Form 15g In Word Format For Ay 2021-22 Download

What is Form 15g in word format for ay 2021-22 download?

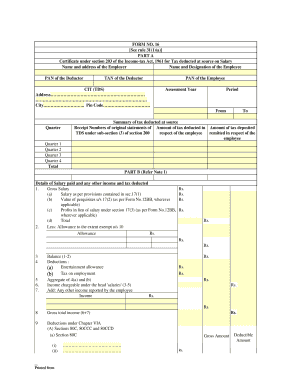

Form 15G is a declaration form that can be used by individuals to avoid the deduction of TDS on interest income. It is specifically for individuals under the age of 60 years whose total income is below the taxable limit.

What are the types of Form 15g in word format for ay 2021-22 download?

There are mainly two types of Form 15G that can be downloaded in Word format for AY 2021-22:

Form 15G for individuals who are below 60 years of age and have no taxable income

Form 15G for individuals who are above 60 years of age but do not have taxable income

How to complete Form 15g in word format for ay 2021-22 download

To complete Form 15G in Word format for AY 2021-22 download, follow these steps:

01

Download the Form 15G Word template from a reliable source.

02

Fill in all the required fields with accurate information.

03

Review the filled form for any errors or missing information.

04

Save the completed form to your device for future reference or printing.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Form 15g in word format for ay 2021-22 download

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How can I download and fill Form 15G?

How to fill Form 15G Online Log into your bank's internet banking with applicable User ID and Password. Click on the online fixed deposits tab which will take you to the page where your fixed deposit details are displayed. On the same page, you should have the option to generate Form 15G and Form 15H.

How do I fill out a g15 form?

How to fill Form 15G? Name of Assesse (Declarant) – Enter your name as per income tax records & PAN number as per your PAN card, Status – Input whether you are an individual or HUF. Previous Year –Input the current financial year for which you are filing up the form.

How can I download Form 15G for EPF?

# Click on ONLINE SERVICES >> Claim (Form 31, 19, 10C). # Then you will see the EPF withdrawal form. # Below I want to apply for, you will see Upload Form 15G as shown in the below image. # Download the Form 15G HERE.

Is 15G form required for PF withdrawal PDF download?

Field (2) PAN of the Assessee: Valid PAN card is mandatory to file Form 15G. If you don't have valid PAN details, your declaration will be treated as invalid.... PDF NameForm 15G For PF Withdrawal PDFPDF CategoryGovernmentPublished/UpdatedJanuary 28, 2022Source / CreditsIncometaxindia.gov.inComments ✎55 more rows • Jan 28, 2022

Can Form 15G be filled online?

Bank customers can also submit Form 15G or Form 15H online from the convenience of their home. You can submit Form 15G or Form 15H either through the Internet Banking of the bank or through the mobile app of the bank.

How fill 15G form in English?

1:15 6:52 How to Fill Form 15G for PF Withdrawal in 2021 - YouTube YouTube Start of suggested clip End of suggested clip Let's see how to fill form 15g for pfv driver in field number 1 write your name as for your epf.MoreLet's see how to fill form 15g for pfv driver in field number 1 write your name as for your epf. Account in field number 2 write your pan number in field number.

Do we need to fill Part 2 of Form 15G?

Every Form 15G has two sections. The first section is to be filled out by the taxpayer, and the second part has to be filled by the bank or the financier. In the first section, fill out your details such as name, PAN number and the year for which you are claiming non-deduction of TDS.

How can I download Form 15G?

Here's how you can do it: Log into your bank's internet banking with applicable User ID and Password. Click on the online fixed deposits tab which will take you to the page where your fixed deposit details are displayed. On the same page, you should have the option to generate Form 15G and Form 15H.

How can I get Form 15G offline?

To submit it offline, you need to download the form from t6he Income Tax portal as discussed above. Print out three copies of the form, fill them up and sign them. Once completed, you can submit these forms at your bank or post office or your employer (in case of Provident fund).

Can I fill 15G form online?

Account holder to login internet banking www.onlinesbi.com. Under “e-services” select > Submit form 15G/H option as applicable to you. Select 15G if you are below 60 years and 15H if above 60 years. Select the CIF number and click on submit.

What is Form 15G for PF withdrawal PDF?

Download 15G Form PDF For PF Withdrawal Form 15G is meant for individuals who want to claim no-deduction of TDS on certain incomes. It should be filled out by fixed deposit holders (less than 60 years) to ensure that no TDS (tax deduction at source) is deducted from their interest income in a year.

How can I get Form 15G from income tax portal?

If you are a deductor, you can file Statement Form 15G and Form 15H on the income tax department website....Filing Status To view the status of uploaded file, Go to My account –>View Form 15G/15H. Once uploaded the status of the statement shall be “Uploaded”. The uploaded file shall be processed and validated.