Pag-ibig Housing Loan

What is Pag-ibig housing loan?

Pag-ibig housing loan is a type of financial assistance offered by the Home Development Mutual Fund, also known as Pag-ibig Fund, to help Filipinos achieve their dream of owning a home. It provides affordable housing loans with flexible terms and competitive interest rates.

What are the types of Pag-ibig housing loan?

Pag-ibig Fund offers different types of housing loans to cater to the varying needs of its members. The types of Pag-ibig housing loans include:

Affordable Housing Loan

End-User Financing Program

Improved Pag-ibig II Program

Home Construction Loan

How to complete Pag-ibig housing loan

Completing a Pag-ibig housing loan application is a simple process that involves the following steps:

01

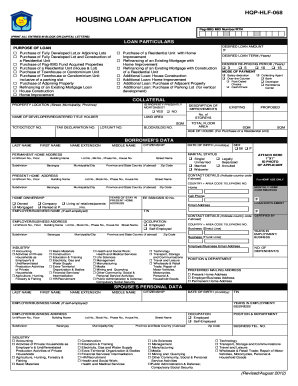

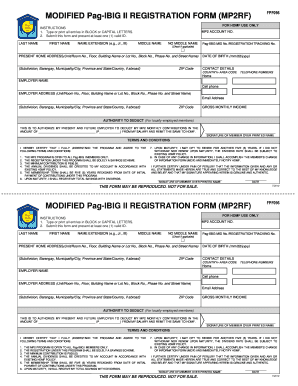

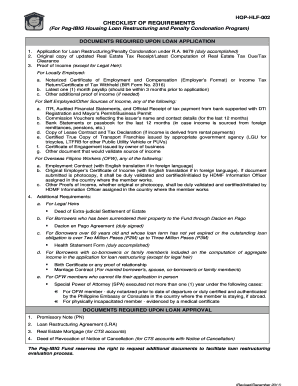

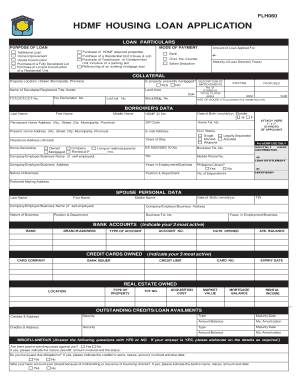

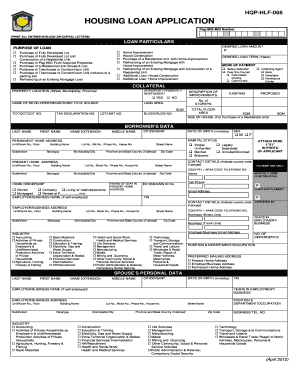

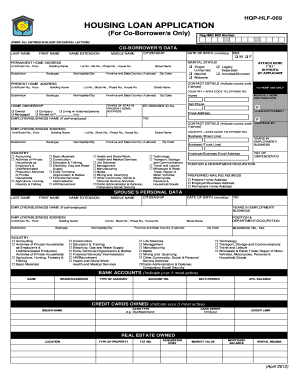

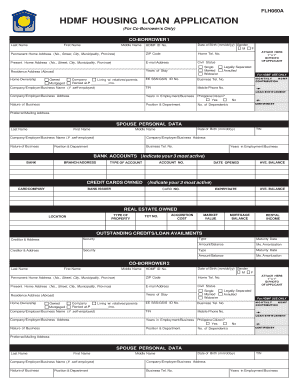

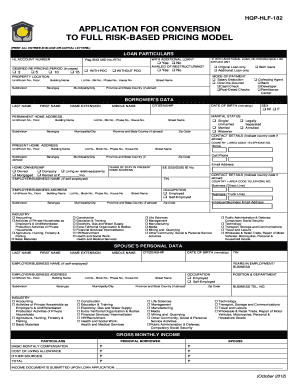

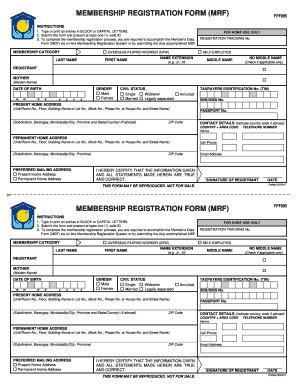

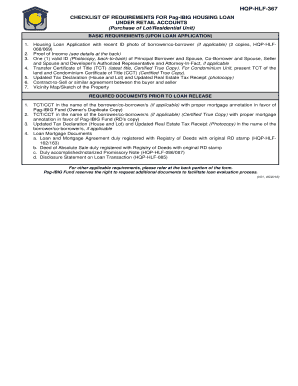

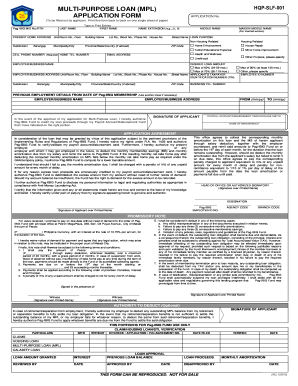

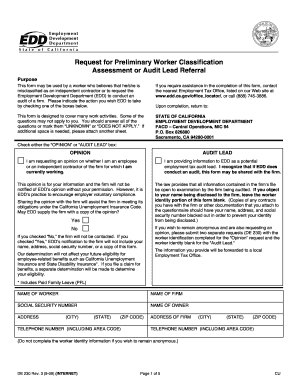

Submit your Pag-ibig housing loan application form along with the required documents.

02

Wait for Pag-ibig Fund's approval and loan assessment.

03

Attend a loan counseling session and sign the necessary loan documents.

04

Start making monthly loan repayments as per the agreed terms and conditions.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Pag-ibig housing loan

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How can I fill my Pag-IBIG housing loan?

Before getting started, please make sure to prepare the following: LOAN APPLICATION FORM. Duly accomplished Housing Loan Application with your "1x1" ID photo. ... PROOF OF INCOME. • For Locally Employed, click here for the list of valid documents. ... ONE (1) VALID ID WITH SIGNATURE. ... SELFIE PHOTO.

How can I check my loanable amount in Pag-IBIG?

Loan Status Verification. Virtual Pag-IBIG. For questions or to follow-up on your loan application, please call (02)8724-4244 or chat us by clicking on the icon found at the bottom right of your screen. Loan Application No.

How long does it take for my Pag-IBIG housing loan to be approved?

Through its more efficient application system, Pag IBIG housing loans can now be approved within 17 days from the date when the borrower completes/submits all requirements. The loan proceeds, on the other hand, can be claimed three days after post-approval compliance.

How much is the down payment for Pag-IBIG housing loan?

Before applying for a housing loan, you should already have saved up at least 20% of the property's value for the down payment. The higher the down payment you can afford to pay, the more likely your housing loan application will get approved.

How do I get Msvs?

More videos on YouTube Go to the Pag-IBIG National Capital Region or regional branch nearest you and look for the Mortgage Loan Specialist who will be assisting you. ... Present one valid ID and get the Membership Status Verification Slip (MSVS) Fill up the MSVS and submit this for verification. Get the following documents.

How much is the interest rate of Pag-IBIG housing loan 2020?

Under the loan program, Pag-IBIG Fund offers a subsidized rate of 3% per annum for socialized home loans up to P580,000.

How can I get Pag-IBIG form?

Here's how: Accomplish a Pag-IBIG Loyalty Card Plus Application Form (HQP-PFF-108). ... Submit the application form at the Pag-IBIG Fund branch nearest you, along with a photocopy of one valid identification (ID) card. ... Pay the corresponding card fee to our accredited bank-operator. Have your photo and biometrics taken.