Asset Transfer Agreement Pdf

What is Asset transfer agreement pdf?

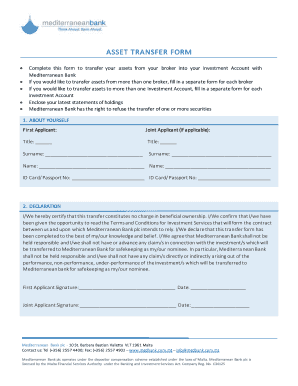

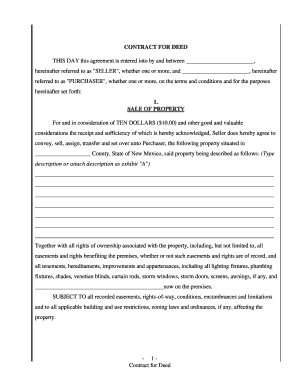

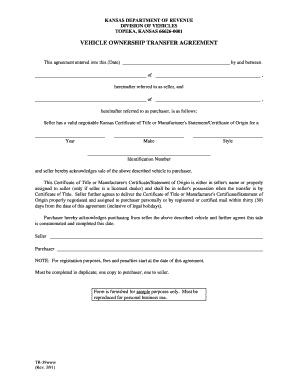

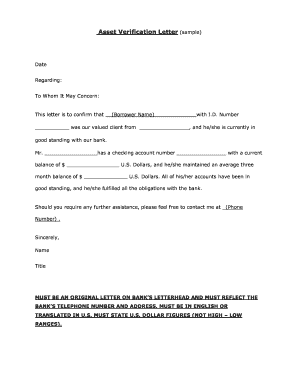

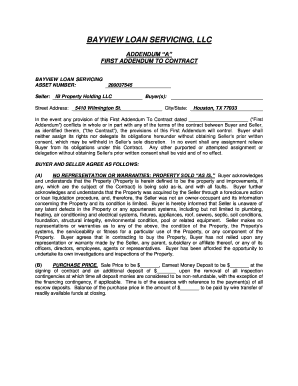

An Asset transfer agreement pdf is a legal document that outlines the transfer of assets from one party to another. It details the terms and conditions of the transfer, including the specific assets being transferred and any warranties or representations made by both parties.

What are the types of Asset transfer agreement pdf?

There are several types of Asset transfer agreement pdf, including:

Purchase Agreement

Gift Agreement

Lease Agreement

Exchange Agreement

Donation Agreement

How to complete Asset transfer agreement pdf

Completing an Asset transfer agreement pdf is simple and straightforward. Here are the steps to follow:

01

Fill in the details of the transferring and receiving parties

02

Specify the assets being transferred and their respective values

03

Include any terms and conditions of the transfer, such as warranties or representations

04

Sign and date the agreement to make it legally binding

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is asset transfer agreement?

An asset transfer agreement (ATA) is a contract between two parties that sets forth the terms and conditions for the transfer of ownership of certain assets. The ATA defines the parties to the agreement, the assets to be transferred, and the consideration to be paid for the transfer.

What is the difference between acquisition of assets and acquisition of shares?

In an asset acquisition, the buyer is able to specify the liabilities it is willing to assume, while leaving other liabilities behind. In a stock purchase, on the other hand, the buyer purchases stock in a company that may have unknown or uncertain liabilities.

Is an asset purchase agreement legally binding?

Yes, an asset purchase agreement is legally binding. The document contains enforceable obligations that require both parties to carry out the APA's terms and conditions. Pay attention to the wording of your APA to understand the penalties for reneging on those terms.

How do you write an asset transfer agreement?

Common Sections in Asset Transfer Agreements Sales of Sold Assets. Representations, Warranties and Covenants of the Seller. Repurchase of Collateral Obligations. Representations, Warranties and Covenants of the Issuer. Closing. Undertaking and Assumption. Notices. GOVERNING LAW.

Which is better share purchase or asset purchase?

Share purchases may result in lower tax liability for the seller. While asset sales can be subject to a double tax charge – once on the gain from the sale and once when the proceeds are distributed – the proceeds of share sales are paid directly to shareholders and taxed just once.

What is the difference between an asset and a stock deal?

An asset sale is the purchase of individual assets and liabilities, whereas a stock sale is the purchase of the owner's shares of a corporation. While there are many considerations when negotiating the type of transaction, tax implications and potential liabilities are the primary concerns.