Form 15b - Page 2

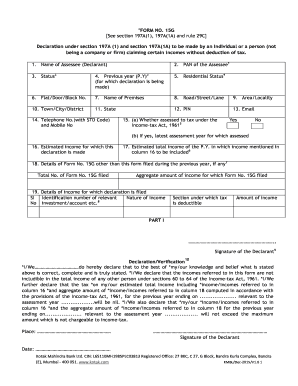

What is Form 15b?

Form 15b is a document that is used to declare specific financial details required by the government. It is commonly used for tax purposes and is essential for individuals and businesses alike.

What are the types of Form 15b?

There are two main types of Form 15b: individual Form 15b and business Form 15b. Individual Form 15b is used by single filers, while business Form 15b is used by companies and organizations.

Individual Form 15b

Business Form 15b

How to complete Form 15b

Completing Form 15b is a straightforward process. Here are the steps to fill out Form 15b:

01

Gather all necessary financial information required on Form 15b.

02

Fill in the appropriate sections of Form 15b with accurate details.

03

Review the filled-out form for any errors or missing information.

04

Sign and date the completed Form 15b before submission.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I file a motion change in Ontario?

STEP 1: DETERMINE IF THERE IS AN ASSIGNEE. ... STEP 2: DECIDE WHERE TO MAKE THE MOTION. ... STEP 3: COMPLETE THE PROPER FORMS. ... STEP 4: FILE YOUR DOCUMENTS AT THE FAMILY COURT OFFICE. ... STEP 5: SERVE A COPY OF THE DOCUMENTS. ... STEP 6: FILE AFFIDAVIT(S) OF SERVICE. ... STEP 7: WHAT TO DO AFTER SERVICE.

What happens if someone doesn't respond to a motion to change by the 30 days Ontario?

Your partner has 30 days to fill out, serve, and file their documents in response to your documents. If your partner doesn't file their Answer within 30 days of you serving them, and hasn't asked for more time to fill out their documents, you may be able to ask the court to make an order on an undefended basis.

How do you respond to motion to change in family court Ontario?

How do I respond to a motion to change? Step 1: Decide whether or not you agree with the change being asked for. Step 2: Serve a copy of your response or send your consent to the moving party. Step 3: File your response and affidavit(s) of service at the family court office.

What happens if the respondent does not file a response Ontario?

If a respondent fails to file a reply or appear in court [Rule 6 (4) and (10) sets out the options available to a judge if the respondent fails to file a reply or fails to appear in court and includes the option of making a final order.]

What is a notice of motion in family law BC?

Form 16 Notice of Motion is a legal document required by the Provincial Court (Family) Rules to bring an application in a Provincial Court proceeding.

Can I download Form 16 online?

You can download the form from the online website of the Income Tax department as well. This form is available in the PDF format, which can be printed. How to Download Form 16?

How do I download Form 15H?

As we all aware that tax payers seeking non-deduction of tax from certain incomes are required to file a self-declaration in Form 15G or Form 15H as per the provisions of Section 197A of the Act....Steps to download the form 15G and 15H. StepsDescriptionStep 1Visit the 'e-Filing' Portal www.incometaxindiaefiling.gov.in7 more rows • May 10, 2020

How can I get my form 16 from previous employer?

You should get the Form 16 before you quit the company. In case, you did not get your Form 16, there is no need to panic. You can add your salary credited to your account along with the tax deducted throughout the period of your employment in the previous company (based on salary slips or statements).

What is IRS Publication 15b?

More In Forms and Instructions Publication 15-B supplements Publication 15 (Circular E), Employer's Tax Guide, and Publication 15-A, Employer's Supplemental Tax Guide. It contains information for employers on the employment tax treatment of fringe benefits.

Where can I get 1099 forms for free?

Those who need to send out a 1099-MISC can acquire a free fillable form by navigating the website of the IRS, which is located at www.irs.gov. Once you've received your copy of the form, you'll want to familiarize yourself with the various boxes that must be completed.

How do I download IRS forms?

Get the current filing year's forms, instructions, and publications for free from the Internal Revenue Service (IRS). Download them from IRS.gov. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

How can I get my 1099 form online?

Follow these steps: Log in to Benefit Programs Online and select UI Online. Select Payments. Select Form 1099G. Select View next to the desired year. ... Select Print to print your Form 1099G information. Select Request Duplicate to request an official paper copy.

How do I get a 1099 MISC form from the IRS?

To order these instructions and additional forms, go to www.irs.gov/EmployerForms. Caution: Because paper forms are scanned during processing, you cannot file certain Forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the IRS website.