Build PDF forms with pdfFiller’s Loan Pre Application Form Creator

How to create a Loan Pre Application Form using pdfFiller

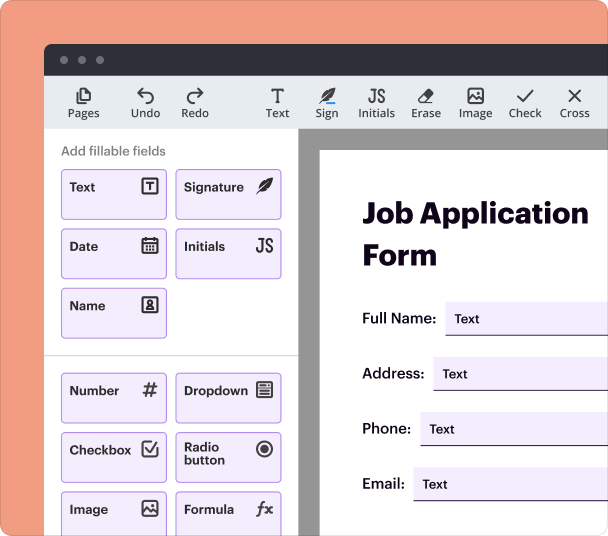

To create a Loan Pre Application Form using pdfFiller, start by selecting a template or creating a new form from scratch. Add interactive fields such as text boxes, checkboxes, and dropdown menus to collect necessary information. After adding fields, set data validation rules to ensure the accuracy of responses. Finally, save your form and share it with applicants for completion.

What is a Loan Pre Application Form Creator?

A Loan Pre Application Form Creator is a digital tool designed for creating interactive PDF forms that streamline the loan application process. It allows users to collect information from prospective borrowers in a structured format, making it easier to process applications efficiently. Users can customize forms according to their specific needs, facilitating better data collection and management.

How does a Loan Pre Application Form Creator change document preparation?

The Loan Pre Application Form Creator transforms document preparation by automating repetitive tasks and minimizing errors. With pdfFiller's intuitive interface, users can easily design forms, ensuring that all necessary fields are included and formatted correctly. This shift from paper-based processes to digital documentation significantly reduces the time spent on preparing and distributing forms.

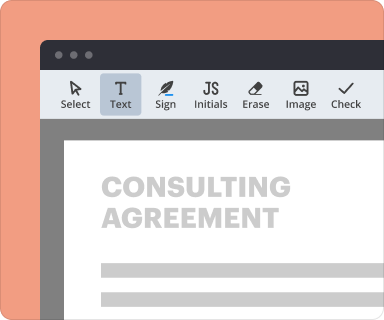

Steps to add fields when you create a Loan Pre Application Form

When creating a Loan Pre Application Form in pdfFiller, follow these steps to add fields:

-

Open your selected template or create a new form.

-

Use the 'Add Fields' feature to place relevant fields such as name, income, and loan type.

-

Select field types (text box, checkbox, dropdown) based on the information you need.

-

Resize and position each field according to your form design.

-

Review the layout to ensure clarity and ease of use.

Setting validation and data rules as you create a Loan Pre Application Form

Establishing validation and data rules within your Loan Pre Application Form is crucial to collect accurate information. pdfFiller allows users to apply constraints, ensuring that the data entered meets specific requirements - for instance, setting limits on number fields, making certain fields mandatory, or defining acceptable formats for email addresses.

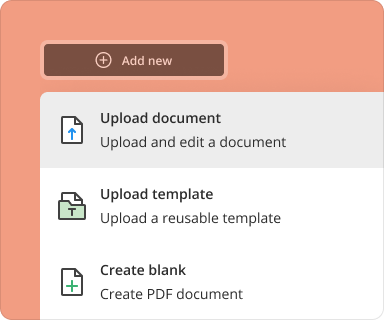

Going from a blank page to a finished form while you create

Starting with a blank page in pdfFiller and creating a completed Loan Pre Application Form is straightforward. Begin by determining what information you need and sketching out a rough layout. Then, follow the steps to create fields, set data rules, and customize the design, ensuring each element serves its purpose in gathering applicant information effectively.

