Easily e-file your Form 1120 online with pdfFiller

How to complete tax forms with pdfFiller

Who needs this?

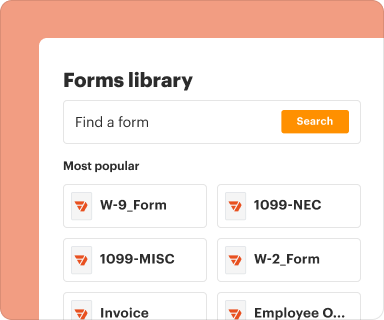

More than a PDF solution

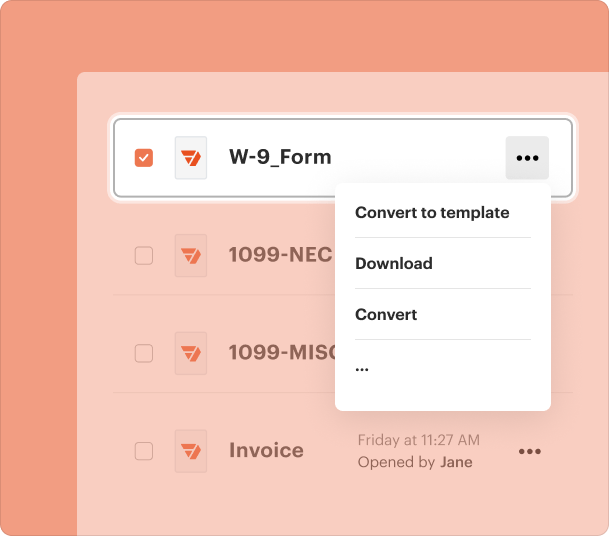

Complete document management

Your productivity booster

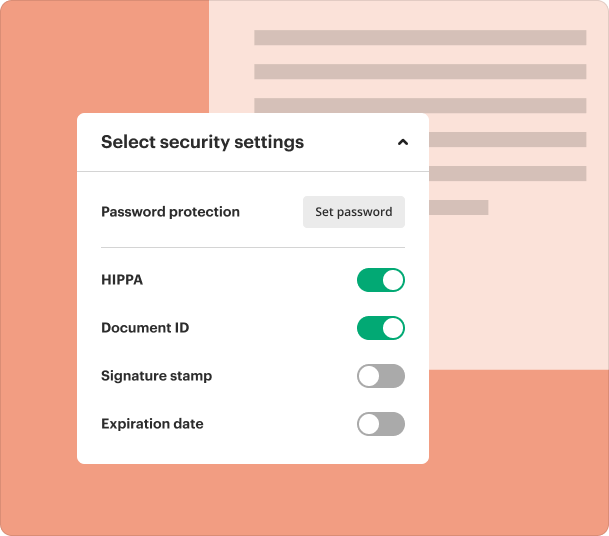

Your documents — secured

pdfFiller scores top ratings on review platforms

Extremely simple way to fill out, edit, and merge PDF documents.

What do you dislike?

Document uploading is slightly slow when working with larger files.

Recommendations to others considering the product:

User frindly/cost effective.

What problems are you solving with the product? What benefits have you realized?

Editing, merging, and sharing PDF files.

Easily e-file your Form 1120 online with pdfFiller

Learn more about Form 1120 before you e-file

Form 1120 is the U.S. Corporation Income Tax Return, designed for corporations to report income, gains, losses, deductions, and credits. Understanding the requirements and specifications of this form is essential for accurate tax compliance.

Who needs to e-file Form 1120?

-

Domestic corporations operating in the United States.

-

Foreign corporations with income sourced from U.S. operations.

-

S corporations, which are taxed as pass-through entities but may file Form 1120 occasionally.

