Irs Fiscal Sponsorship

What is Irs fiscal sponsorship?

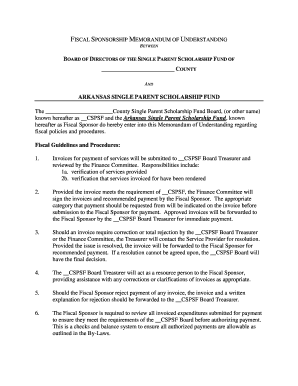

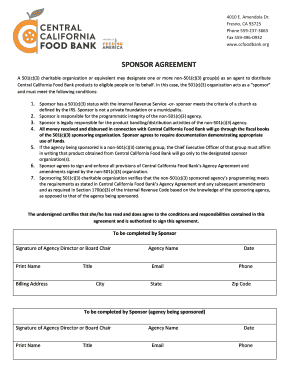

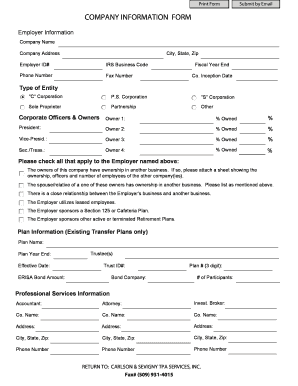

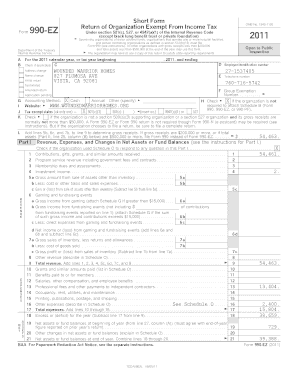

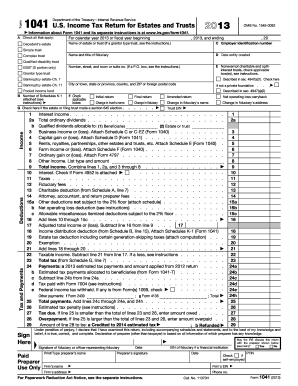

Irs fiscal sponsorship refers to a relationship between a nonprofit organization and another entity that allows the nonprofit to receive charitable donations under the tax-exempt status of the sponsoring organization. This arrangement provides smaller or newer nonprofits with access to resources and support to carry out their charitable activities.

What are the types of Irs fiscal sponsorship?

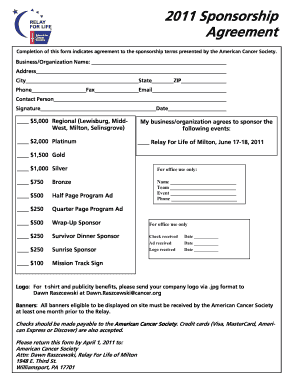

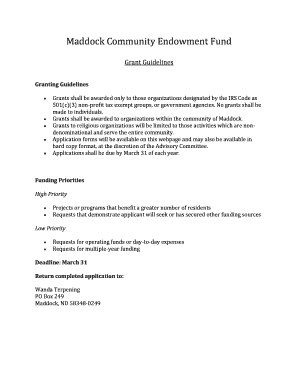

There are three main types of Irs fiscal sponsorship that organizations can choose from: 1. Direct Project Sponsorship - where the sponsor manages specific projects on behalf of the sponsored organization. 2. Comprehensive Fiscal Sponsorship - where the sponsor provides extensive support and administrative services to the sponsored organization. 3. Pre-approved Grant Relationship - where the sponsor manages grants on behalf of the sponsored organization.

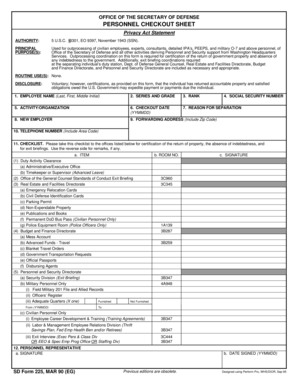

How to complete Irs fiscal sponsorship

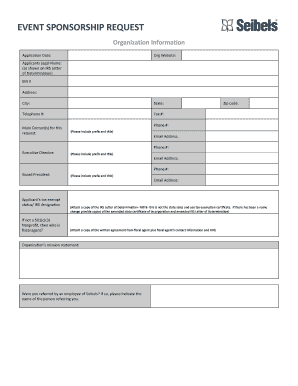

Completing Irs fiscal sponsorship involves the following steps: 1. Find a suitable fiscal sponsor that aligns with your organization's mission and values. 2. Negotiate a sponsorship agreement detailing the terms and responsibilities of both parties. 3. Ensure compliance with IRS regulations regarding fiscal sponsorship. 4. Maintain open communication and transparency with your fiscal sponsor throughout the sponsorship.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.