Lic Surrender Value After 3 Years

What is Lic surrender value after 3 years?

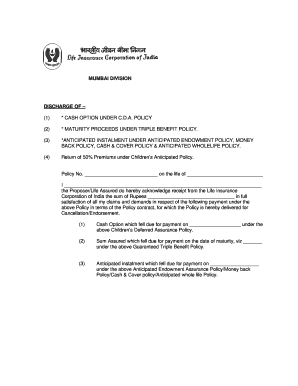

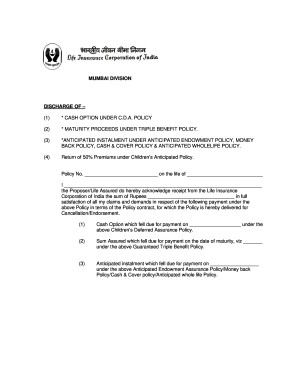

When you surrender your LIC policy after three years, the surrender value is the amount that the insurance company will pay you. This value is calculated based on a variety of factors, such as the premium amount paid, the policy term, and any bonuses that may have been accrued.

What are the types of Lic surrender value after 3 years?

There are two main types of LIC surrender value after three years: Special Surrender Value (SSV) and Guaranteed Surrender Value (GSV). The Special Surrender Value is calculated by the insurance company based on the policy's performance, while the Guaranteed Surrender Value is pre-determined and mentioned in the policy document.

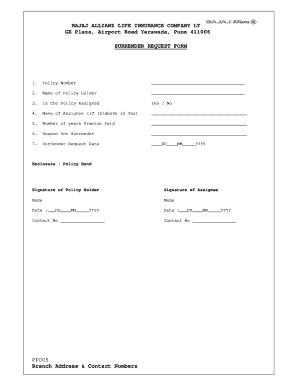

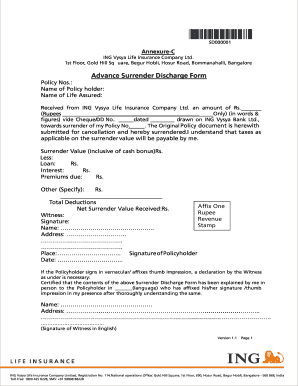

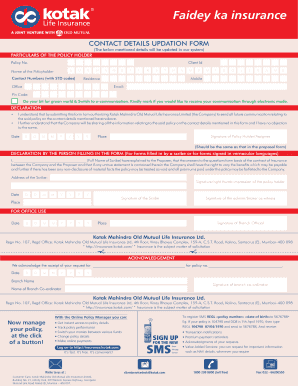

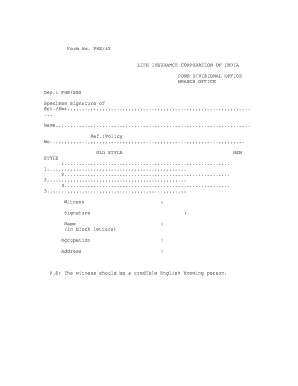

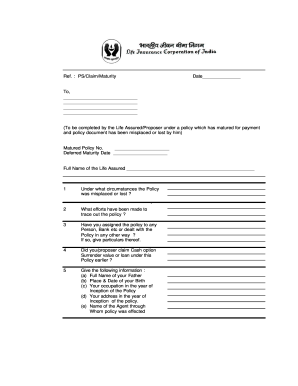

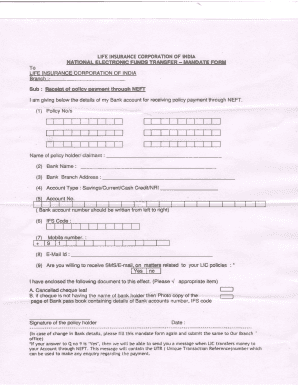

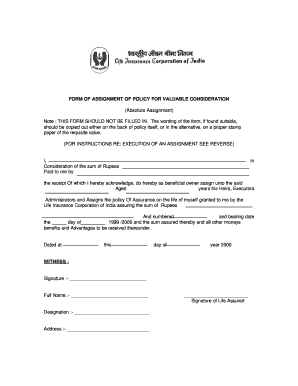

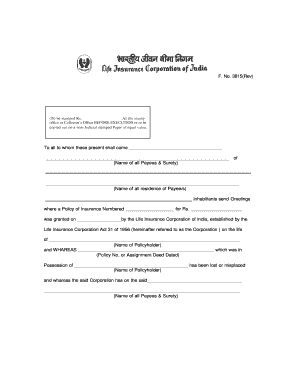

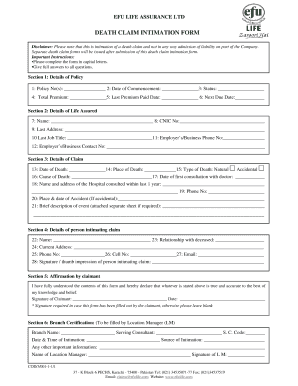

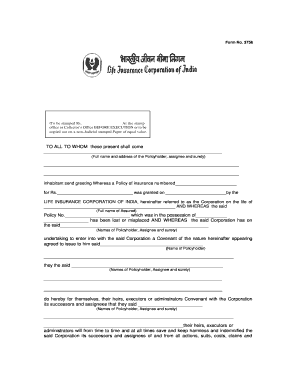

How to complete Lic surrender value after 3 years

To complete the process of surrendering your LIC policy after three years, you will need to follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.