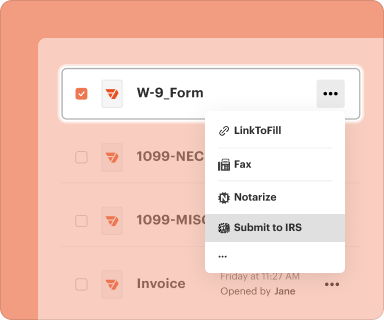

Other forms you should prepare when you e-file Form 1120

When filing Form 1120, corporations may need to include additional schedules and forms, such as Schedule C for dividends and special deductions, or Schedule J for tax computation. It’s vital to refer to the latest IRS guidance to ensure all necessary documentation accompanies Form 1120.

What information is required to e-file Form 1120?

-

Legal name of the corporation and its Employer Identification Number (EIN).

-

Principal business activity and address.

-

Income, deductions, and tax credits for the applicable tax year.

-

Information regarding shareholders and stock ownership.

Filing requirements

To submit Form 1120, corporations must adhere to deadlines set by the IRS, typically on the 15th day of the fourth month after the end of their tax year. Filing late or providing inaccurate data may result in penalties. Corporations can e-file or mail their completed forms and must ensure compliance with electronic filing requirements where applicable.

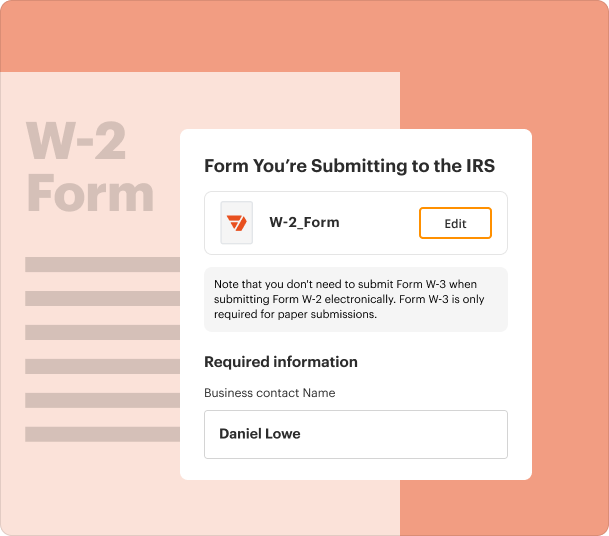

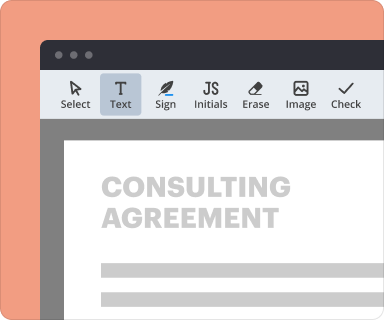

How do e-file Form 1120 with pdfFiller?

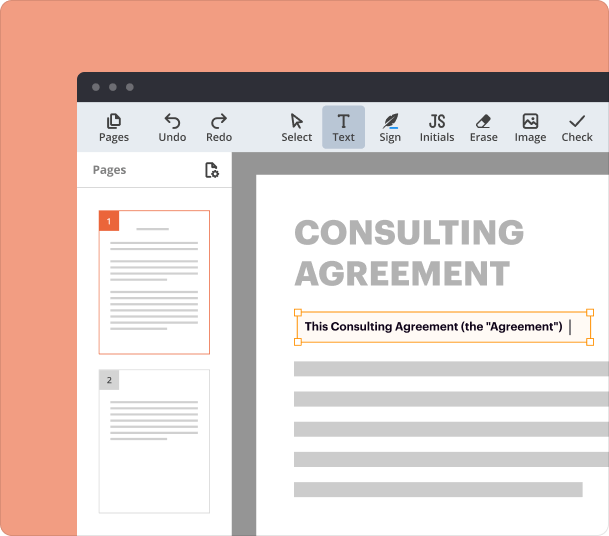

pdfFiller simplifies the e-filing process for Form 1120, providing an intuitive interface for editing, eSigning, and submitting documents seamlessly online.

