Guarantor Form For Sales Representative - Page 2

What is Guarantor form for sales representative?

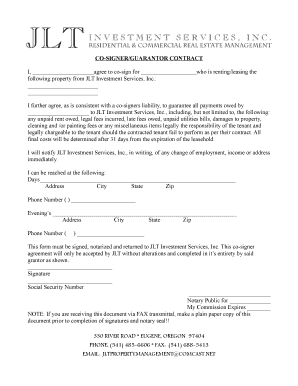

A Guarantor form for a sales representative is a legally binding document that assures the selling party that the representative will fulfill their obligations as per the sales agreement. It serves as a security measure to protect the interests of the seller in the event the representative fails to meet their responsibilities.

What are the types of Guarantor form for sales representative?

There are primarily two types of Guarantor forms for sales representatives: 1. Personal Guarantor Form: In this type, an individual agrees to be responsible for the sales representative's obligations. 2. Corporate Guarantor Form: Here, a company guarantees the sales representative's performance and compliance with the sales agreement.

How to complete Guarantor form for sales representative

Completing a Guarantor form for a sales representative is a straightforward process. Follow these steps to ensure accuracy and completeness:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.