Payment Bond Claim

What is Payment bond claim?

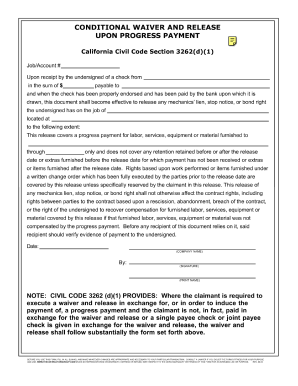

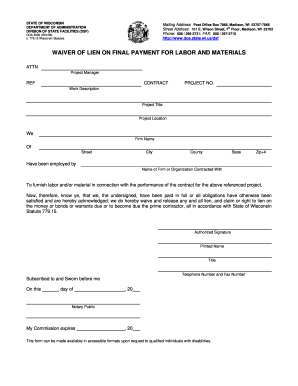

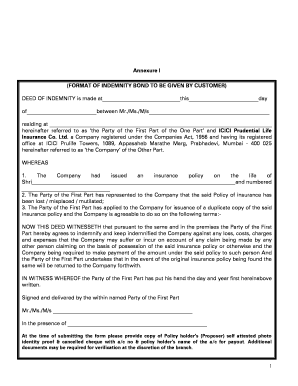

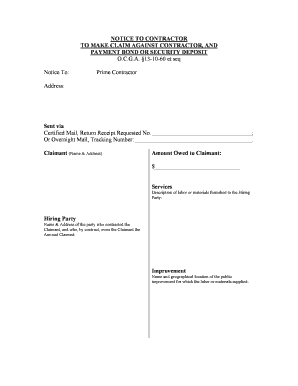

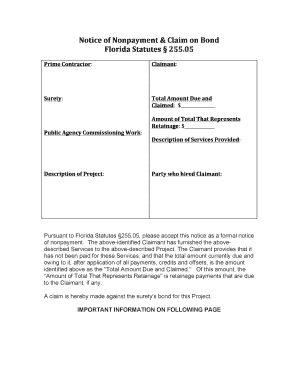

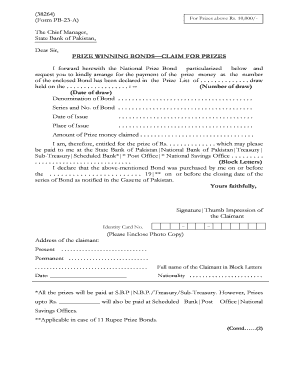

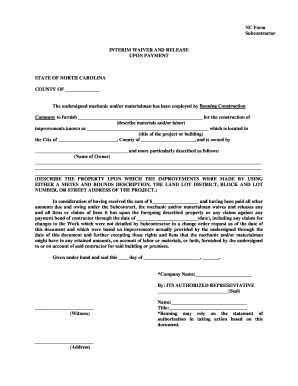

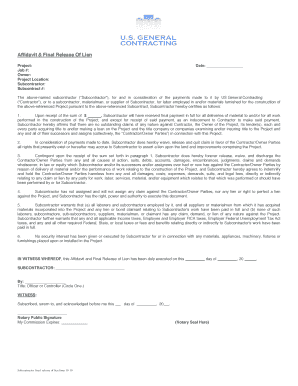

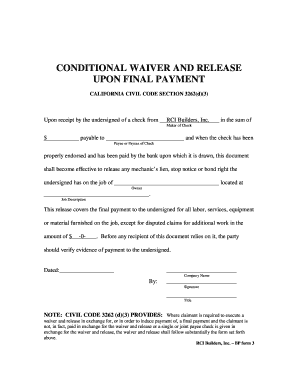

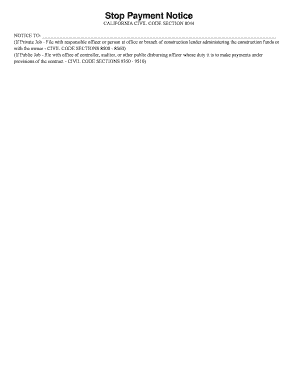

A Payment bond claim is a legal tool used to ensure that all parties involved in a construction project are paid appropriately. It is a type of surety bond that protects subcontractors and suppliers in case the contractor fails to pay them for their work or materials.

What are the types of Payment bond claim?

There are two main types of Payment bond claims: First-tier claims and second-tier claims. First-tier claims are made directly against the contractor who hired the claimant. Second-tier claims are made against the surety bond company that issued the payment bond.

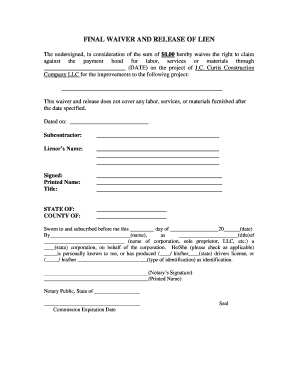

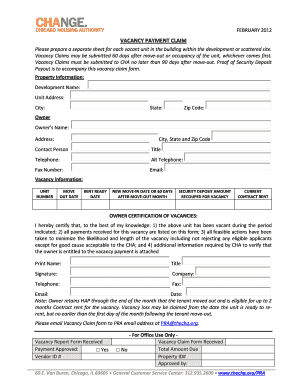

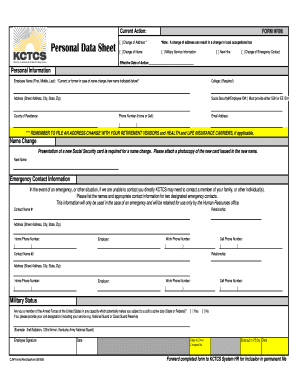

How to complete Payment bond claim

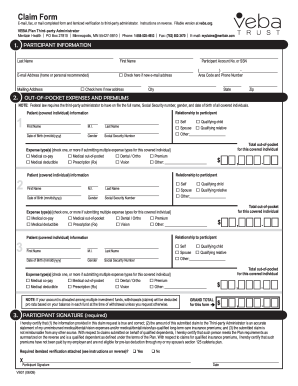

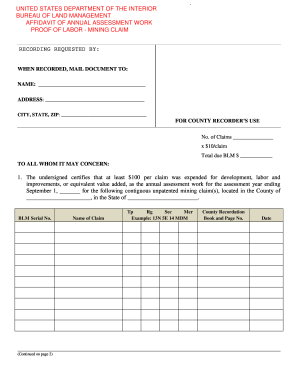

Completing a Payment bond claim can be a complex process, but with the right guidance, it can be done effectively. Here are some steps to help you complete a Payment bond claim:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.