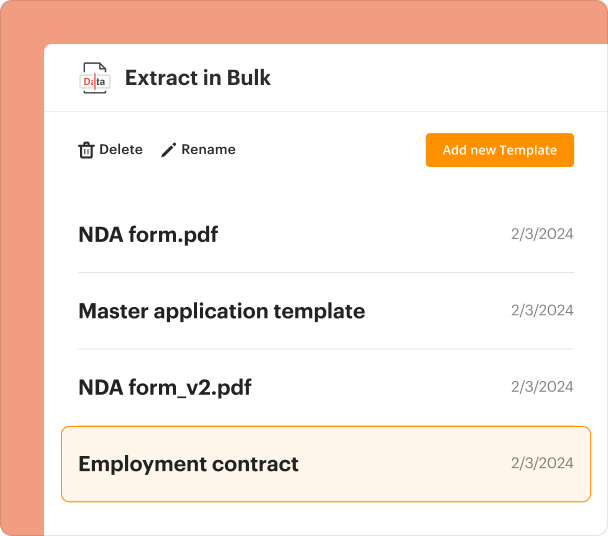

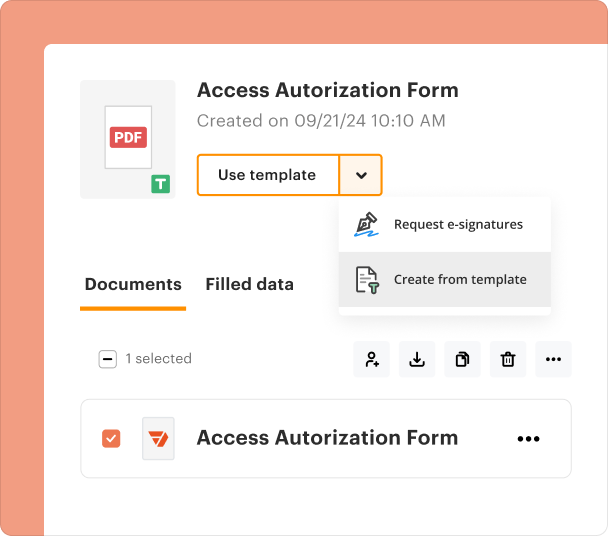

Organizing and revising templates when you create a Loan Pre Application Form

Organizing and keeping your Loan Pre Application Form templates updated is essential for maintaining relevance. pdfFiller enables users to save templates and make revisions easily. You can archive outdated forms, duplicate successful templates for further customization, and consistently update fields based on evolving needs or regulatory changes.

