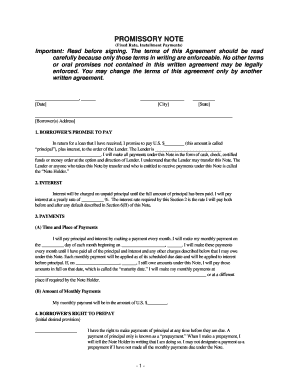

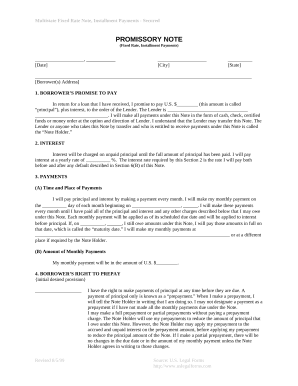

Unsecured Promissory Note Template

What is Unsecured promissory note template?

An Unsecured promissory note template is a legal document that outlines the terms and conditions of a loan agreement between two parties. It serves as a written promise to repay a specific amount of money borrowed without the need for collateral.

What are the types of Unsecured promissory note template?

There are several types of Unsecured promissory note templates that can be used depending on the specific situation. Some common types include:

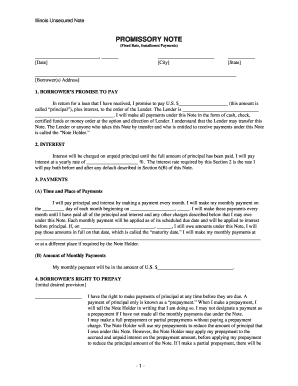

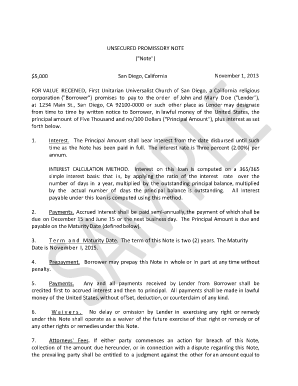

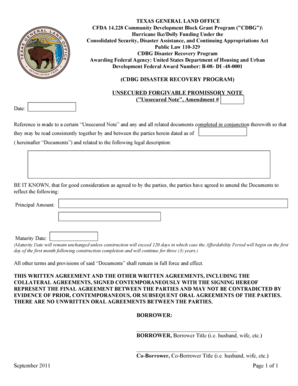

Standard Unsecured promissory note template

Convertible Unsecured promissory note template

Demand Unsecured promissory note template

How to complete Unsecured promissory note template

Completing an Unsecured promissory note template is a straightforward process. Here are the steps to follow:

01

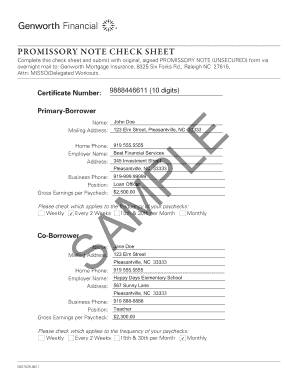

Fill in the borrower's and lender's information

02

Specify the loan amount and repayment terms

03

Include any additional terms and conditions agreed upon by both parties

04

Sign and date the document to make it legally binding

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Unsecured promissory note template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Does a promissory note need collateral?

A secured promissory note requires the borrower to safeguard the loan by putting up items of hard value, such as the home, condominium, or rental property being purchased, as collateral to ensure that sums are repaid.

How do you write an unsecured promissory note?

What does it Include? Borrower's name. Lender's name. Loan terms. Borrowed amount ($) Interest rate (%) Repayment period. Late Fees (if any) Co-signer (if any) Prepayment penalty (if any)

How do you know if a promissory note is secured?

So, what's the difference between secured and unsecured promissory notes? It's actually quite simple. A secured note is any debt collateralized with real property like a first deed of trust or car title. Conversely, an unsecured note is any debt not secured by collateral (or uncollateralized).

Can I write my own promissory note?

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

What is an example of an unsecured note?

A common example of an unsecured note is medical bills, as patients do not have to provide collateral in exchange for receiving care. Unsecured note agreements generally identify the buyer, the lender, state the promise to pay, the payment arrangement, due date, and penalties in the case of default.

What are unsecured promissory notes called?

An unsecured promissory note is a legally binding contract between two parties where one party agrees to pay the other a certain amount of money at a specific time in the future. The reason it is called 'unsecured' is because the borrower does not want to pledge any assets as collateral for the loan.