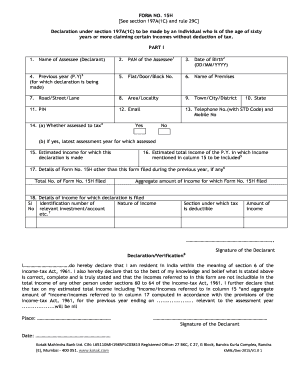

Estimated Total Income Of The. P.y. In Which Income Mentioned In Column 16 To Be Included.

What is Estimated total income of the. p.y. in which income mentioned in column 16 to be included.?

When determining the estimated total income of the previous year where income from column 16 should be included, it is essential to consider all sources of revenue and earnings reported within that specific timeframe.

What are the types of Estimated total income of the. p.y. in which income mentioned in column 16 to be included.?

The types of estimated total income for the previous year that should be included when referencing column 16 comprise salaries, dividends, capital gains, rental income, royalties, and any other financial gains accrued during that period.

How to complete Estimated total income of the. p.y. in which income mentioned in column 16 to be included?

To accurately complete the estimated total income for the previous year, ensuring to include income from column 16, users should gather all relevant financial documents, such as tax statements, investment records, and income statements. Then, categorize each income source and sum up the totals to obtain the final estimated income figure.

pdfFiller enables users to effortlessly create, edit, and share documents online. With unlimited fillable templates and robust editing tools, pdfFiller is the all-in-one PDF editor users need to streamline their document workflow.