Irs Annual Lease Value Table

What is Irs annual lease value table?

The IRS Annual Lease Value Table is a tool used to determine the annual lease value of leased vehicles for tax purposes. This value is essential for calculating the taxable portion of an employee's personal use of a company vehicle.

What are the types of Irs annual lease value table?

There are three main types of IRS Annual Lease Value Tables based on the fair market value of the vehicle. These types include:

Luxury Vehicle Lease Value Table

Vehicle Value Tables for trucks and vans

SUV Lease Value Table

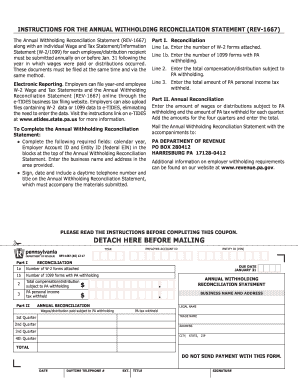

How to complete Irs annual lease value table

Completing the IRS Annual Lease Value Table is a straightforward process. Here are the steps to follow:

01

Gather the necessary information like the fair market value of the leased vehicle and the number of days the vehicle was used for personal reasons.

02

Calculate the annual lease value using the appropriate IRS table based on the vehicle type.

03

Use the calculated annual lease value when reporting the taxable portion of the employee's personal use of the vehicle on tax forms.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Irs annual lease value table

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How is GTL calculated?

Group Term Life Insurance is calculated as the taxable cost per month of coverage and is calculated by multiplying the number of thousands of dollars of insurance coverage (figured to the nearest tenth) less 50,000, by the cost from the group insurance table.

What is IRS annual lease value?

A vehicle's annual lease value is based on the fair market value of the vehicle when it is first available for personal use and is determined under an annual lease value table provided by the IRS.

How do you calculate personal use of a company vehicle 2021?

Cents-Per-Mile. The IRS standard mileage rate for the use of cars, vans, pickups or panel trucks driven for business use is 58 cents per mile for 2019, 57.5 cents per mile for 2020 and 56 cents per mile for 2021.

How do you calculate PUCC?

To find an employee's PUCC value under the cents-per-mile rule, multiply their personal miles driven by the IRS standard mileage rate. For 2022, the standard mileage rate is 58.5¢ per mile. The rate includes the costs of maintenance, insurance, and fuel.

How do you calculate annual lease value?

The value of a vehicle that is made available to an employee for less than a year but for at least 30 days is measured by a prorated annual lease value (that is, the annual lease value multiplied by the number of days during the year the vehicle was available to the employee and divided by 365 or 366).

What is the lease value of a vehicle?

What is residual value of a car? Leasing a car is kind of like renting a vehicle for a set amount of time. The difference with a lease is that the lion's share of your monthly payment is for the cost of vehicle depreciation. Your car's value at the end of the lease is what's referred to as its residual value.

How do you calculate personal use of a vehicle?

To use this method, multiply the annual lease value of the car (via the IRS Annual Lease Value table) by the percentage of personal miles driven. This will give you the Fair Market Value (FMV) of the employee's personal use of a company-provided vehicle.

Are fringe benefits taxable for Social Security and Medicare?

In general, fringe benefits with significant value are considered taxable to the employee and subject to federal withholding, Social Security, and Medicare taxes. ... Amounts paid to employees for moving expenses in excess of actual expenses.

How are auto fringe benefits calculated?

Employees who use the Cents-Per-Mile Rule must determine the number of commute/personal miles driven in the vehicle. The fringe benefit is calculated by multiplying these commute/personal miles by the IRS standard mileage rates.