Fiscal Sponsorship Agreement Samples

What is Fiscal sponsorship agreement samples?

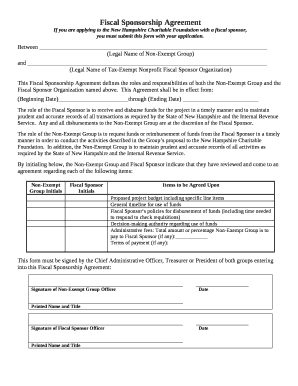

A fiscal sponsorship agreement sample is a legal document that outlines the terms and conditions of a fiscal sponsorship arrangement between a sponsor organization and a sponsored project. It serves as a roadmap for the financial and programmatic relationship between the two parties.

What are the types of Fiscal sponsorship agreement samples?

There are several types of fiscal sponsorship agreement samples, including:

Comprehensive Fiscal Sponsorship Agreement

Pre-approved Grant Relationship Agreement

Model A Fiscal Sponsorship Agreement

Model B Fiscal Sponsorship Agreement

Model C Fiscal Sponsorship Agreement

How to complete Fiscal sponsorship agreement samples

Completing a fiscal sponsorship agreement sample involves the following steps:

01

Review the terms and conditions outlined in the agreement carefully.

02

Fill in the relevant information specific to your sponsorship arrangement.

03

Ensure all parties involved in the sponsorship sign the document.

04

Make any necessary edits or revisions before finalizing the agreement.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Fiscal sponsorship agreement samples

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the purpose of a fiscal sponsor?

A fiscal sponsor is a nonprofit organization that provides fiduciary oversight, financial management, and other administrative services to help build the capacity of charitable projects. Fiscal Sponsorship: a 360 Degree Perspective, Trust for Conservation Innovation.

What is a fiscal sponsorship letter?

Fiscally sponsored groups applying to Flexible Support and Arts Impact for Groups must submit a Fiscal Sponsor Agreement Letter to confirm that your organization/group has an active working relationship with the fiscal sponsor at the time of application.

What are the two types of fiscal sponsorship?

The most common forms of fiscal sponsorship are the Direct Model and the Grant Model. The Direct Model is the most common form of fiscal sponsorship. In the Direct Model, the project becomes an integrated part of the fiscal sponsor, with no legal identity separate from the fiscal sponsor.

What is a fiscal sponsor agreement?

A fiscal sponsorship relationship confers the sponsor's 501(c)(3) tax-exempt status and certain administrative benefits onto a charitable project so that it can receive grants and tax-deductible contributions that it would otherwise be unable to receive.

What should be included in a sponsorship agreement?

A sponsorship agreement should include the length of the agreement, an exclusivity clause, payment calculation and method, the sponsor benefits, intellectual property rights and termination conditions.

What is the process of fiscal sponsorship?

The Project submits a grant request to the Sponsor detailing the project and its activities. The Sponsor approves the request and then receives funds on behalf of the Project and disperses them ingly. The Sponsor may receive a one-time grant on behalf of the Project, or the relationship may be continual.