Make tax filing easier with pdfFiller's streamlined solutions

How to complete tax forms with pdfFiller

Who needs this?

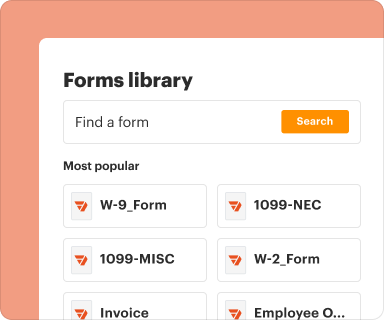

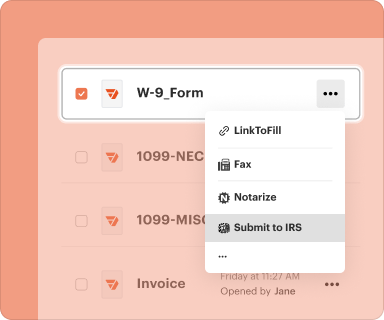

More than a PDF solution

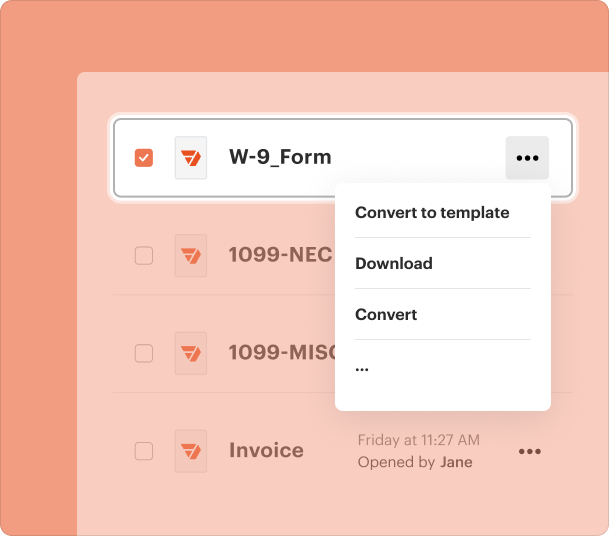

Complete document management

Your productivity booster

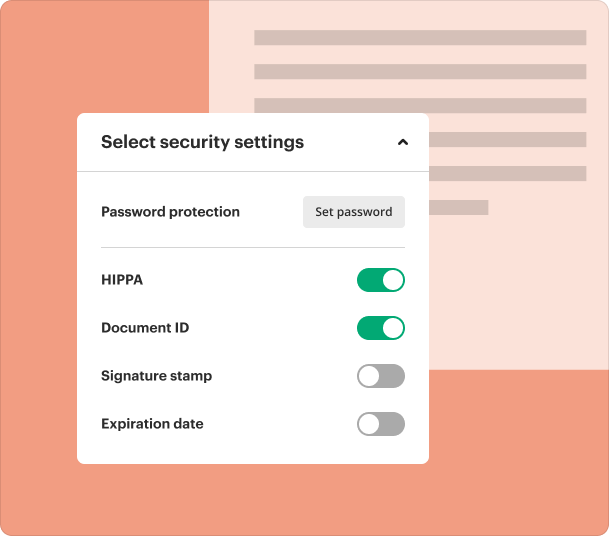

Your documents — secured

pdfFiller scores top ratings on review platforms

Make tax filing easier with pdfFiller's streamlined solutions

Learn about Form 1040 before you make tax filing easier

Form 1040 is the standard individual income tax form used by U.S. taxpayers to report their annual income. This form is essential for calculating taxes owed and determining the refund due from the Internal Revenue Service (IRS).

Who needs to make tax filing easier?

-

Individuals earning wages or salaries.

-

Freelancers and self-employed individuals.

-

U.S. citizens living abroad.

-

Foreign nationals earning income in the U.S.

-

Individuals receiving income from rental properties.

-

Taxpayers claiming deductions or tax credits.

Other forms you should prepare when you make tax filing easier

When completing Form 1040, you may need to submit additional forms and schedules depending on your financial situation. Commonly required forms include Schedules A (Itemized Deductions), B (Interest and Ordinary Dividends), C (Profit or Loss from Business), and D (Capital Gains and Losses). Make sure to check the latest official IRS instructions for the complete list of necessary attachments that correspond with your specific tax profile.

What information is required to make tax filing easier?

-

Personal identification details (Name, SSN, address).

-

Filing status (Single, Married Filing Jointly, etc.).

-

Income data (Wages, salaries, interest, dividends).

-

Deductions and credits eligible for the tax year.

-

Bank account information for direct deposit refunds.

Filing requirements

To successfully submit your Form 1040, ensure you file by the annual deadline, typically April 15. Providing accurate information is crucial, as errors or missing deadlines can result in IRS penalties. You may e-file or mail your completed tax form to designated addresses based on your state. Always check the current IRS guidelines for updates on submission methods and deadlines.