-

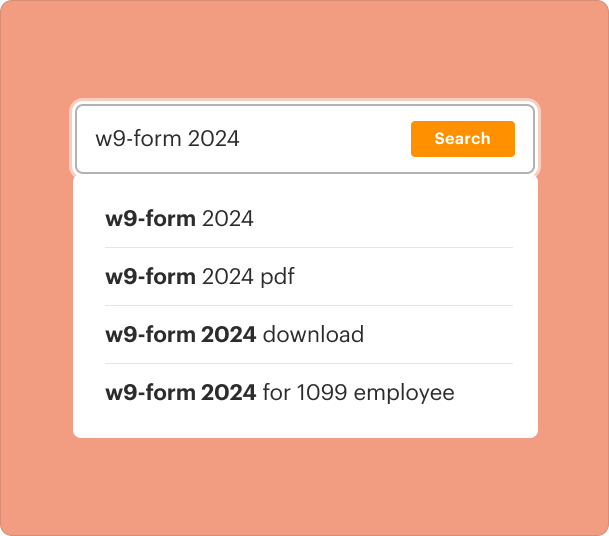

Click the 'Get form' button to access Form 1120.

-

Read the instructions on the form carefully.

-

Fill in the required fields, using the navigation tools to ensure every section is completed.

-

Use editing features to add images if necessary and complete any checkboxes using the Cross or Check tool.

-

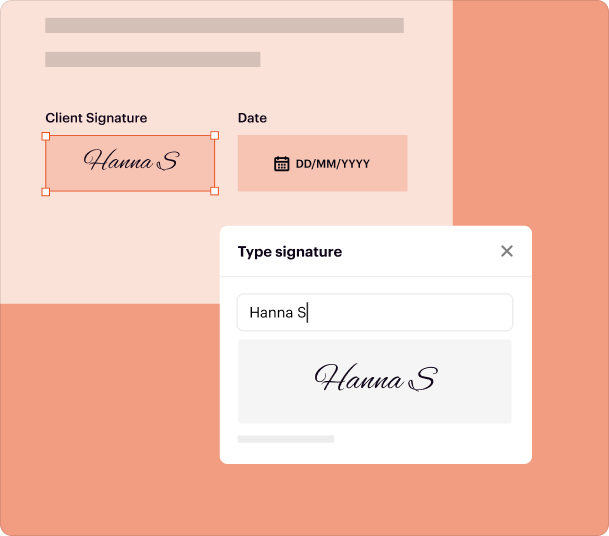

Click 'Sign' to add your legally binding eSignature if required.

-

Review your completed Form 1120 thoroughly before submission.

-

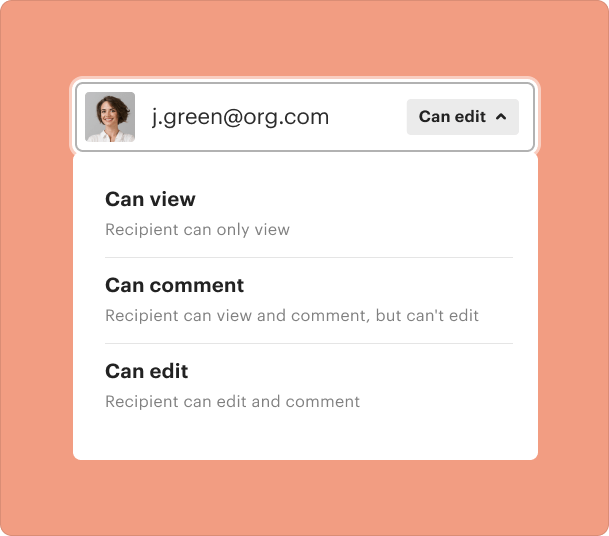

Click the 'Done' button and select how to save and share your document via email, fax, or USPS directly from the editor.

-

Access your completed documents anytime 24/7, or convert them into reusable templates.

Get started with pdfFiller today to ensure your Form 1120 and other tax-related paperwork is prepared accurately and on time.