Build PDF forms with pdfFiller’s Pdf Form Builder For Tax Accountants

What is a PDF form builder for tax accountants?

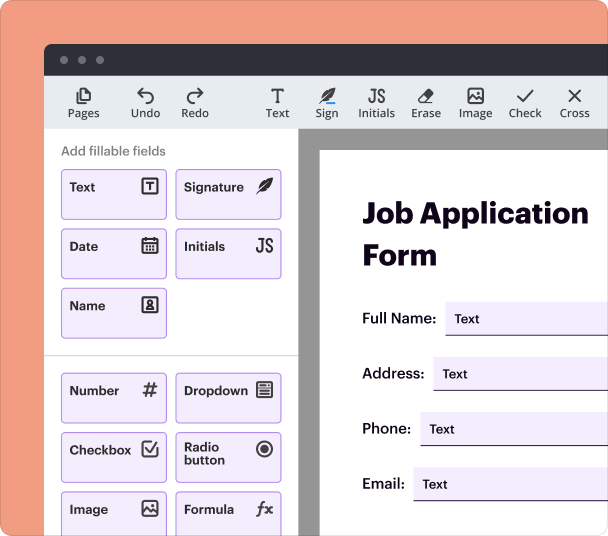

A PDF form builder for tax accountants is a tool that enables professionals to create and manage interactive PDF forms specifically designed for tax-related documents. These forms can include input fields, checkboxes, and drop-down menus to facilitate data entry and streamline the collection of information from clients. With pdfFiller, tax accountants can easily customize forms, ensuring they meet industry standards and compliance regulations.

How does a PDF form builder for tax accountants change document preparation?

The introduction of PDF form builders revolutionizes document preparation for tax accountants by simplifying the process of creating, distributing, and managing forms. Instead of relying on traditional paper methods, accountants can create forms that are accessible online, reducing the overall time spent on paperwork and minimizing human errors. This transition fosters a more efficient workflow, allowing accountants to focus on analysis rather than administrative tasks.

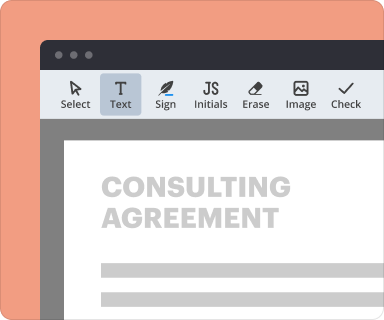

Steps to add fields when you use a PDF form builder

Adding fields to your PDF form is straightforward with pdfFiller. Follow these steps to enhance your forms with interactive elements:

-

Open the desired PDF document in pdfFiller.

-

Select the 'Add Fields' option from the toolbar.

-

Choose the type of field you want to add, such as text boxes or checkboxes.

-

Drag and drop the field into the desired location within the form.

-

Customize field properties, including validation rules and data formats.

Setting validation and data rules as you create a PDF form

Implementing validation and data rules in your PDF forms ensures that the data collected meets specific criteria, which is critical for accuracy in tax preparation. In pdfFiller, you can establish rules that validate types of input, restrict entries to specific formats, and require certain fields to be completed before submission.

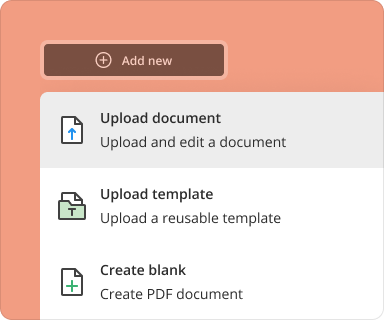

Going from blank page to finished form while using a PDF form builder

Creating a PDF form from scratch involves several steps. Here’s a brief overview:

-

Start with a blank PDF or upload an existing document.

-

Define the form structure by adding sections and headings.

-

Insert interactive fields and customize their settings.

-

Preview the form to ensure all elements function as expected.

-

Finalize and save the form for distribution.

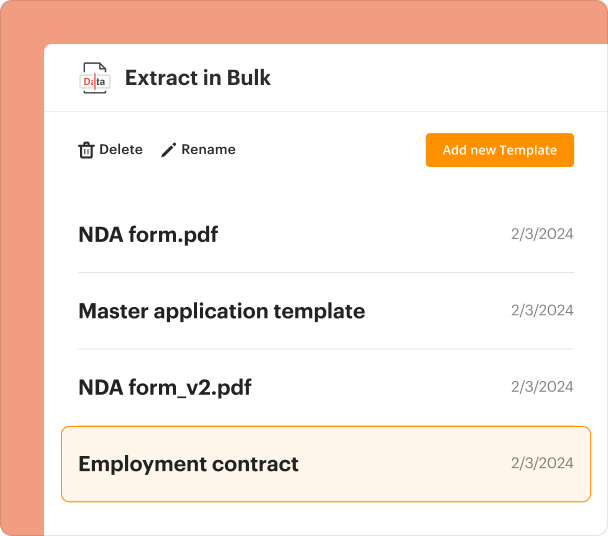

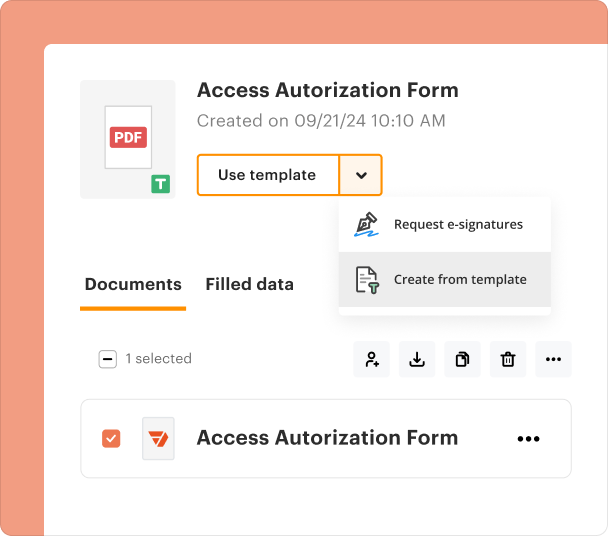

Organizing and revising templates when using a PDF form builder

pdfFiller allows users to organize their PDF form templates efficiently. Users can categorize forms based on client needs, types of services offered, or deadlines. Revising templates is equally simple; modifications can be made in real time, and previous versions can be saved for reference, ensuring that tax accountants always have access to the most up-to-date materials.