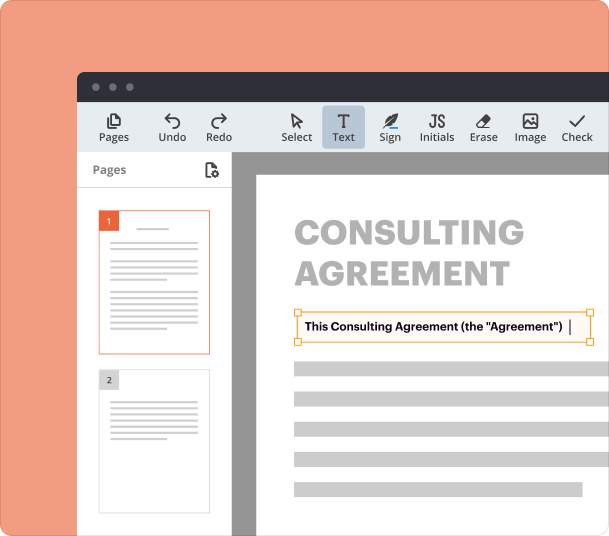

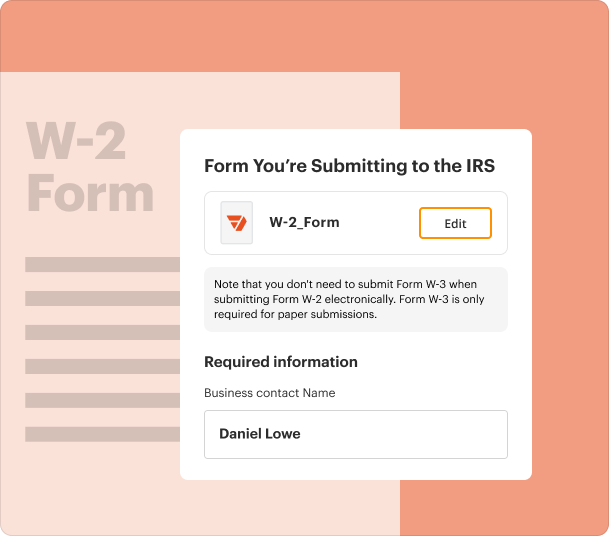

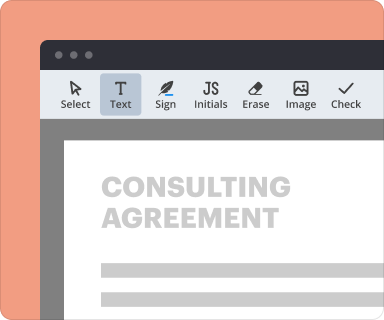

How do make tax filing easier with pdfFiller?

Using pdfFiller simplifies your tax filing process by providing an all-in-one solution to edit, eSign, and share your documents seamlessly. The user-friendly interface allows you to manage your tax forms from anywhere, ensuring a hassle-free experience.

-

Click the 'Get form' button to access Form 1040.

-

Carefully read the instructions provided in the form.

-

Fill out the fillable fields with your personal data, navigating between fields to avoid missing any information.

-

Use editing tools to insert images, checkboxes, and other necessary elements.

-

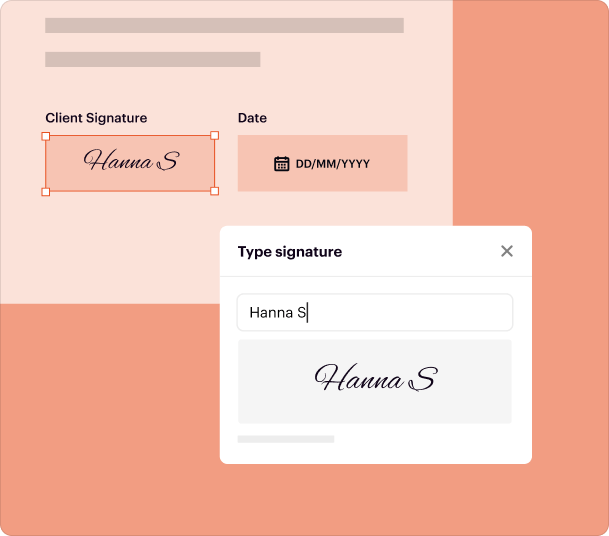

If the document requires a signature, click the 'Sign' button to add your legally binding eSignature.

-

Review the completed document thoroughly before finalizing.

-

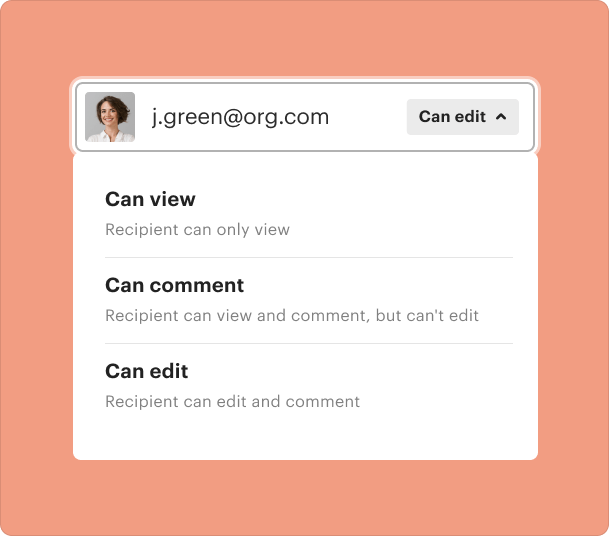

Click the 'Done' button to proceed with saving and sharing options (email, fax, or USPS).

-

Access your completed document anytime or convert it into a reusable template.

Get started with pdfFiller today to prepare your tax-related paperwork accurately and on time. Streamline your filing process and ensure you stay compliant with IRS regulations effortlessly.