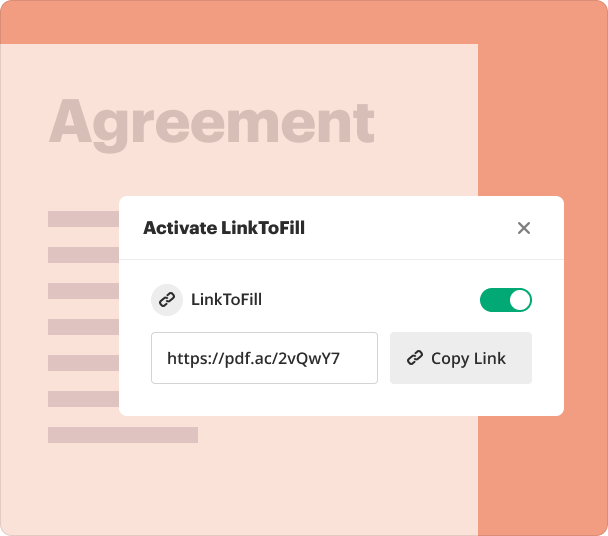

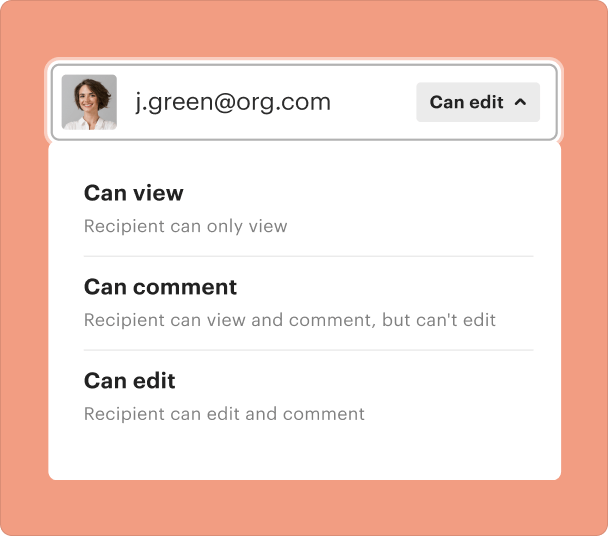

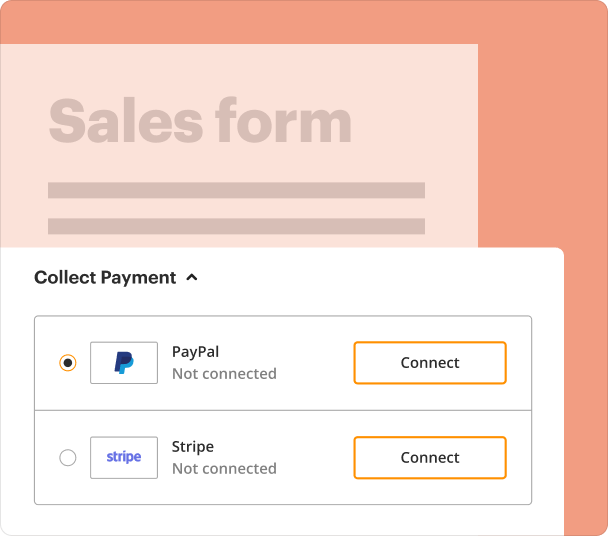

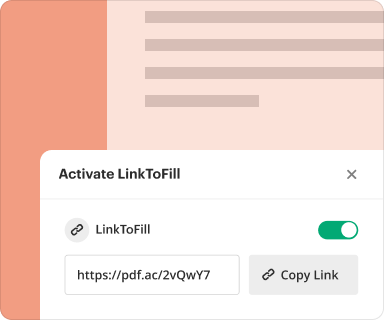

Sharing results and monitoring responses after you create

Once your Loan Pre Application Form is ready, sharing it with potential applicants simplifies the collection of responses. With pdfFiller, you can send forms directly via email or share a link. The platform also allows you to track who has opened and completed the form, providing insights into application progress and response rates.

Exporting collected data once you create a Loan Pre Application Form

After applicants submit their Loan Pre Application Forms, pdfFiller facilitates easy exporting of the collected data. Users can download responses in various formats, such as CSV or Excel, allowing for efficient analysis and record-keeping. This feature is crucial for loan officers who need to review applications promptly.

Where and why businesses create Loan Pre Application Forms

Businesses across various industries, particularly in finance and real estate, utilize Loan Pre Application Forms to streamline the initial stages of the lending process. By setting clear templates for information collection, organizations can allocate resources more effectively, verify applicant eligibility faster, and enhance overall productivity.

Conclusion

The Loan Pre Application Form Creator from pdfFiller revolutionizes how businesses handle document preparation related to loans. By providing an accessible platform to create, manage, and export PDF forms, pdfFiller not only improves efficiency but also enhances accuracy in the application process. Explore how pdfFiller can simplify your document workflows and empower your organization today.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms

I like the fact that it is easy to use and has all of the forms that I am looking for. I use this product on a monthly basis and find that it is easy to use and that the documents are easy to find.

What do you dislike?

There are times that I can't find a form that I know I have filled out. Also there are times that I am unable to get back to the home screen to find a new form.

Recommendations to others considering the product:

I would highly recommend this product to others and in fact I have done so. This product is easy to use and inexpensive compared to other products like it.

What problems are you solving with the product? What benefits have you realized?

Form 2848, Form 1099Misc and W2s

Easy of use, and broad variety of features on the platform

What do you dislike?

Sometimes, it takes awhile to adjust to the new configurations that happen after an update

Recommendations to others considering the product:

None

What problems are you solving with the product? What benefits have you realized?

Data submission times, due to illegible values