Simple Loan Agreement Template South Africa

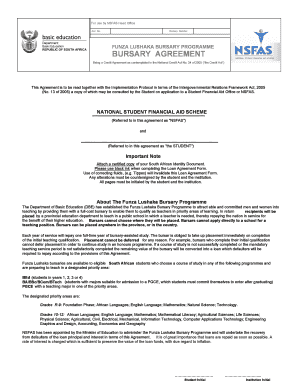

What is Simple loan agreement template south africa?

A Simple loan agreement template south africa is a legally binding document that outlines the terms and conditions of a loan between a lender and a borrower in South Africa. This agreement is crucial in protecting both parties' rights and clarifying the repayment terms of the loan.

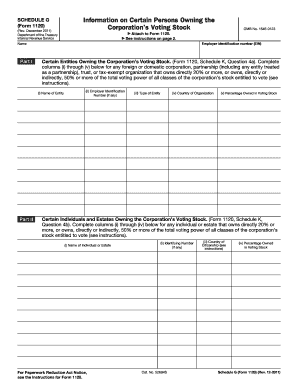

What are the types of Simple loan agreement template south africa?

There are several types of Simple loan agreement templates in South Africa, including: 1. Fixed-Term Loan Agreement 2. Revolving Loan Agreement 3. Demand Loan Agreement 4. Secured Loan Agreement 5. Unsecured Loan Agreement Each type of agreement serves different purposes and is suitable for different loan scenarios.

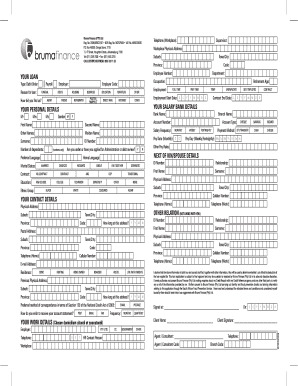

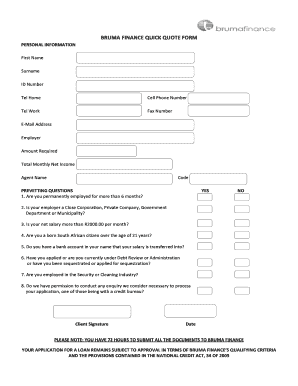

How to complete Simple loan agreement template south africa

Completing a Simple loan agreement template in South Africa is a straightforward process. Here are the steps to follow: 1. Fill in the borrower and lender information accurately 2. Clearly state the loan amount and repayment terms 3. Specify any interest rates or late payment penalties 4. Sign and date the agreement 5. Have both parties keep a copy of the signed agreement for their records

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.