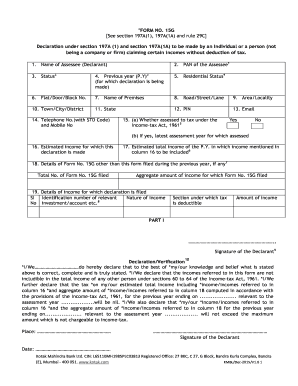

How To Fill Form 15g New Format

What is How to fill form 15g new format?

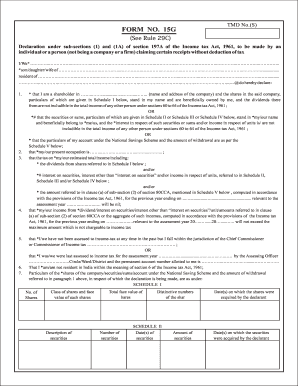

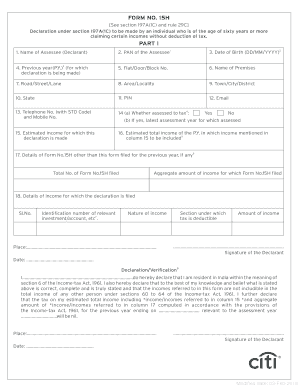

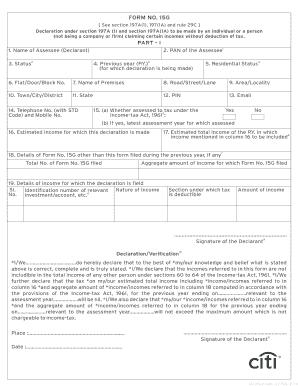

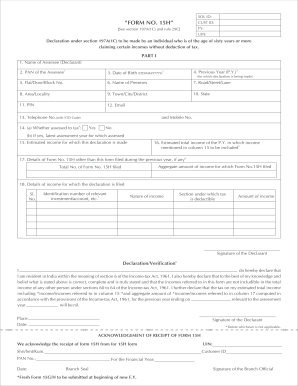

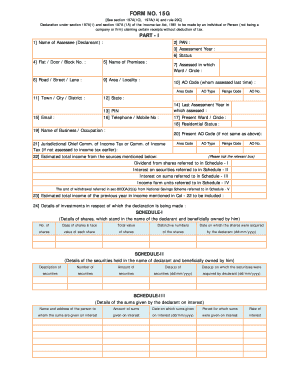

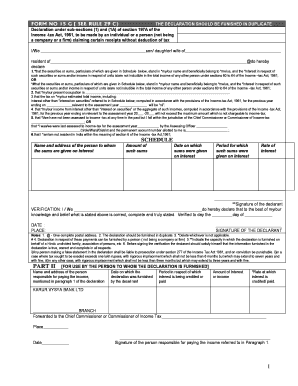

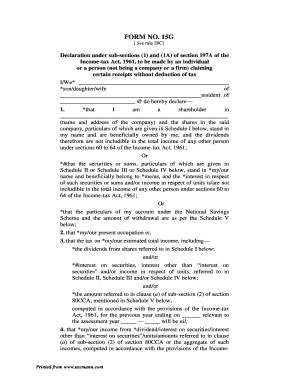

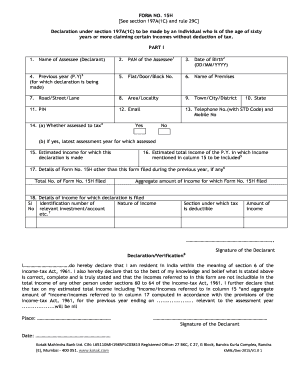

When you need to declare your income for tax-saving purposes, Form 15G comes in handy. The new format of Form 15G is a simplified way for individuals to submit their income details to the Income Tax Department to avoid TDS deductions.

What are the types of How to fill form 15g new format?

There are two types of Form 15G new format based on the age of the individual. One is for individuals below 60 years of age, and the other is for senior citizens aged 60 years and above. Both formats serve the same purpose of declaring income to prevent TDS deductions.

How to complete How to fill form 15g new format

Filling out Form 15G new format is a simple process. Here are the steps to complete the form:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.