. minutes of your organizational meeting (or first directors meeting) a list of the names and addresses of your directors. for a membership organization, a membership roster listing the names and addresses of your current members.

How do you write a non profit contract?

How to Make a Nonprofit Agreement Include a provision about unforeseen circumstances. Include a termination clause. Indicate the parties' roles and assignments. Make a note of the financial arrangements. Finally, don't overlook the signatures to validate the agreement.

What is the organizing document for nonprofit?

The primary corporate document for every nonprofit corporation is its articles of incorporation. A corporation comes into existence on the date its articles of incorporation are filed with the state corporate filing office.

How do you write a non profit MOU?

An MOU should identify the collaboration's partners. Each partner should sign the MOU to indicate their agreement and participation. An MOU should include a clear and specific statement of the collaboration's purpose. It may also include a vision statement and/or a values statement.