Build PDF forms with pdfFiller’s PDF Form Builder for Repossession Companies

How to use a Pdf Form Builder for Repossession Companies

Using a PDF form builder for repossession companies streamlines document management by allowing you to create, edit, and manage PDF forms efficiently. This tool offers customizable features designed specifically for the unique needs of the repossession industry.

What is a PDF form builder for repossession companies?

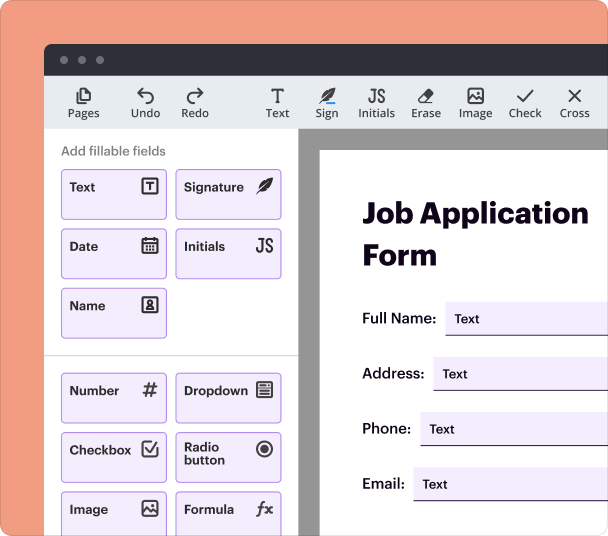

A PDF form builder tailored for repossession companies allows users to create interactive PDF forms that can be filled out digitally. This is especially beneficial for collecting client information, generating reports, and streamlining communication. pdfFiller’s PDF form builder provides simple drag-and-drop functionality to design forms without any coding knowledge.

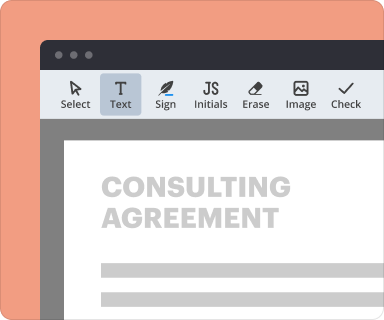

How does a PDF form builder enhance document preparation?

A PDF form builder like pdfFiller dramatically improves document preparation by providing tools to automate and simplify tedious processes. By allowing users to create templates, add customizable fields, and incorporate electronic signatures, repossession companies can reduce time spent on paperwork while enhancing accuracy and compliance.

Steps to add fields when you use a PDF form builder

Adding fields in pdfFiller is straightforward. Here are the steps:

-

Open your PDF document in pdfFiller.

-

Select the 'Add' button and choose the type of field you wish to add.

-

Drag and place the field into the desired spot on the document.

-

Modify the field's properties (e.g., size, required status) as needed.

-

Save the changes to your document.

Setting validation and data rules when creating forms

In pdfFiller, users can enforce validation rules to ensure data integrity. This feature allows you to define the format of the information required in each field, helping to minimize errors.

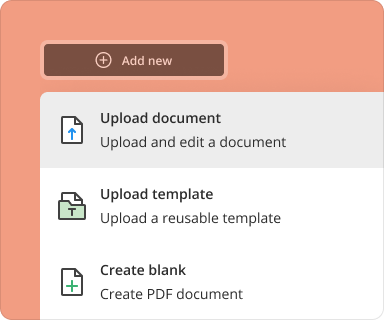

Going from blank page to finished form

Creating a complete form from scratch is simple with pdfFiller. Here's how it can be done:

-

Start with a blank template or upload an existing document.

-

Use the drag-and-drop feature to add essential fields.

-

Incorporate branding elements such as logos or colors.

-

Apply rules for how fields should be filled out.

-

Preview the form to make any necessary adjustments before saving.

