How To Fill Form 15g For Pf Withdrawal 2021 - Page 2

What is How to fill form 15g for pf withdrawal 2021?

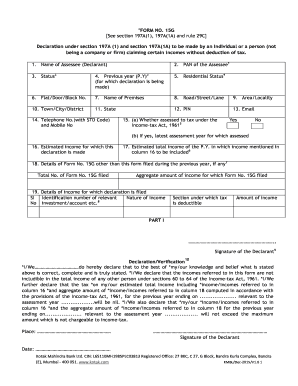

When it comes to filling out Form 15G for PF withdrawal in 2021, it's essential to understand the process thoroughly. Form 15G is a declaration for individuals below a certain age to claim exemption from tax deduction on interest income. By filling out this form correctly, you can ensure that you don't face unnecessary deductions on your PF withdrawals.

What are the types of How to fill form 15g for pf withdrawal 2021?

There are primarily two types of Form 15G for PF withdrawal in 2021: Form 15G and Form 15H. Form 15G is for individuals below 60 years of age, while Form 15H is for senior citizens above 60 years. Both forms serve the same purpose of declaring that your income is below the taxable limit and requesting exemption from TDS on interest income.

How to complete How to fill form 15g for pf withdrawal 2021

To successfully fill out Form 15G for PF withdrawal in 2021, follow these steps:

It's important to fill out Form 15G correctly to ensure a smooth PF withdrawal process without any tax deductions. Remember, pdfFiller provides the tools you need to create, edit, and share documents online, making it easier for you to manage your paperwork efficiently.