Security Agreement Form For Vehicle

What is Security agreement form for vehicle?

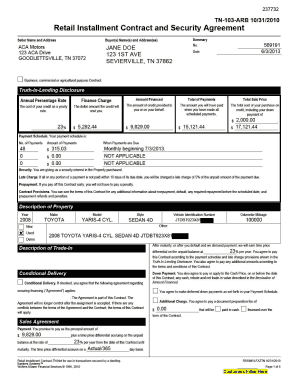

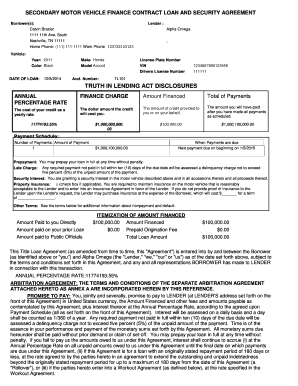

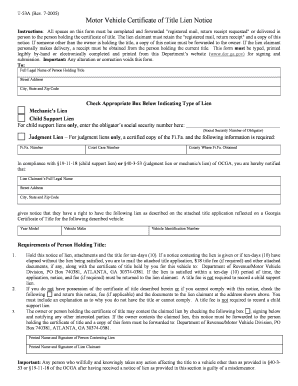

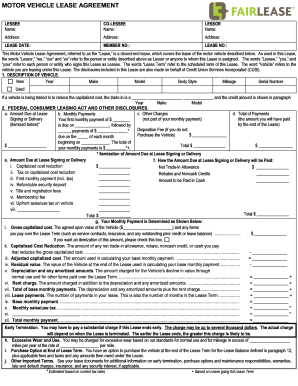

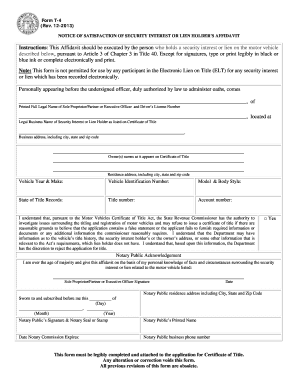

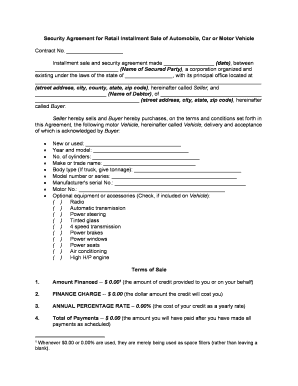

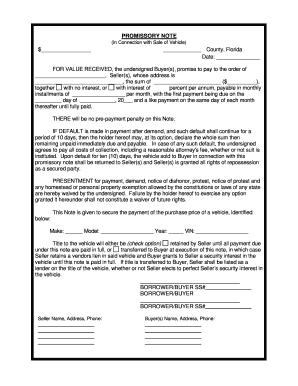

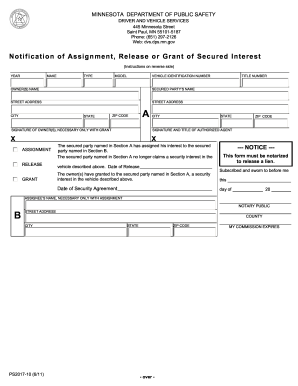

A Security Agreement form for a vehicle is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender. It serves as collateral for the loan, giving the lender the right to repossess the vehicle if the borrower fails to make payments as agreed.

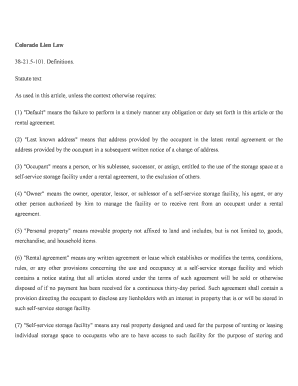

What are the types of Security agreement form for vehicle?

There are two main types of Security Agreement forms for vehicles: 1. Chattel Mortgage: This type of agreement involves the transfer of ownership of the vehicle to the lender until the loan is paid off. 2. Conditional Sale Contract: In this type of agreement, the lender retains ownership of the vehicle until the borrower fulfills the terms of the loan agreement.

How to complete Security agreement form for vehicle

Completing a Security Agreement form for a vehicle is a straightforward process. Follow these simple steps:

pdfFiller can assist you in completing your Security Agreement form for a vehicle with ease. With its user-friendly interface and robust features, pdfFiller streamlines the document creation, editing, and sharing process, making it the go-to PDF editor for all your needs.