How To Fill Guarantor Form

What is How to fill guarantor form?

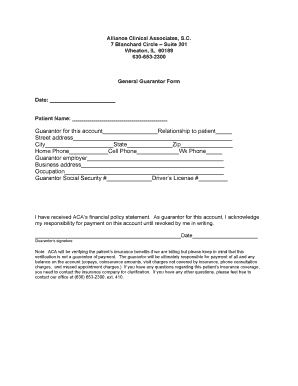

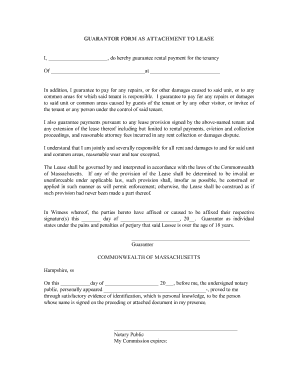

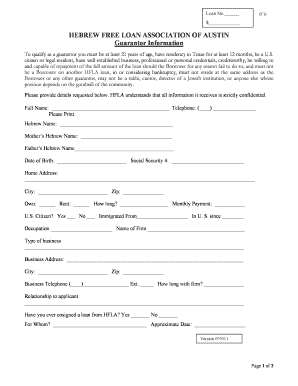

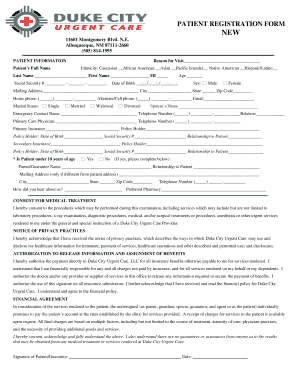

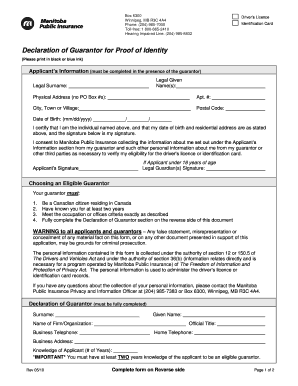

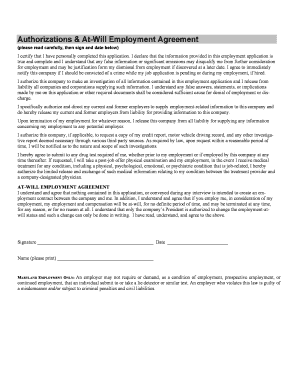

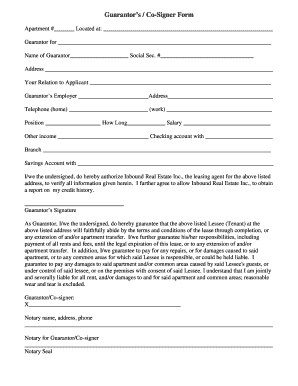

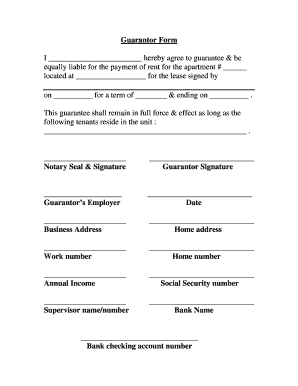

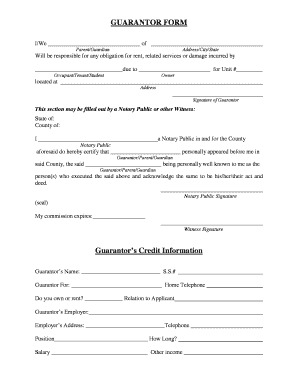

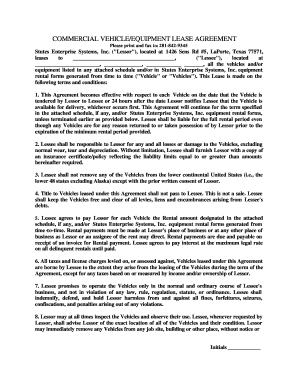

The guarantor form is a document that allows someone to act as a financial guarantee for another person, ensuring that certain obligations will be met. This form is commonly used in loan applications or rental agreements.

What are the types of How to fill guarantor form?

There are different types of guarantor forms depending on the purpose. Some common types include:

Individual Guarantor Form

Corporate Guarantor Form

Parental Guarantor Form

How to complete How to fill guarantor form

To successfully fill out a guarantor form, follow these steps:

01

Obtain the form from the lender or landlord.

02

Fill in your personal details accurately.

03

Provide information about your financial situation and assets.

04

Sign the form in the designated sections.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out How to fill guarantor form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a letter of guarantee on behalf of someone?

A letter of guarantee refers to the motion of confidence from a bank on behalf of their customer during the purchase of goods or materials from a supplier. This letter is to reiterate that if the customer defaults on their payments to the supplier, the bank shall step in to pay the dues.

What is an example of a guarantor?

For example, in a rental agreement, a co-signer would be responsible for the rent from day one, whereas a guarantor would only be responsible for the rent if the renter fails to make a payment. This also applies to any loan. Guarantors are only notified when the borrower defaults, not for any payment before that.

What is an example of a guarantor?

For example, a mortgage guarantor promises to make mortgage repayments if the mortgage borrower defaults on their obligation. A passport guarantor is an individual who stands a guarantee for passport application.

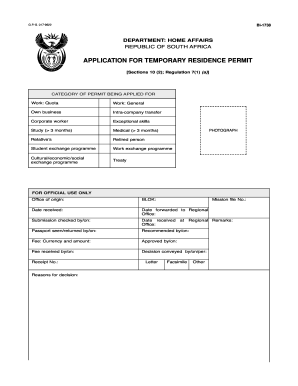

What should a guarantor letter say?

In this guarantor letter example, the letter is divided into five general topics: firstly, the statement of the guarantor assuming the financial responsibility and promising to perform all the terms and conditions of the cottage rental upon the renter's failure to do so is presented. secondly, the name and address of

How do you write a good guarantor letter?

In this guarantor letter example, the letter is divided into five general topics: firstly, the statement of the guarantor assuming the financial responsibility and promising to perform all the terms and conditions of the cottage rental upon the renter's failure to do so is presented. secondly, the name and address of

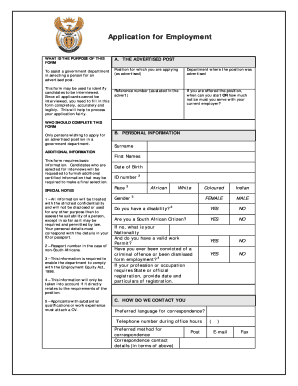

How do I write an employee guarantor form?

To write a guarantor letter, start by writing the date at the top of the paper, followed by your full name and address. Below your information, address the letter to the company you're dealing with and begin the letter by identifying yourself and the person you're guaranteeing.