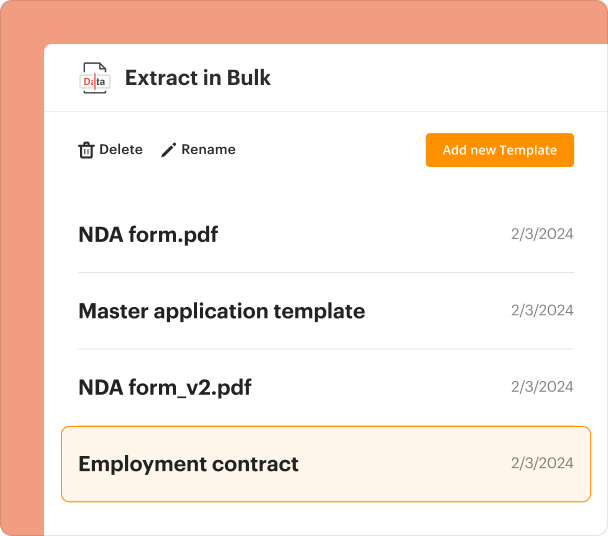

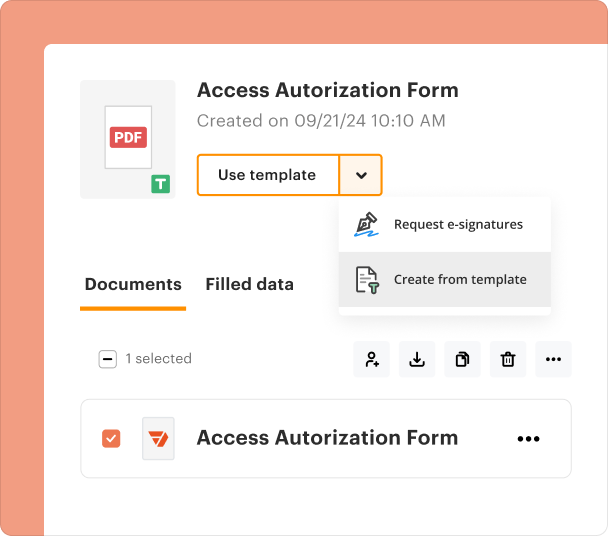

Organizing and revising templates

Managing and updating your PDF form templates is essential to keeping your documents current. With pdfFiller, you can easily edit templates, ensuring they reflect the latest information and standards within the repossession industry.

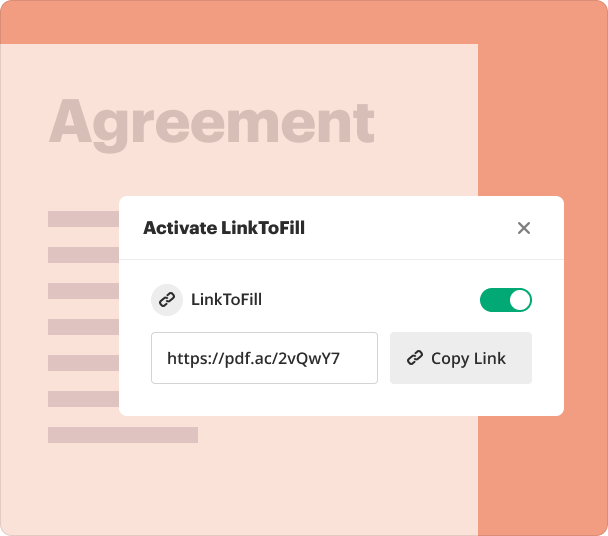

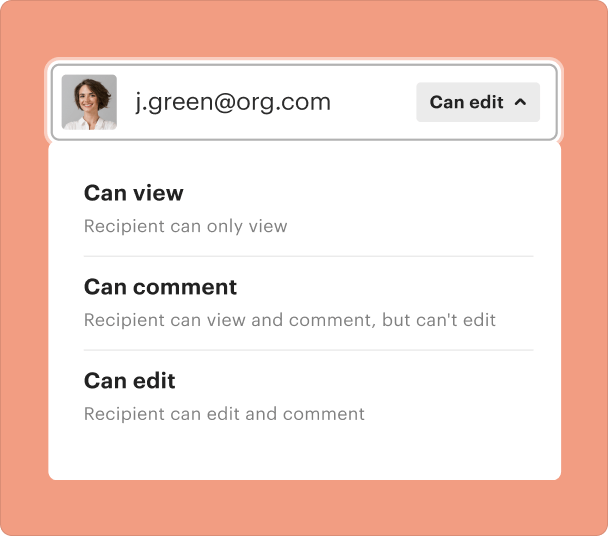

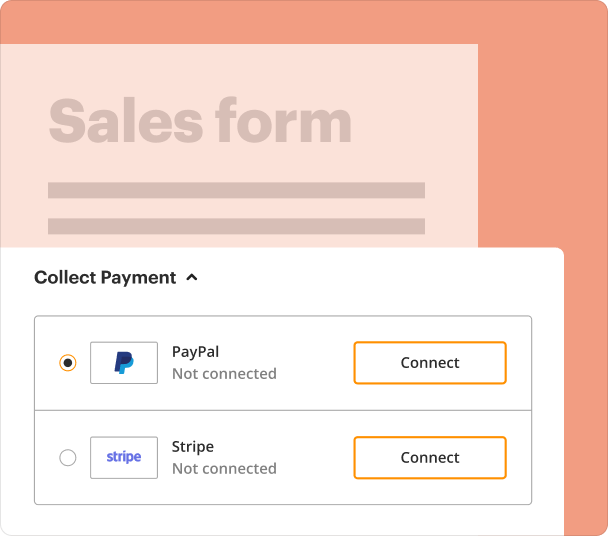

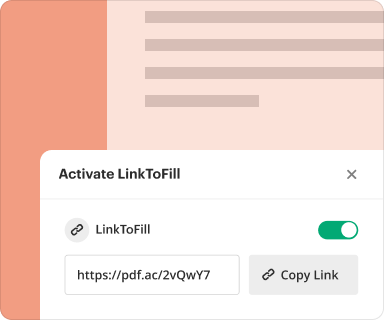

Sharing results and monitoring responses

Once forms are shared, pdfFiller allows you to track responses in real-time. This transparency helps repossession companies manage client interactions and understand gaps in data collection.

Exporting collected data after submissions

pdfFiller enables users to effortlessly export submitted data. This information can be integrated with other systems or used for analytical purposes, enhancing operational efficiency.

Where and why businesses utilize a PDF form builder

Repossession companies utilize PDF form builders to improve document accuracy, speed up processing times, and ensure compliance with legal standards. Industries such as finance, automotive, and property management frequently rely on effective document management solutions to streamline operations.

Conclusion

In conclusion, leveraging a PDF form builder specifically designed for repossession companies greatly enhances document management workflows. With comprehensive features provided by pdfFiller, businesses can create, share, and analyze forms efficiently, driving operational success.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms