Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

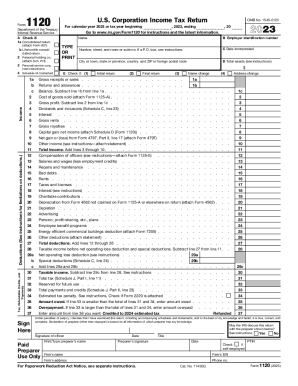

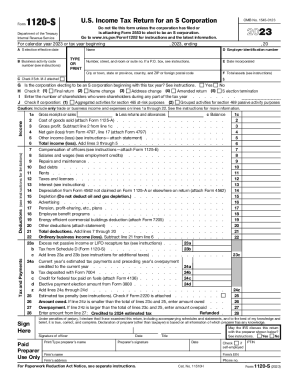

What is form 1120 us corporation?

Form 1120 is the U.S. Corporate Income Tax Return, which is used by domestic corporations (including S corporations) to report their income, deductions, and taxes owed to the Internal Revenue Service (IRS). This form is filed annually and must be completed by corporations regardless of whether they have taxable income or not. It is used to calculate the corporation's tax liability and determine if any taxes are owed or if a refund is due. The form also requires information about the corporation's financial activities and may include certain schedules and attachments depending on the corporation's specific circumstances.

Who is required to file form 1120 us corporation?

A U.S. corporation is required to file Form 1120 if it falls under any of the following categories:

1. Domestic corporations organized under federal or state law, including S corporations (unless they are converting to or from S corporation status).

2. Foreign corporations engaged in a U.S. trade or business, or having income effectively connected with a U.S. trade or business.

3. Corporations, including dissolved entities, that are engaged in the banking business (federal- or state-chartered), or savings and loan business, or federally sponsored credit agencies, or entities involved in other financial activities, regardless of whether they are domestic or foreign.

4. Corporations with shareholders that include tax-exempt organizations or other corporations that are required to file Form 990-T.

5. Corporations with gross income of $500,000 or more during the tax year.

6. Corporations with assets of $500,000 or more at the end of the tax year.

7. Corporations with an employee retirement plan and are required to file Form 5500.

It is important to consult with a tax professional or review the official guidelines from the Internal Revenue Service (IRS) to determine the specific filing requirements for a U.S. corporation.

How to fill out form 1120 us corporation?

Filling out Form 1120 for a US corporation requires careful attention to detail. Here is a step-by-step guide to help you navigate the process:

1. Gather all necessary documents and information: Before starting, make sure you have the following information ready:

a. Company name, address, and Employer Identification Number (EIN)

b. Financial statements including balance sheet, income statement, and retained earnings statement

c. Details of any deductions, credits, or adjustments that may apply

2. Begin with basic details: Fill in the company's name, address, EIN, and tax year at the top of the form.

3. Fill out Part I - Income: Provide details regarding the company's income, including gross receipts or sales, cost of goods sold (if applicable), and other income or expenses. Make sure to complete all relevant schedules if applicable.

4. Fill out Part II - Deductions: Report any deductible expenses such as wages, rent, supplies, utilities, and depreciation. Include any applicable Schedule(s) to provide supporting details.

5. Fill out Part III - Tax Computation: Calculate the corporation's taxable income, including adjustments, credits, and general business credits. Use the appropriate tax rate to determine the corporation's tax liability.

6. Fill out Part IV - Payments: Report any estimated tax payments already made, including any overpayment from a prior year that was applied. Also, provide details for any requested refund or carryover amount.

7. Review and sign the form: Carefully review all the information provided on the form, paying close attention to accurate calculations and supporting schedules. Sign and date the form as required.

8. Attach any required schedules and supporting documents: Attach any requested schedules, such as Schedule K-1 and Schedule C, along with supporting documentation such as financial statements, receipts, or invoices.

9. Retain a copy: Before submitting the form, make a copy for your records to refer to in case of future audits or inquiries.

10. Submit the form: Mail the completed Form 1120 to the appropriate IRS service center, following the instructions provided in the form's accompanying instructions. It's recommended to send the form using certified mail to ensure it reaches its destination.

Note: While this guide provides a general overview of the process, it is still advisable to consult a tax professional or accountant for accurate and personalized guidance based on your specific situation.

What is the purpose of form 1120 us corporation?

Form 1120 is used by United States corporations to report their income, deductions, gains, losses, and other pertinent information to the Internal Revenue Service (IRS). The purpose of Form 1120 is to calculate the corporation's taxable income and calculate the income tax due to the IRS. This form is required for every domestic corporation, including those with no taxable income. It is used to determine the corporation's tax liability and ensure compliance with federal tax laws.

What information must be reported on form 1120 us corporation?

When preparing Form 1120 for a U.S. corporation, the following information must be reported:

1. Basic identification details: The corporation's name, address, Employer Identification Number (EIN), and the tax year covered by the form.

2. Accounting method: The corporation must indicate whether it uses the cash or accrual method of accounting.

3. Income details: The corporation needs to report its total income, including sales, services, interests, dividends, rental income, and gains from the sale of assets. Various schedules may be attached to provide specific information for different types of income.

4. Deductions: The corporation must report its deductible expenses, including the cost of goods sold, employee wages, rent, utilities, depreciation, insurance, and interest expenses.

5. Cost of Goods Sold: The corporation must report the cost of goods sold during the tax year. This includes the cost of raw materials, direct labor, and indirect costs.

6. Other information and schedules: Depending on the corporation's activities, additional information and schedules may be required. For example, Schedule C may be used to report income from a rental property or Schedule M-3 to report the corporation's financial statement adjustments.

7. Taxes and payments: The corporation needs to calculate its income tax liability based on the reported income and deductions. It must also report any estimated tax payments made throughout the year or any tax credits it may be eligible for.

8. Balance sheet: The corporation must provide a balance sheet reflecting its assets, liabilities, and shareholders' equity at the beginning and end of the tax year.

It is crucial to consult the official instructions for Form 1120 provided by the Internal Revenue Service (IRS) to ensure accurate reporting and compliance with all applicable regulations.

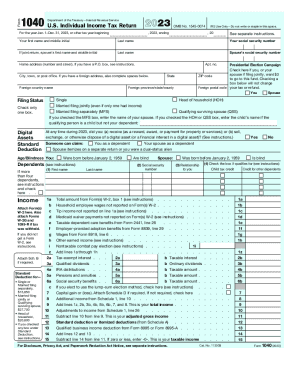

When is the deadline to file form 1120 us corporation in 2023?

The deadline to file Form 1120 for a US corporation in 2023 would be March 15th. However, if the corporation is on a fiscal year rather than a calendar year, the deadline would be the 15th day of the third month following the end of the fiscal year. It is always recommended to double-check with the Internal Revenue Service (IRS) or consult a tax professional for the most accurate and up-to-date information.

What is the penalty for the late filing of form 1120 us corporation?

If a US corporation fails to file Form 1120 (U.S. Corporation Income Tax Return) by the due date, there might be penalties imposed. The penalty for late filing of Form 1120 is generally calculated based on the corporation's unpaid tax liability.

If the corporation owes tax and fails to file the return by the due date (excluding extensions), the penalty is usually 5% of the unpaid tax liability for each month or part of a month that the return is late, up to a maximum of 25%.

If the return is more than 60 days late, the minimum penalty is either the lesser of $435 or the corporation's balance due.

However, if the corporation is eligible for a refund, there is generally no penalty for late filing.

It is important to note that these are general guidelines, and the exact penalties may vary depending on the circumstances and the tax laws in effect at the time. It is advisable to consult with a tax professional or review the specific IRS guidelines for the most accurate and up-to-date information.

How do I execute form 1120 us corporation online?

Completing and signing form 1120 us corporation online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make edits in form 1120 us corporation without leaving Chrome?

form 1120 us corporation can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out the form 1120 us corporation form on my smartphone?

Use the pdfFiller mobile app to fill out and sign form 1120 us corporation. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.