Form 15g Download - Page 2

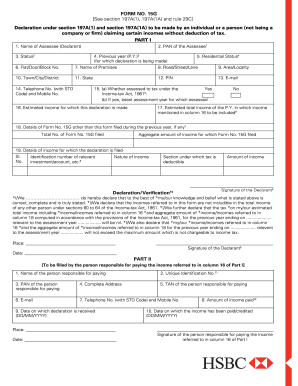

What is Form 15g download?

Form 15G download is a declaration form that can be submitted to the income tax department to avoid the deduction of TDS on interest income. It is mostly used by individuals who do not have taxable income.

What are the types of Form 15g download?

There are two types of Form 15G downloads available:

Form 15G for senior citizens (above 60 years of age)

Form 15G for individuals below the age of 60 years

How to complete Form 15g download

Completing Form 15G download is a simple process. Here are the steps:

01

Fill in your personal details accurately

02

Provide details of your income sources

03

Sign the form

04

Submit the form to the concerned authority

pdfFiller is a user-friendly platform that enables you to effortlessly create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is your go-to PDF editor to streamline your document workflow.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How can I download and fill Form 15G?

How to fill Form 15G Online Log into your bank's internet banking with applicable User ID and Password. Click on the online fixed deposits tab which will take you to the page where your fixed deposit details are displayed. On the same page, you should have the option to generate Form 15G and Form 15H.

How do I fill out a g15 form?

How to fill Form 15G? Name of Assesse (Declarant) – Enter your name as per income tax records & PAN number as per your PAN card, Status – Input whether you are an individual or HUF. Previous Year –Input the current financial year for which you are filing up the form.

How can I download Form 15G for PF?

Login to EPFO UAN Unified Portal for members i.e. https://www.epfindia.gov.in/. Click on the ONLINE SERVICES option – Claim (Form 31, 19, 10C). Verify the last 4 digits of your bank account. Below the option, 'I want to apply for, click on Upload form 15G as depicted in the image.

Can Form 15G be filled online?

Bank customers can also submit Form 15G or Form 15H online from the convenience of their home. You can submit Form 15G or Form 15H either through the Internet Banking of the bank or through the mobile app of the bank.

How can I download Form 15G?

Form 15G for reduction in TDS burden can be downloaded for free from the website of all major banks in India. However, this form can also be downloaded from the Income Tax Department website. You also have the option of submitting Form 15G online on the website of most major banks in India.

How can I download Form 15G for EPF?

# Click on ONLINE SERVICES >> Claim (Form 31, 19, 10C). # Then you will see the EPF withdrawal form. # Below I want to apply for, you will see Upload Form 15G as shown in the below image. # Download the Form 15G HERE.

Can I fill 15G form online?

Account holder to login internet banking www.onlinesbi.com. Under “e-services” select > Submit form 15G/H option as applicable to you. Select 15G if you are below 60 years and 15H if above 60 years. Select the CIF number and click on submit.

How do I download 15H?

As we all aware that tax payers seeking non-deduction of tax from certain incomes are required to file a self-declaration in Form 15G or Form 15H as per the provisions of Section 197A of the Act....Steps to download the form 15G and 15H. StepsDescriptionStep 1Visit the 'e-Filing' Portal www.incometaxindiaefiling.gov.in7 more rows • May 10, 2020

How do I download Form 15H?

As we all aware that tax payers seeking non-deduction of tax from certain incomes are required to file a self-declaration in Form 15G or Form 15H as per the provisions of Section 197A of the Act....Steps to download the form 15G and 15H. StepsDescriptionStep 1Visit the 'e-Filing' Portal www.incometaxindiaefiling.gov.in7 more rows • May 10, 2020

How can I download 15G form from EPF?

Login to EPFO UAN Unified Portal for members i.e. https://www.epfindia.gov.in/. Click on the ONLINE SERVICES option – Claim (Form 31, 19, 10C). Verify the last 4 digits of your bank account. Below the option, 'I want to apply for, click on Upload form 15G as depicted in the image.