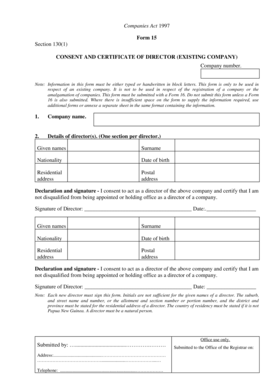

Form15

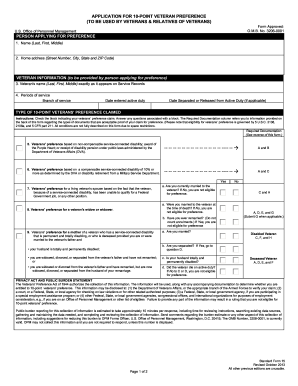

What is Form15?

Form15 is a legal document that is used to...

What are the types of Form15?

There are two main types of Form15: Type A and Type B.

Type A: Used for...

Type B: Used for...

How to complete Form15

Completing Form15 is a simple process that can be done...

01

Gather all necessary information and documents

02

Fill out the required fields accurately

03

Review the completed form for any errors

04

Submit the form as instructed

pdfFiller provides users with the tools they need to easily create, edit, and share Form15 online. With unlimited fillable templates and powerful editing features, pdfFiller is the go-to PDF editor for getting documents done efficiently.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a Form 15 filing?

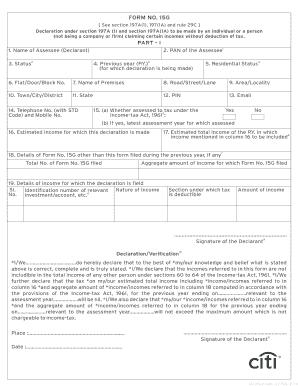

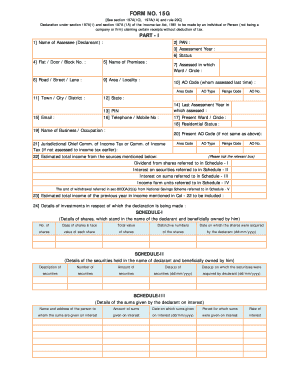

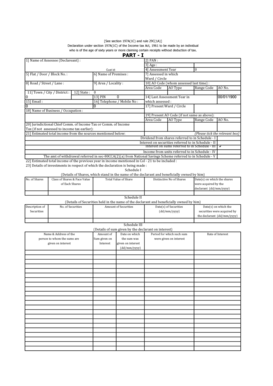

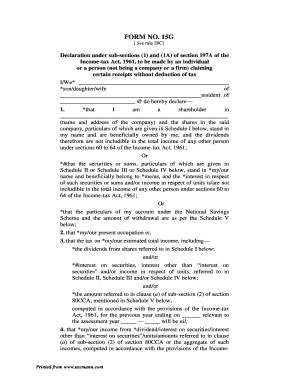

Form 15G and Form 15H are self declaration forms that an individual submits to the bank requesting not to deduct TDS on interest income as their income is below the basic exemption limit. For this, providing PAN is compulsory.

Why would a company file a Form 15?

Form 15 is typically used by small companies with a limited number of shareholders who decide that the expense and reporting requirements of remaining a publicly-traded corporation are too onerous. The company's shares will cease trading, while its remaining owners may retain or sell their shares privately.

What is a 15E?

FOR ASSET-BACKED SECURITIES Section 15E(s)(4)(B) of the Securities Exchange Act of 1934 requires a person providing the due diligence services to provide a written certification to any nationally recognized statistical rating organization that produces a credit rating to which such due diligence services relate.

What is a 15 15D filing?

SEC Form 15-15D is a certification of termination of registration of a class of security under Section 12(g) or a notice of suspension of duty to file reports pursuant to Section 13 and 15(d) of the 1934 Securities Exchange Act.

Where can I get Form 15G?

Form 15G for reduction in TDS burden can be downloaded for free from the website of all major banks in India. However, this form can also be downloaded from the Income Tax Department website. You also have the option of submitting Form 15G online on the website of most major banks in India.

What is Form 15f?

Banks have to deduct TDS when your interest income is more than Rs. ... 40,000 in a year for individuals other than senior citizens (for senior citizens, the limit is Rs. 50,000) under section 194A of the Income Tax Act.

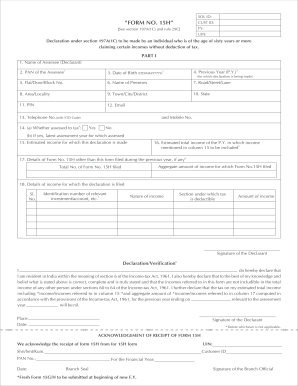

How do I file Form 15H?

Filing Process Click on FORM 15G/FORM 15H (Consolidated) and prepare the xml zip file. Select the Form Name either Form 15G or Form 15H, Financial Year, Quarter and the Filing Type. Click Validate. Once the details are validated, the following screen is displayed.

What is a Form 15 12B?

SEC Form 15-12B is a certification of termination of registration of a class of security under Section 12(g) or notice of suspension of duty to file reports pursuant to Section 13 and 15(d) of the 1934 Securities Exchange Act Section 12(b).

Can I fill 15G form online?

Account holder to login internet banking www.onlinesbi.com. Under “e-services” select > Submit form 15G/H option as applicable to you. Select 15G if you are below 60 years and 15H if above 60 years. Select the CIF number and click on submit.

Where can I download Form 15?

Form 15G for reduction in TDS burden can be downloaded for free from the website of all major banks in India. However, this form can also be downloaded from the Income Tax Department website. You also have the option of submitting Form 15G online on the website of most major banks in India.

Is 15G form required for PF withdrawal PDF download?

Field (2) PAN of the Assessee: Valid PAN card is mandatory to file Form 15G. If you don't have valid PAN details, your declaration will be treated as invalid.... PDF NameForm 15G For PF Withdrawal PDFPDF CategoryGovernmentPublished/UpdatedJanuary 28, 2022Source / CreditsIncometaxindia.gov.inComments ✎55 more rows • Jan 28, 2022

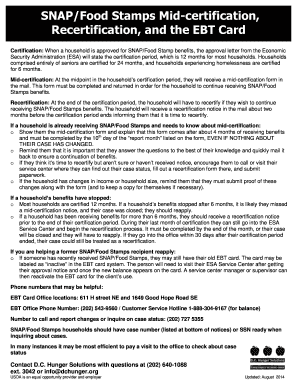

How can I submit my EPF 15G online?

How to Fill Form 15G for PF Withdrawal Login to EPFO UAN Unified Portal for members. Click on the ONLINE SERVICES option – Claim (Form 31, 19, 10C). Verify the last 4 digits of your bank account. Below the option, 'I want to apply for', click on Upload form 15G as depicted in the image.

How can I download Form 15G for PF?

Where to Get Form 15G? Form 15G can be easily found and downloaded for free from the website of all major banks in India as well as the official EPFO portal. Additionally, this form can also be easily downloaded from the Income Tax Department website.

How do I fill out a g15 form?

How to fill Form 15G? Name of Assesse (Declarant) – Enter your name as per income tax records & PAN number as per your PAN card, Status – Input whether you are an individual or HUF. Previous Year –Input the current financial year for which you are filing up the form.

How can I download Form 15H for PF withdrawal?

Form 15H for PF Withdrawal PDF Login to EPFO UAN Unified Portal for members. Click on the ONLINE SERVICES option – Claim (Form 31, 19, 10C). Verify the last 4 digits of your bank account. Below the option, 'I want to apply for', click on Upload form 15G as depicted in the image.