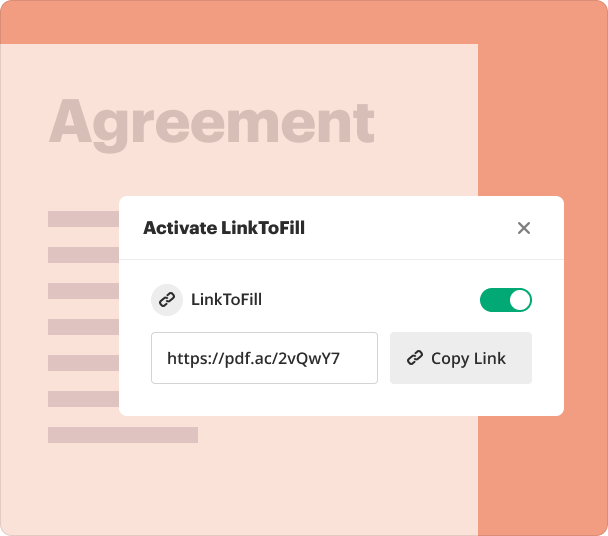

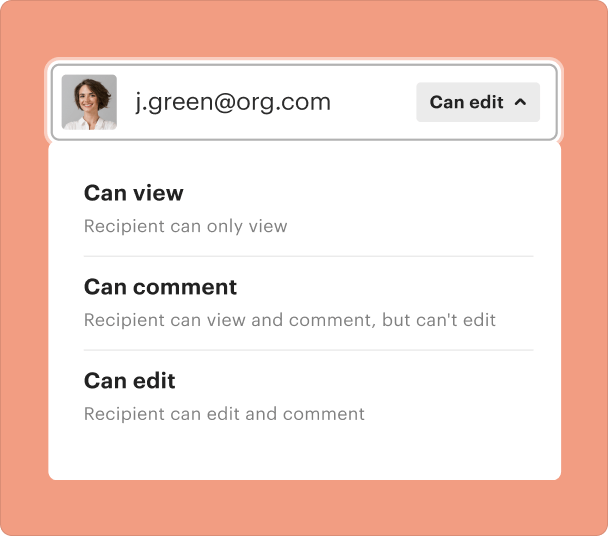

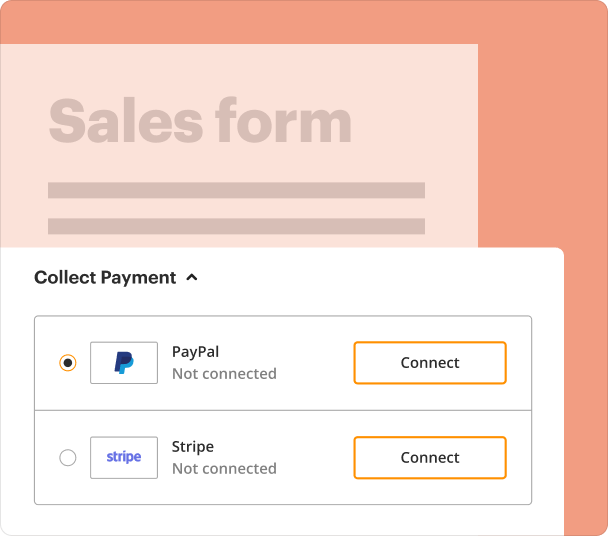

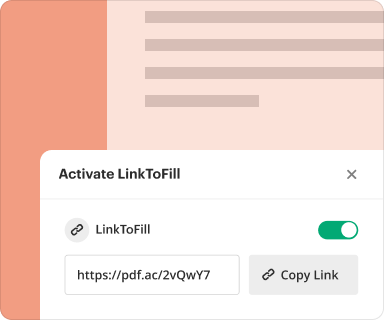

Sharing results and monitoring responses after creating a PDF form

Once your forms are created, pdfFiller empowers you to share them easily with clients or colleagues. You can track responses and submissions in real time, allowing you to manage your workflow effectively and follow up on pending documents. This feature is particularly useful during tax season, where timely submission of forms is crucial.

Exporting collected data once you have gathered responses

After collecting data from submitted forms, exporting the information for further analysis or storage is crucial. pdfFiller permits users to export data in various formats, including CSV and Excel, making it easier to utilize the information in tax preparation software or accounting systems.

Where and why businesses use a PDF form builder

Businesses in various sectors utilize PDF form builders to enhance their document handling processes. Tax accountants appreciate the ability to customize forms that meet regulatory standards while ensuring data accuracy. This tool is invaluable for maintaining client relationships, increasing efficiency, and ensuring compliance in an increasingly digital workspace.

Conclusion

The pdfFiller PDF form builder for tax accountants is a powerful tool that simplifies the creation and management of tax documents. By enabling users to design interactive forms, enforce data rules, and facilitate the sharing and submission process, pdfFiller empowers accountants to work more efficiently and accurately. Whether working individually or as part of a team, adopting a robust PDF form builder can greatly enhance your document management approach and improve overall productivity.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms

The ability to sign, fill out and send documents easily and quickly.

What do you dislike?

Slow start up.and slow "save as" time. That is all.

Recommendations to others considering the product:

none at this time

What problems are you solving with the product? What benefits have you realized?

Signing contracts.