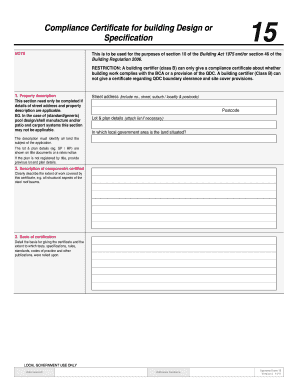

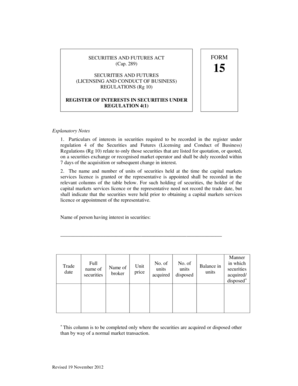

What Is Form 15

What is Form 15?

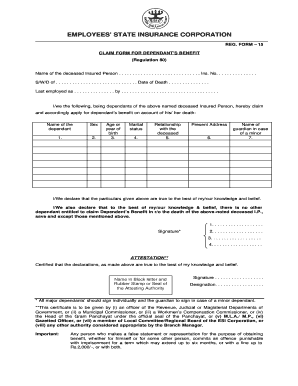

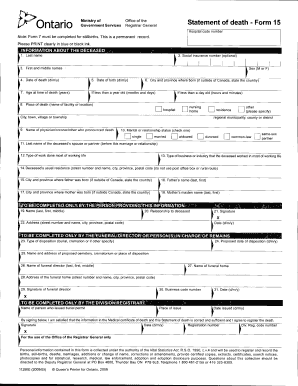

Form 15 is a document used for various financial purposes, depending on the country or jurisdiction. It is typically used for reporting financial information to the relevant authorities or organizations.

What are the types of Form 15?

There are several types of Form 15 that serve different purposes, such as:

Form 15 - Income Tax Declaration

Form 15 - Loan Application Form

Form 15 - Expense Reimbursement Form

How to complete Form 15

Completing Form 15 is a straightforward process that involves following these steps:

01

Gather all necessary financial information and documents

02

Fill in the required fields with accurate information

03

Review the completed form for any errors or missing information

04

Submit the form to the appropriate recipient or authority

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

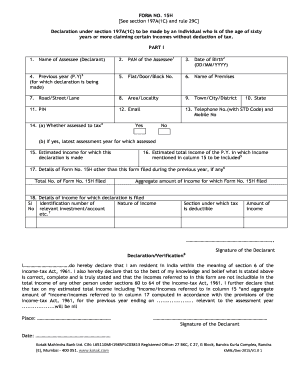

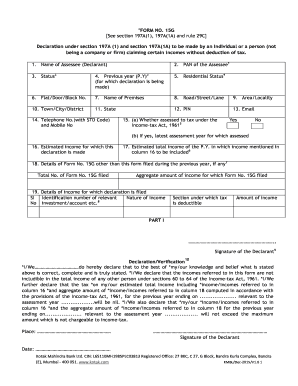

What is the Form 15?

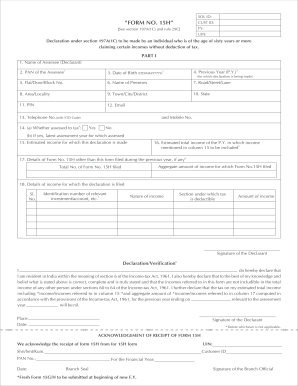

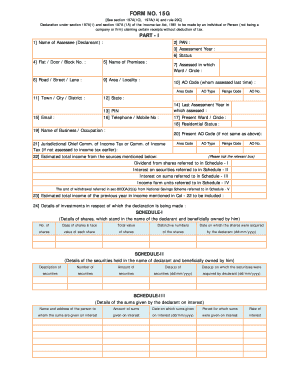

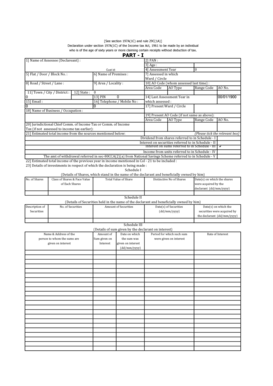

Key Features of Form 15G Form 15G is a self-declaration form for seeking non-deduction of TDS on specific income as annual income of the tax assessee is less than the exemption limit. The rules for this specific self-declaration form are mentioned under the provisions of Section 197A of the Income Tax Act, 1961.

How do I fill out a No 15 form?

How to fill Form 15G? Name of Assesse (Declarant) – Enter your name as per income tax records & PAN number as per your PAN card, Status – Input whether you are an individual or HUF. Previous Year –Input the current financial year for which you are filing up the form.

Who fills Form 15G?

Who can Submit Form 15G You can be an individual, Hindu Undivided Family (HUF) or Trust, but not a company or a firm. You must be a resident of India. You should be less than 60 years of age. Your income tax calculated should be nil.

Is it necessary to fill 15G form?

No, it's not mandatory but it will be helpful if you submit Form 15G every financial year if you are earning interest more than INR 40000 in a financial year.

What is a form 15 filing?

Form 15G and Form 15H are self declaration forms that an individual submits to the bank requesting not to deduct TDS on interest income as their income is below the basic exemption limit. For this, providing PAN is compulsory.

What is a 15E?

FOR ASSET-BACKED SECURITIES Section 15E(s)(4)(B) of the Securities Exchange Act of 1934 requires a person providing the due diligence services to provide a written certification to any nationally recognized statistical rating organization that produces a credit rating to which such due diligence services relate.

What is a Section 15 D filer?

Section 15(d) requires companies to file certain periodic reports and information required by Section 13 of the Exchange Act (such as Form 10-K and Form 10-Q reports) as if they had securities registered under Section 12 of the Exchange Act.

What is a form 15 12B?

SEC Form 15-12B is a certification of termination of registration of a class of security under Section 12(g) or notice of suspension of duty to file reports pursuant to Section 13 and 15(d) of the 1934 Securities Exchange Act Section 12(b).

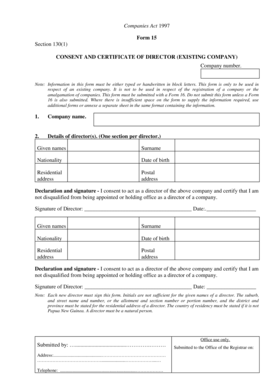

Why would a company file a form 15?

Form 15 is typically used by small companies with a limited number of shareholders who decide that the expense and reporting requirements of remaining a publicly-traded corporation are too onerous. The company's shares will cease trading, while its remaining owners may retain or sell their shares privately.

What does a form 15 12G mean?

SEC Form 15-12G is the certification and notice of termination of registration of a class of securities under Section 12(g)of the Securities Exchange Act of 1934. The Form is also used to provide notice of suspension of duty to file reports under sections 13 and 15(d) of the Securities Exchange Act.

What forms are required to be filed with the SEC?

Among the most common SEC filings are: Form 10-K, Form 10-Q, Form 8-K, the proxy statement, Forms 3,4, and 5, Schedule 13, Form 114, and Foreign Investment Disclosures.

How can I get non registration certificate of SEC?

How to apply? Submit the complete documentary requirements. Get an Order of Payment Slip (OPS). Pay the required fees. Submit copy of Official Receipt. Documents shall be verified in Fingerprinting Section. If approved, the certificate shall be issued.

What is SEC certificate?

Law Firm in Metro Manila, Philippines | Corporate, Family, IP law, and Litigation Lawyers > Philippine Legal Advice > What Is A Secretary's Certificate? A Secretary's Certificate is a written document executed by the Corporate Secretary confirming the actions and resolutions of the Board of Directors.

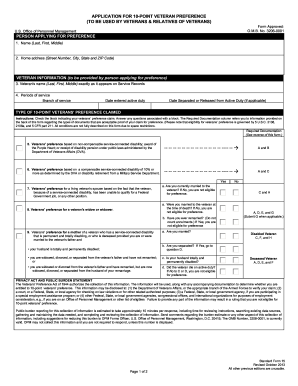

What is a standard form 15?

An SF-15 Form is an Application for 10-Point Veteran Preference (to be used by Veterans and Relatives of Veterans, the name of which actually answers the question on who is liable for its completion. That is, it is used by Federal Agencies and the US Office of Personnel Management as a job application supporting form.

What is a form 15 12G?

SEC Form 15-12G is the certification and notice of termination of registration of a class of securities under Section 12(g)of the Securities Exchange Act of 1934. The Form is also used to provide notice of suspension of duty to file reports under sections 13 and 15(d) of the Securities Exchange Act.